Cardano Price Prediction: ADA in no-trade zone while momentum builds for high volatility

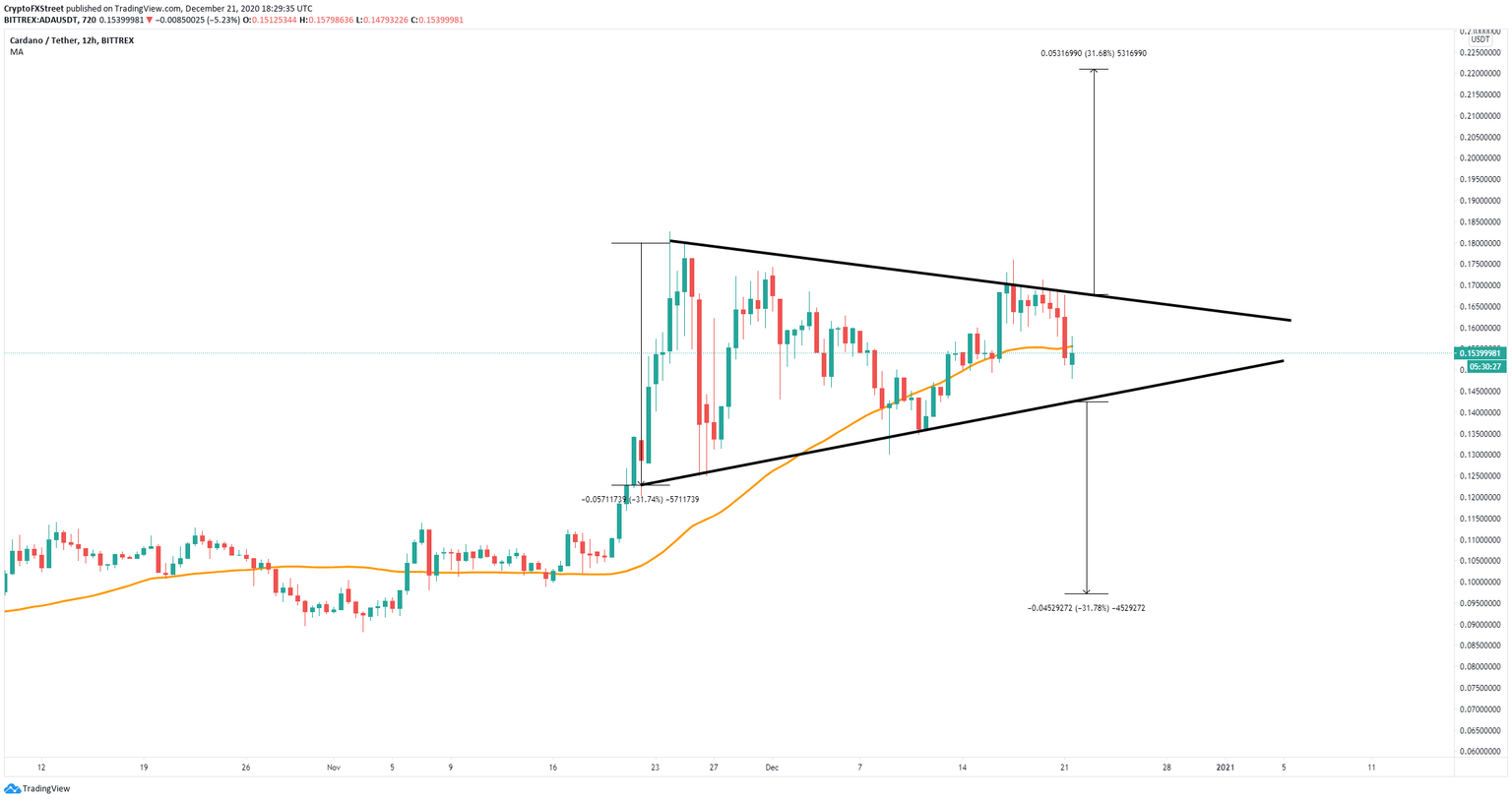

- Cardano price is contained inside a symmetrical triangle pattern on the 12-hour chart.

- The digital asset trades right in the middle of the pattern awaiting clarity.

- It seems that bears have taken control of the short-term trend.

Cardano attempted to crack the 2020-high of $0.182 on December 17, but bulls came off short and only managed to push ADA to $0.176 before a violent sell-off in the next four days. It seems that bears are pushing Cardano price towards $0.14.

Cardano price awaits a clear breakout

ADA has formed a symmetrical triangle pattern on the 12-hour chart and it’s trading at $0.152 at the time of writing. Bulls have lost the 50-SMA support level and it seems that the next bearish price target is the lower trendline of the pattern at $0.14.

ADA/USD 12-hour chart

However, bears would still need to crack the critical support level at $0.14 in order to see a clear breakdown. Using the height of the pattern as a reference point, we can estimate the most likely price target to be at $0.1.

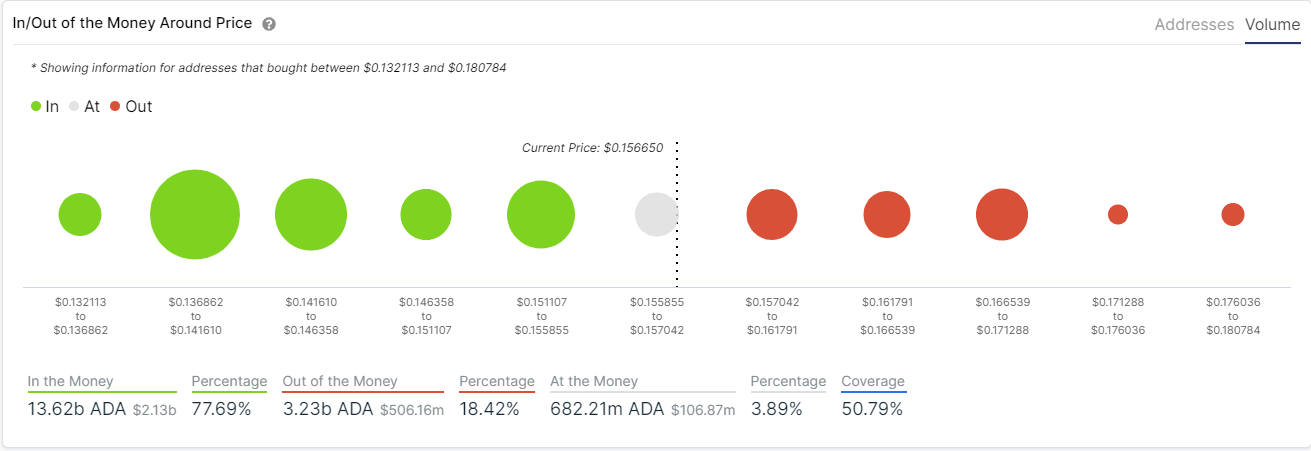

ADA IOMAP chart

The In/Out of the Money Around Price (IOMAP) chart shows very little resistance to the upside. It seems that a breakout above the area between $0.157 and $0.162 can easily drive Cardano price towards $0.18.

That breakout would also represent cracking the symmetrical triangle pattern with a price target of $0.22 in the long-term.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.