Cardano Price Prediction: ADA needs to cross this level to break the monotony

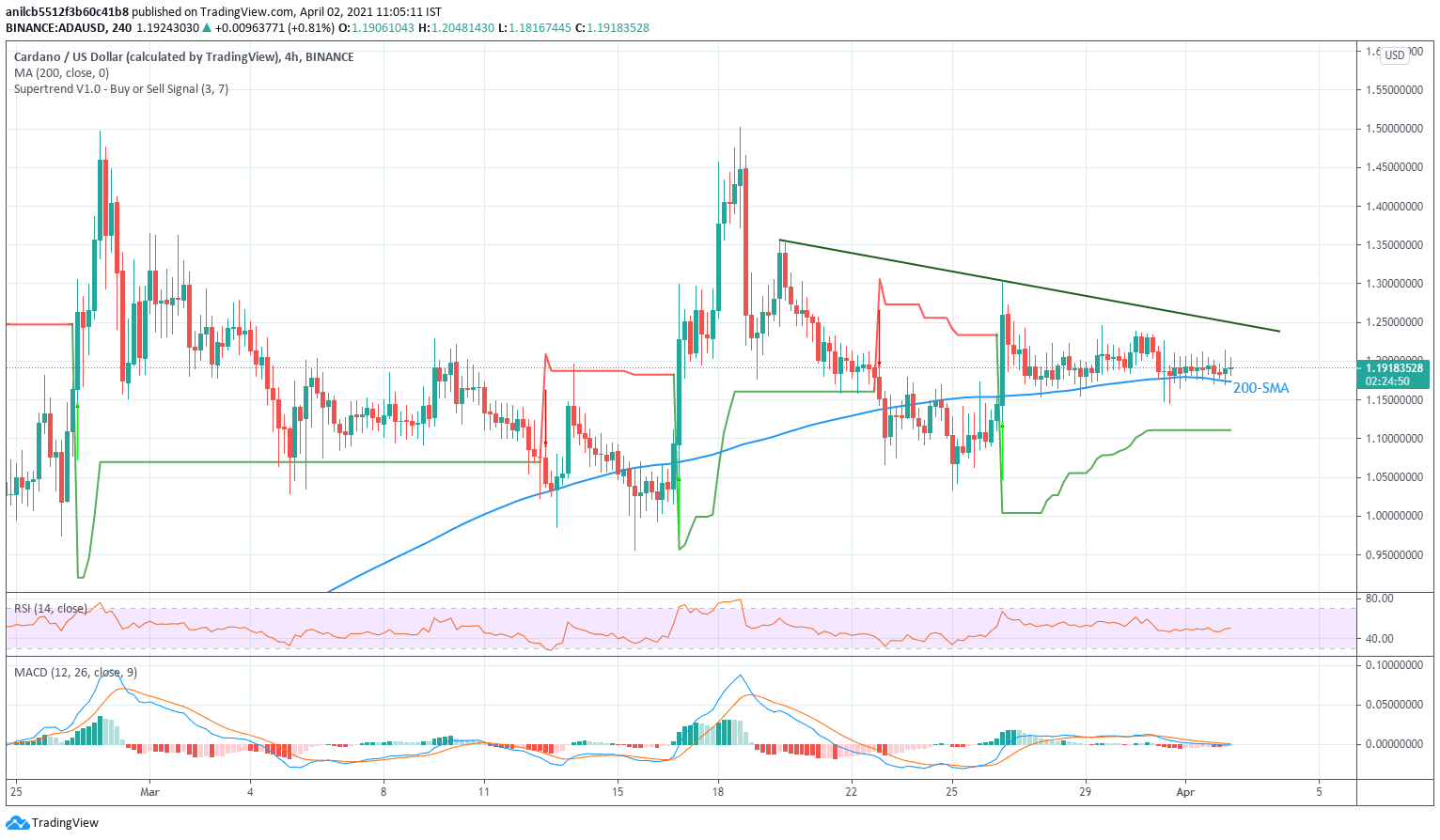

- ADA/USD holds gains above 200-SMA despite recently choppy moves.

- SuperTrend also flashes buy signal, MACD swinging back towards bullish favor.

- Two-week-old resistance line guards immediate upside, bears to have a bumpy road on their return.

Cardano bulls stay hopeful even as the quote seesaws around 1.1950, up 0.86% intraday, during early Friday.

Not only the cryptocurrency pair’s sustained trading above 200-SMA but buy signals from SuperTrend indicator and MACD’s gradual rush towards the bullish zone also suggest further upside quote the quote.

However, a clear break of the downward sloping trend line from March 19, around 1.2555, becomes necessary for the buyer’s entry.

Following that a two-week top near 1.3560 can offer an intermediate halt during the rally towards the 1.5000 threshold comprising the previous month’s top.

Meanwhile, the 1.2000 round-figure can offer immediate support ahead of highlighting the 200-SMA level of 1.1737.

Although prices are likely to bounce off 1.1737, failures to do so will make ADA/USD vulnerable to test the previous month’s low near 0.9560.

ADA/USD four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.