Cardano Price Prediction: ADA eyes 30% gain amid market sell-off

- Cardano price holds the March-April trading range high for five consecutive days.

- Accumulation/distribution metrics favor further upside for ADA.

- Daily and weekly Relative Strength Index (RSI) readings are not overbought.

Cardano price continues to ascend a wave of selling in the cryptocurrency market, generating the necessary relative strength needed to reach the measured move target at $2.27.

Cardano price not waiting for buy-on-the-dip investors

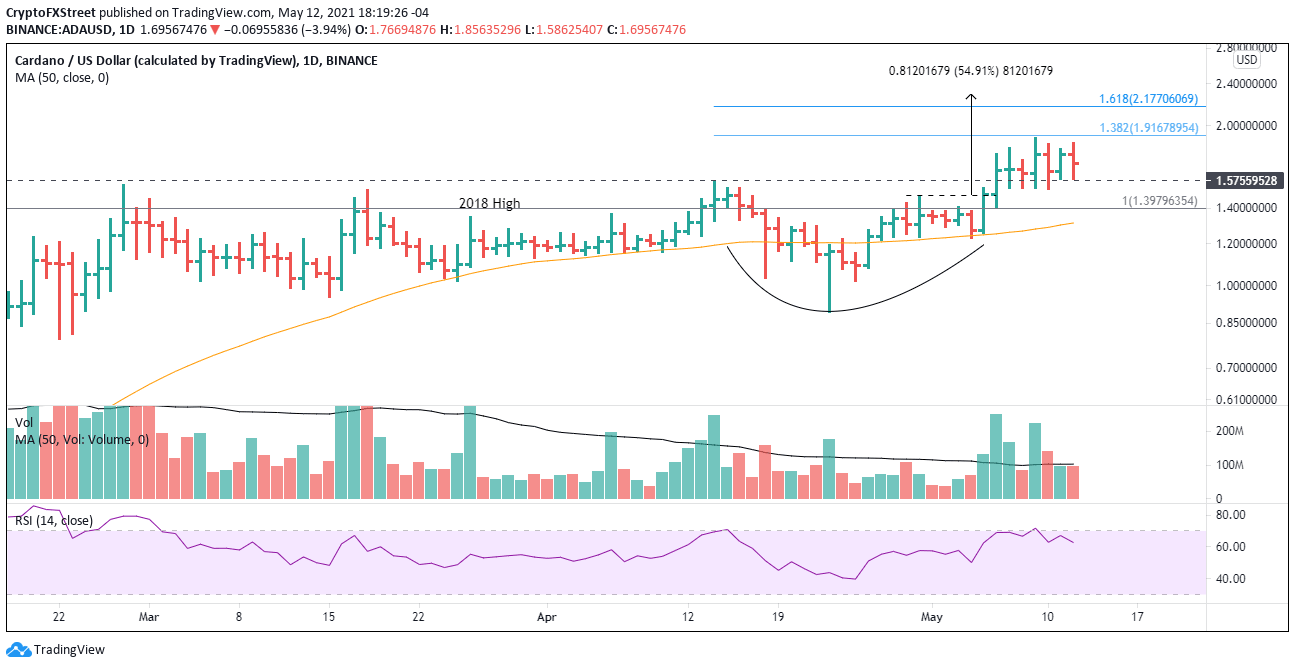

On May 5, Cardano price emerged from a multi-week cup-with-handle base with a notable jump in volume, marking a trend change for the altcoin after two months of trendless price action. The rally since has been awkward, but the accumulation/distribution profile has remained steadfastly positive, despite the gyrations in the broader market.

The measured move target of the cup-with-handle base is $2.27, yielding a 55% gain from the breakout and a 30% gain from price at the time of writing.

Standing in front of the measured move target is the 138.2% Fibonacci extension of the April decline at $1.92, followed closely by the psychologically important $2.00.

From February to April, $1.00 was omnipresent, either serving as resistance or support for Cardano price, suggesting that $2.00 could be an obstacle.

If ADA is successful in the battle at $2.00, Cardano price will have very little resistance to the measured move target of $2.27, except for the 161.8% extension of the April decline at $2.18.

ADA/USD daily chart

A widespread sell-off in the crypto market is the only thing that could derail a push to $2.27, but in light of the weakness over the last few days, it is necessary to plan for a bearish outcome.

The March-April trading range high at $1.57 is significant support for Cardano price, as noted by the five consecutive tests between May 7 and May 11.

An acceleration in selling pressure will test the handle high at $1.46 and the 50-day simple moving average at $1.31.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.