Cardano Price Prediction: ADA's final decline before the mother of all bull runs occurs

- Cardano price coils within a consolidating range since the spring of 2022.

- A second attempt of the $0.42 support zone could induce a 40% decline.

- Invalidation of the bearish thesis is a breach above $0.59.

Cardano price could set up for the final decline before a reversal occurs. Key levels have been identified.

Cardano price is setting up for one more decline

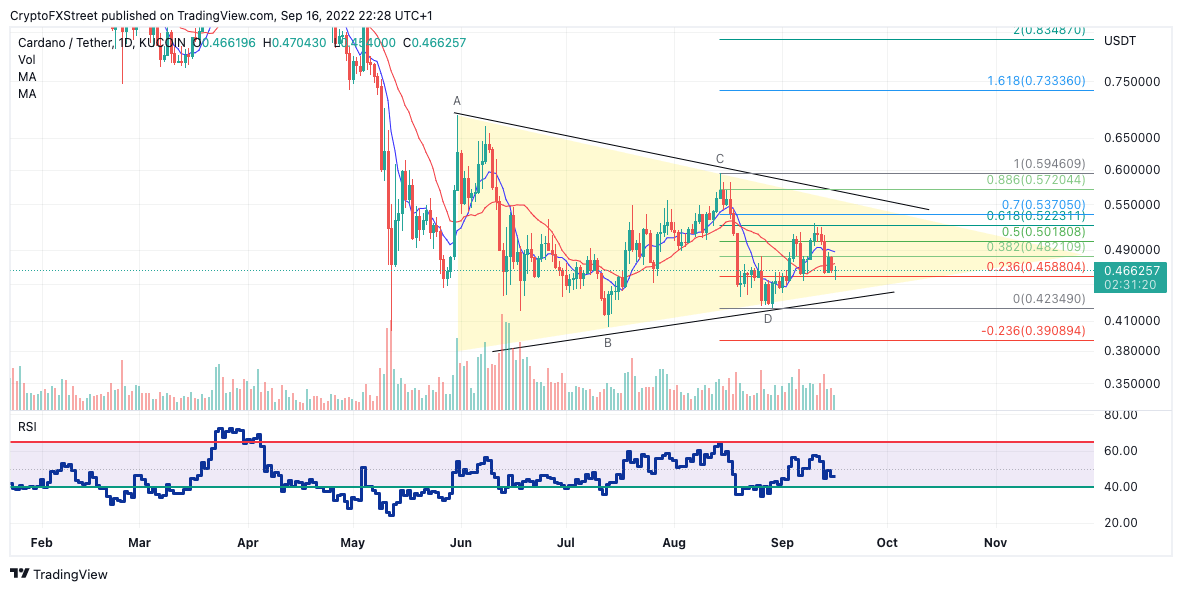

Cardano price has been reading range bound since May of 2022. The back-and-forth price action appears to have formed a large symmetrical triangle. The Relative Strength Index confirms the triangle idea as divergences between prices correlate with each swing high and swing low.

Cardano price currently auctions at $0.46. A Fibonacci Retracement tool surrounding the August through high at $0.59 and the most recent swing low at $0.42 shows the current downtrend catalyzed by the 61.8% Fibonacci level. Based on Elliott Wave and Fibonacci theory, the final E wave of the prospective triangle could be over.

ADA USDT

Thus, A reattempt of the $0.42 should not be taken lightly. If the triangle thesis is correct, an impulsive wave targeting $0.27 could occur in the coming weeks. Such a move would result in a 40% decline from ADA’s current market value. A double backtest towards the 61.8% fib level at $0.52 is still possible. Therefore under Elliott Wave Theory, invalidation of the bearish thesis should remain Wave C at $0.59.

Investors should remember that if the triangle thesis is validated, an explosive five-wave impulse should target the mid $0.20 level. Once the target is reached, investors could begin looking for a knife catch opportunity, as triangles are usually the last consolidation before a trend change occurs. A rally towards the all-time highs would result in a 500% increase from the current Cardano price.

In the following video, our analysts deep dive into the price action of Cardano, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.