Cardano Price Prediction: ADA eyes 25% gains despite recent slowdown

- Cardano price rallied 16% after a swing low on June 8 to hit a local top.

- This upswing displays a decreasing bullish momentum and hints at a minor retracement to $1.50.

- A resurgence of bulls at this level could propel ADA 25% upward to $1.95.

Cardano price shows a bullish structure despite the mayhem caused in late May. ADA set up a higher low on June 8, followed by a quick upswing, a common theme across the crypto market.

Lately, this rally has slowed down, indicating the exhaustion of bullish momentum. ADA might be due for a minor retracement before the uptrend resumes.

Cardano price takes a detour

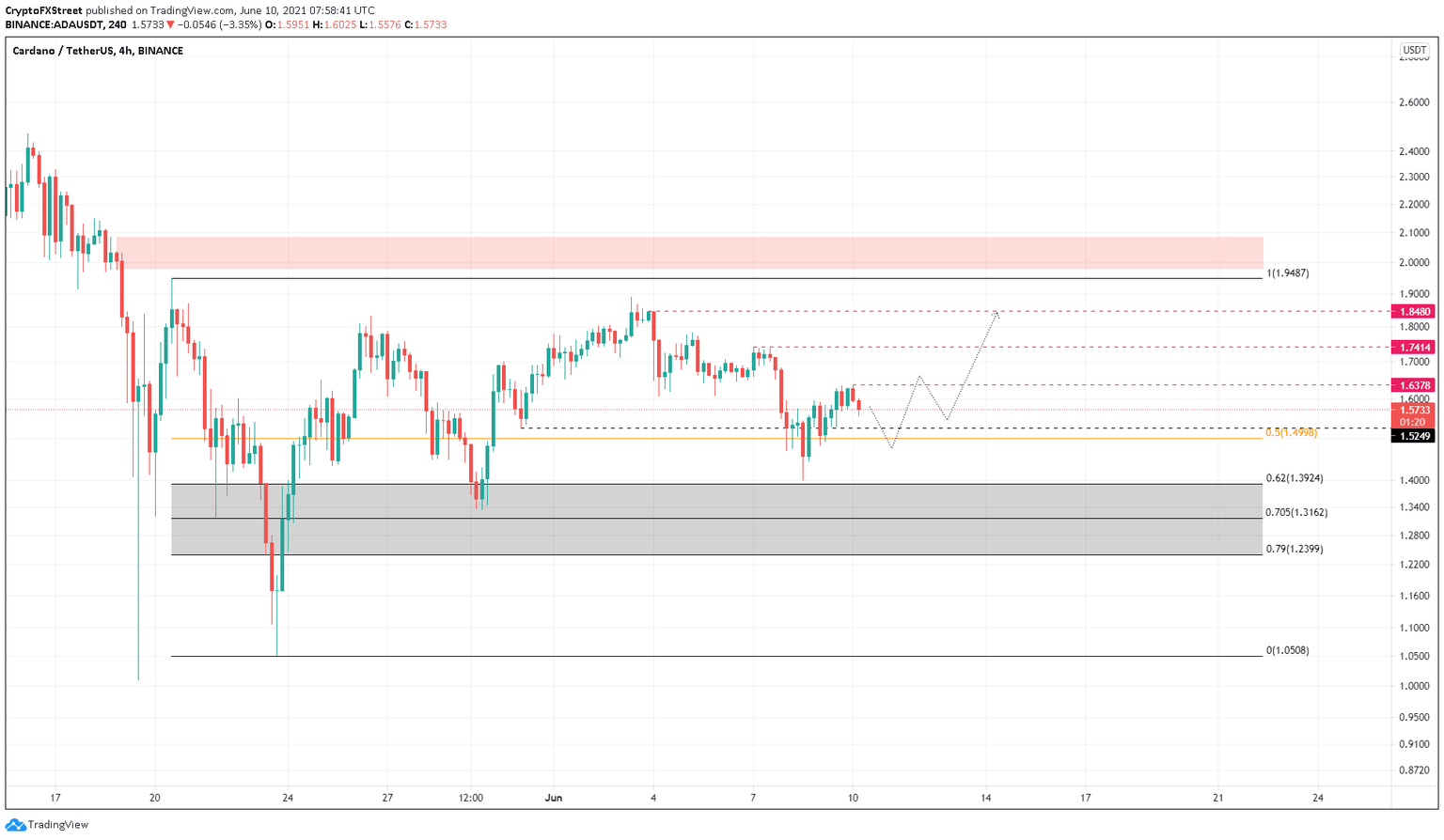

Cardano price rode the bull wave, rising 16% to $1.638 after a swing low on June 8. As investors begin to book profits, the rally seems to be coming undone. So far, ADA price has dropped roughly 3% from the previous swing high and might continue until it encounters the 50% Fibonacci retracement level at $1.50.

A swift return of the bulls at this point seems likely. That said, the outlook for Cardano price will stay bullish up to the 70.5% Fibonacci retracement level at $1.316. Therefore, a dip into the support levels ranging from $1.50 to $1.316 will likely trigger massive buying pressure, pushing ADA to critical levels at $1.638, $1.741 and $1.848.

In a highly bullish case, Cardano price might tag the range high at $1.949 or the lower limit of the supply zone extending from $1.977 to $2.084.

ADA/USDT 4-hour chart

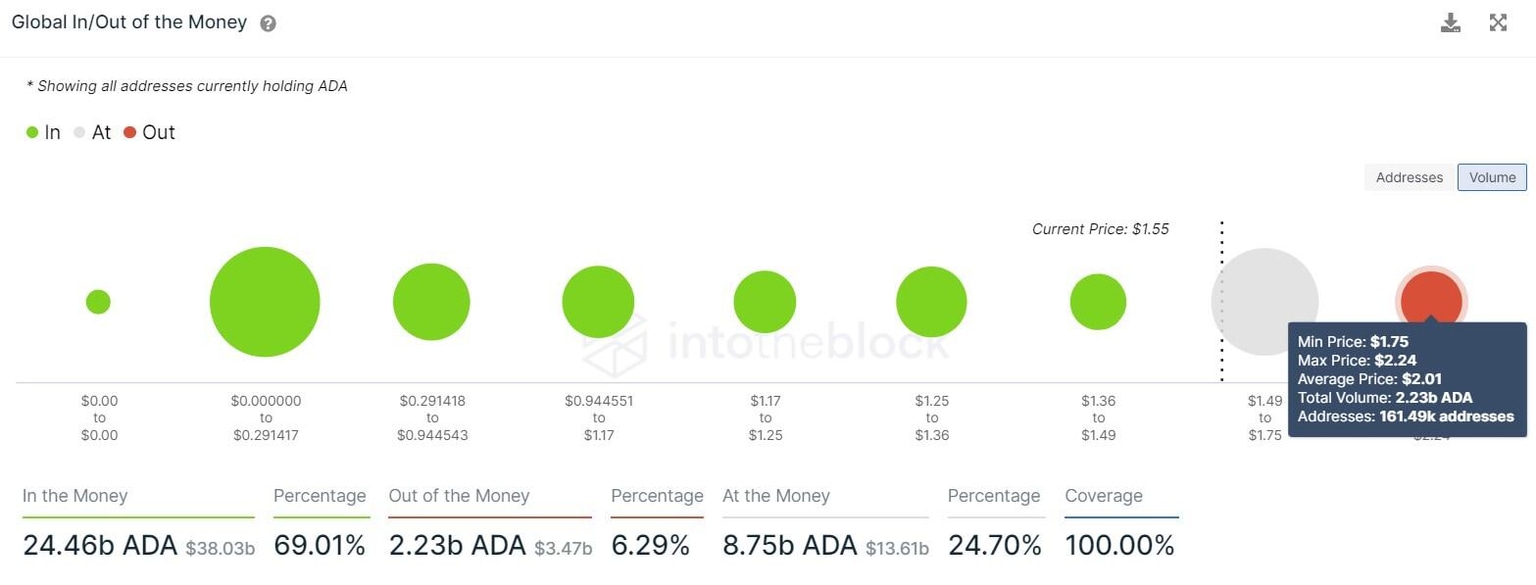

While the technicals hint at a drop, the on-chain metrics solidify it. IntoTheBlock’s Global In/Out of the Money (GIOM) model reveals a massive cluster of underwater investors present ahead.

Roughly 162,000 addresses purchased nearly 2.23 billion ADA at an average price of $2.01. These “Out of the Money” investors might slow down the upswing or halt it if they decide to break even and sell their holdings.

ADA GIOM chart

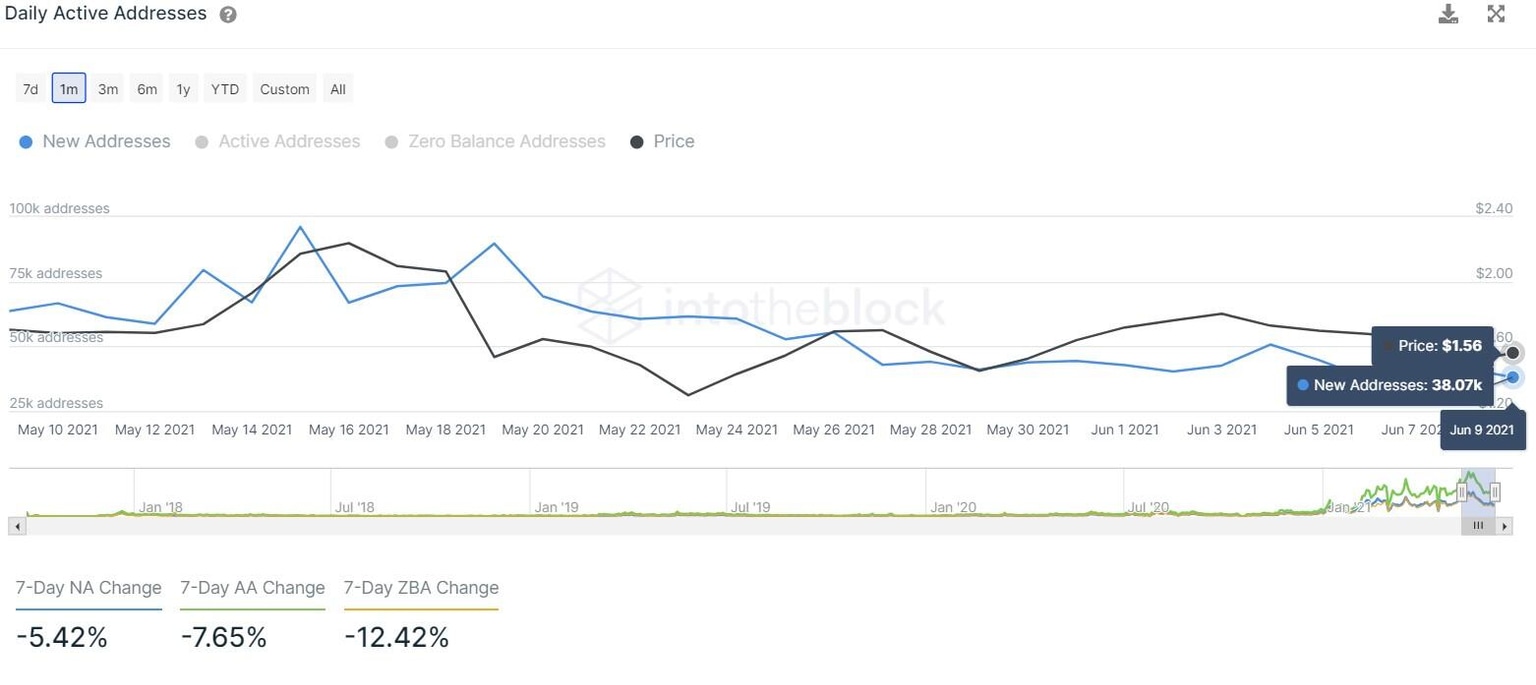

Further supporting the retracement is the lack of users interacting with the Cardano blockchain. The number of new addresses joining the network has reduced from 63,660 to 38,070 over the past month.

This 40% decline suggests that market participants are reallocating their funds or booking profits. Both of which paint a short-term bearish picture, adding credence to the pullback thesis.

ADA new addresses chart

If Cardano price dips below the 79% Fibonacci retracement level at $1.24, it would invalidate the bullish thesis and open the possibility of a further downswing. A potential spike in selling pressure could push ADA down by 15% to the range low at $1.051.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.