- Cardano price shows signs of a massive bounce.

- Bollinger Bands indicator confirms a volatile move as it tightly envelops ADA.

- MRI’s State Trend Resistance at $1.34 and flat supply barrier at $1.46 are two critical hurdles.

The Cardano price is primed for a massive bull run based on multiple technical indicators.

Cardano price looks to make record highs again

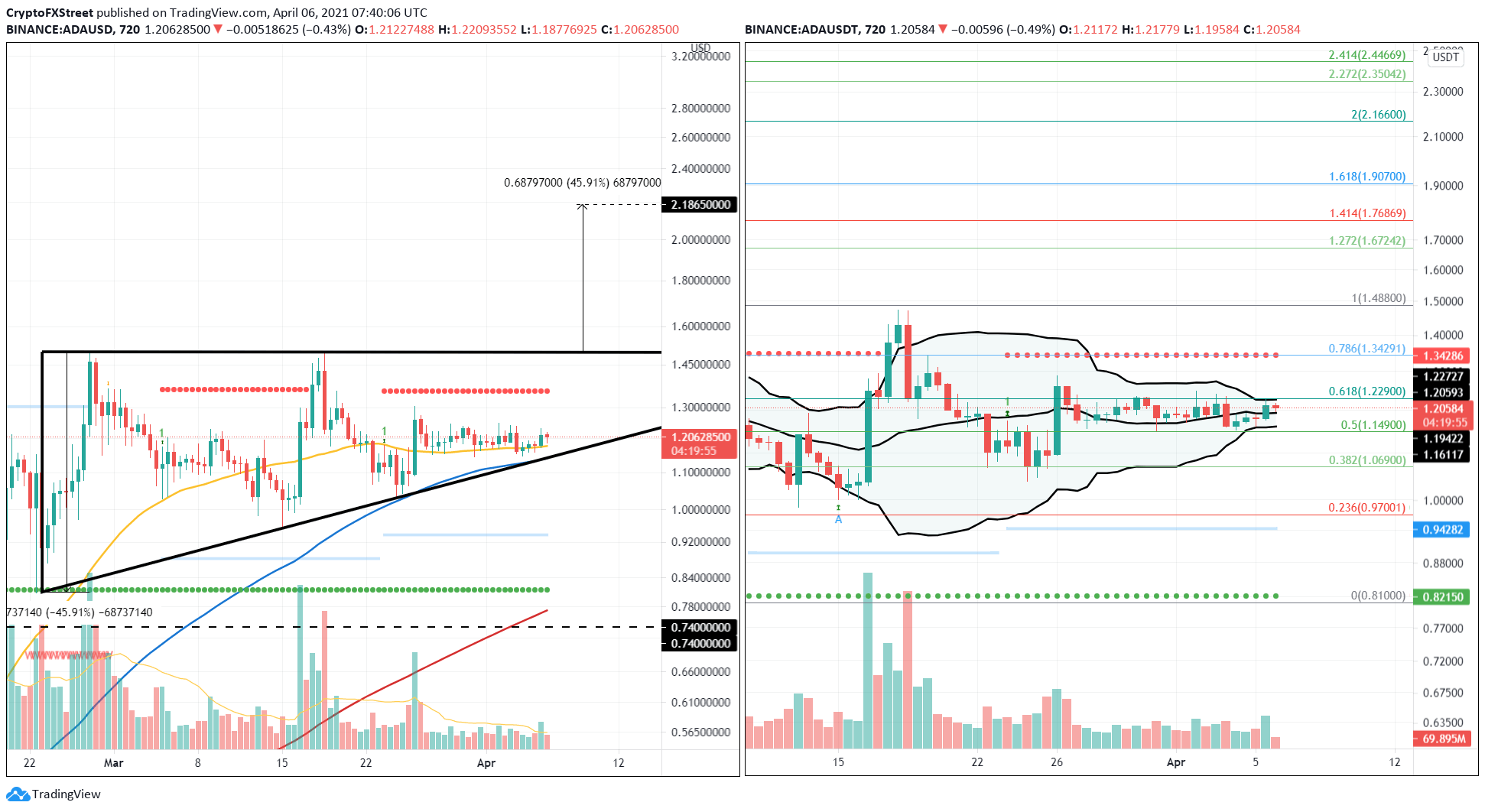

The Cardano price has been on a tear this bull run. However, it slid into consolidation after setting up an all-time high at $1.54 on February 27. Since then, ADA has formed higher lows while being restricted by a horizontal resistance at $1.49.

By connecting these swing lows and series of highs using trend lines, an ascending triangle forms. This technical formation is a continuation pattern and projects a 45% upswing, determined by measuring the pivot high and low distance.

Adding this measure to the breakout point at $1.49 yields the Cardano price target at $2.18.

ADA confirmed buyers’ resurgence at the time of writing as it bounced off the technical formation’s inclined trend line. This area approximately coincides with the 50 and 100 Simple Moving Averages (SMA) at $1.18 and $1.14, which serve as stable support barriers.

A continuation of this bullish momentum will push the Cardano price to encounter the Momentum Reversal Indicator’s State Trend Resistance at $1.34, which is a significant level that needs to be overcome. Following this, ADA bulls must produce a decisive close above $1.49 on the 12-hour chart to trigger a 45% upswing.

Assuming a swift move, the so-called “Ethereum killer” could potentially surge 80% from its current price to hit the intended target at $2.18.

Adding credibility to this enormous run-up is the Bollinger Bands indicator that has squeezed the Cardano price to trade between the upper and the lower bands. This phase indicates a period of reduced volatility and confirms that a highly volatile move will ensue.

ADA/USDT 12-hour chart

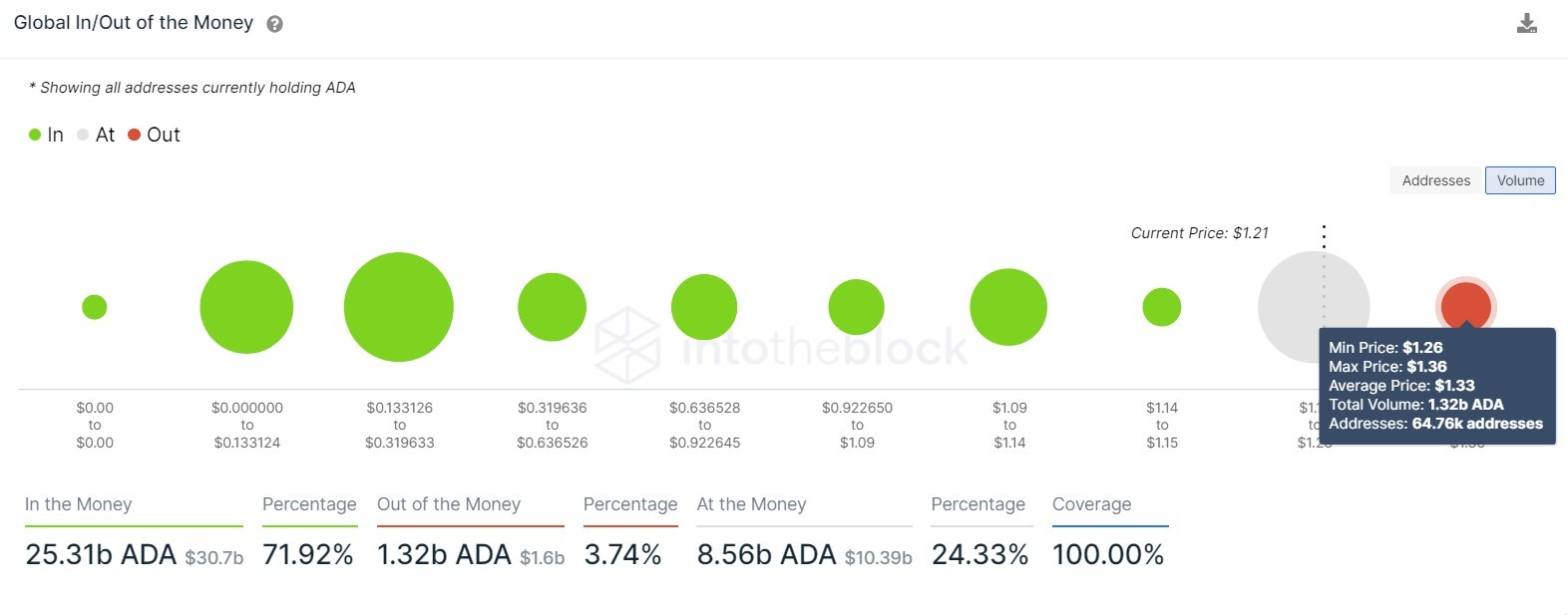

Supporting the upside move is IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, which shows a cluster of small “Out of the Money” investors at $1.33. Here roughly 65,000 addresses previously purchased 1.32 billion ADA.

Moreover, the Cardano price level ranging from $1.15 to $1.26 has seen 350,000 addresses purchase a whopping 8.56 billion ADA. This development shows accumulation underway further supporting the volatile move.

Cardano GIOM chart

Regardless of the optimism, a spike in selling pressure that pushes the Cardano price below $1.02 for an extended period will invalidate the bullish outlook as it would create a lower low. This move would also signal the start of a new downtrend.

In such a scenario, ADA could fall 9% to the immediate demand barrier at $0.94.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 meme coins Dogecoin, Shiba Inu and Bonk: Bitcoin gains could fuel recovery in DOGE, SHIB, BONK

Prices of meme coins Dogecoin (DOGE), Shiba Inu (SHIB) and Bonk (BONK) are broadly steady on Tuesday, as the broader crypto market recovers on the back of Bitcoin’s recent gains. BTC climbed to a high of $64,400 on Tuesday, catalyzing gains in altcoins.

XRP holders to see redacted versions of SEC reply in Ripple lawsuit on Wednesday

Ripple (XRP) lawsuit’s latest development is Securities and Exchange Commission (SEC) filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

Polygon launches zk-based Ethereum scaling solution Miden on testnet, fuelling Layer 2 war

Polygon (MATIC), the largest Ethereum scaling solution, announced on Monday the launch of its zero-knowledge (zk) based “Miden”, a scaler to boost Ethereum chain’s capabilities.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

Bitcoin: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.