Cardano price faces one final resistance level before a full-blown rally towards $0.20

- Cardano price is on the verge of a massive breakout as the entire market turned bullish.

- The digital asset needs to crack a critical resistance level located at $0.173.

Bitcoin had a massive breakout towards $23,800 for the first time ever and it seems to be dragging the market with it. Cardano price is up by only 13% since Wednesday, which means bulls still have a lot of room to the upside.

Cardano price needs to climb above $0.173 to reach a new 2020 high

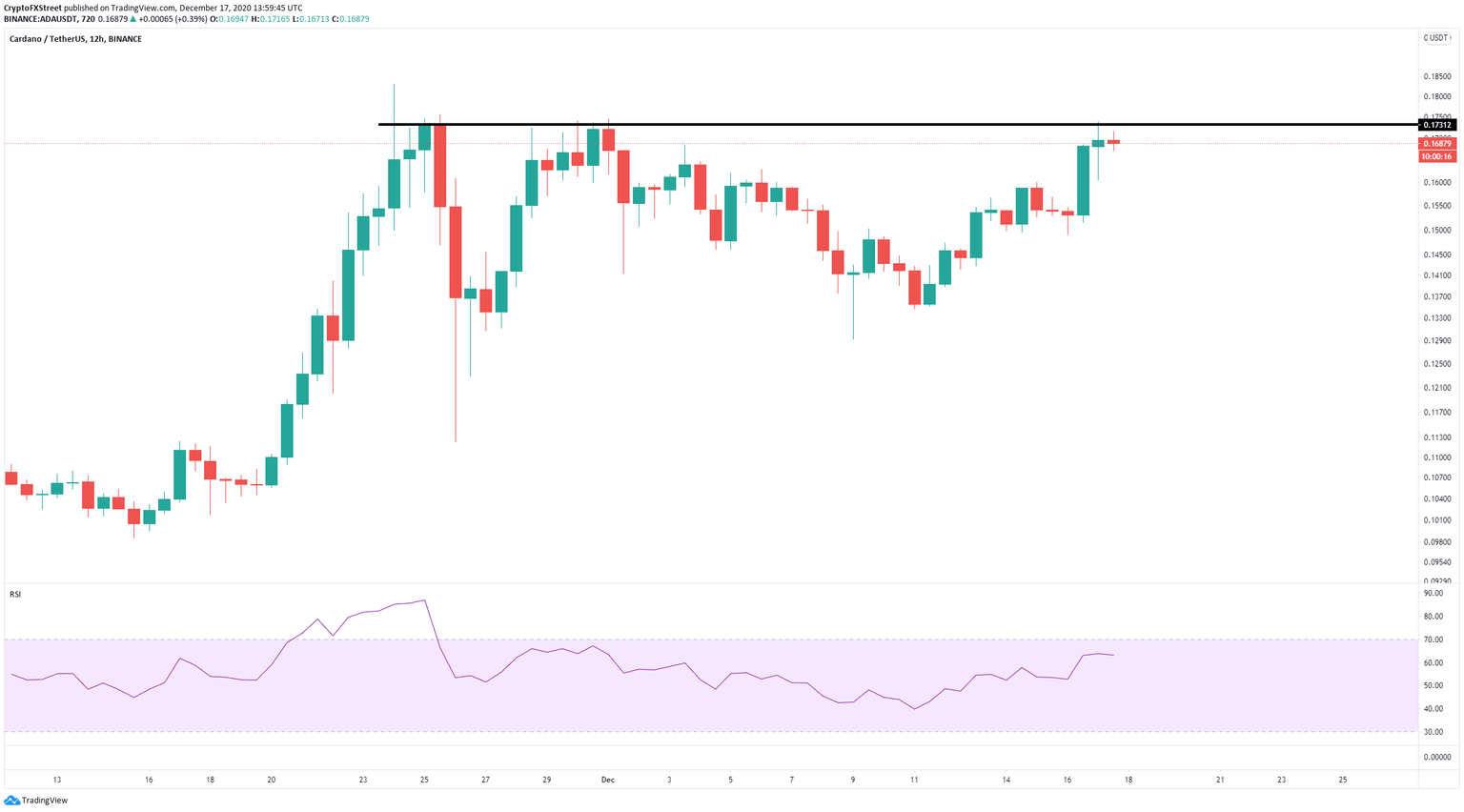

Cardano has established a crucial resistance level at $0.173, which has been tested several times since November 24. This is the final resistance point before a new 2020 high above $0.183.

ADA/USD 12-hour chart

Bulls should have the upper hand as the entire cryptocurrency market has turned bullish thanks to Bitcoin reaching new all-time highs. Since the price action for ADA hasn’t been as crazy as that of BTC – leaving the RSI below overextension levels, – the bullish outlook has more credence.

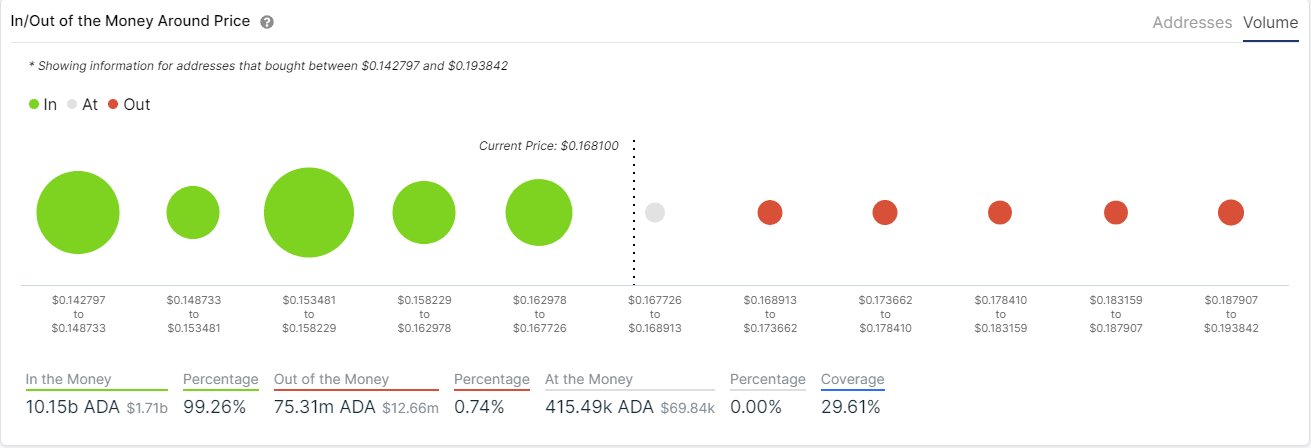

ADA IOMAP chart

Additionally, the In/Out of the Money Around Price (IOMAP) chart shows practically no resistance above $0.16 up until $0.193, which again adds strength to the bulls. The most significant support area seems to be located between $0.153 and $0.158.

Bears need to see a rejection from the resistance level at $0.173 and a breakdown below the support range mentioned above for Cardano price to dive towards $0.14 in the short-term.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.