Cardano price only faces one last critical obstacle before a jump to $0.13

- Cardano price has climbed above the 200-SMA at $0.095 and the 50-SMA at $0.098 on the daily chart.

- There is only one big resistance level ahead before the price target at $0.13.

On October 12, the price of Cardano hit an obstacle at $0.112 and re-tested this resistance level for the next two days. The digital asset also tried to crack the same hurdle on October 22 and 23 unsuccessfully.

Since then, the horizontal line at $0.112 has been established as a robust resistance level which now coincides with the 100-SMA on the daily chart. Cardano is up 12% in the past 24 hours but still needs to break this massive resistance point to hit $0.13.

Can Cardano’s price finally rise above $0.112?

On the daily chart, the price of Cardano has climbed above the 50-SMA and the 200-SMA, turning both into support levels. The digital asset has seen an increase in trading volume over the past four days, which indicates the bullish momentum is strong.

ADA/USD daily chart

The 100-SMA at $0.11 has rejected the price already and practically coincides with the massive resistance level at $0.112. A breakout above this point can easily drive ADA’s price towards $0.13 as an initial price target.

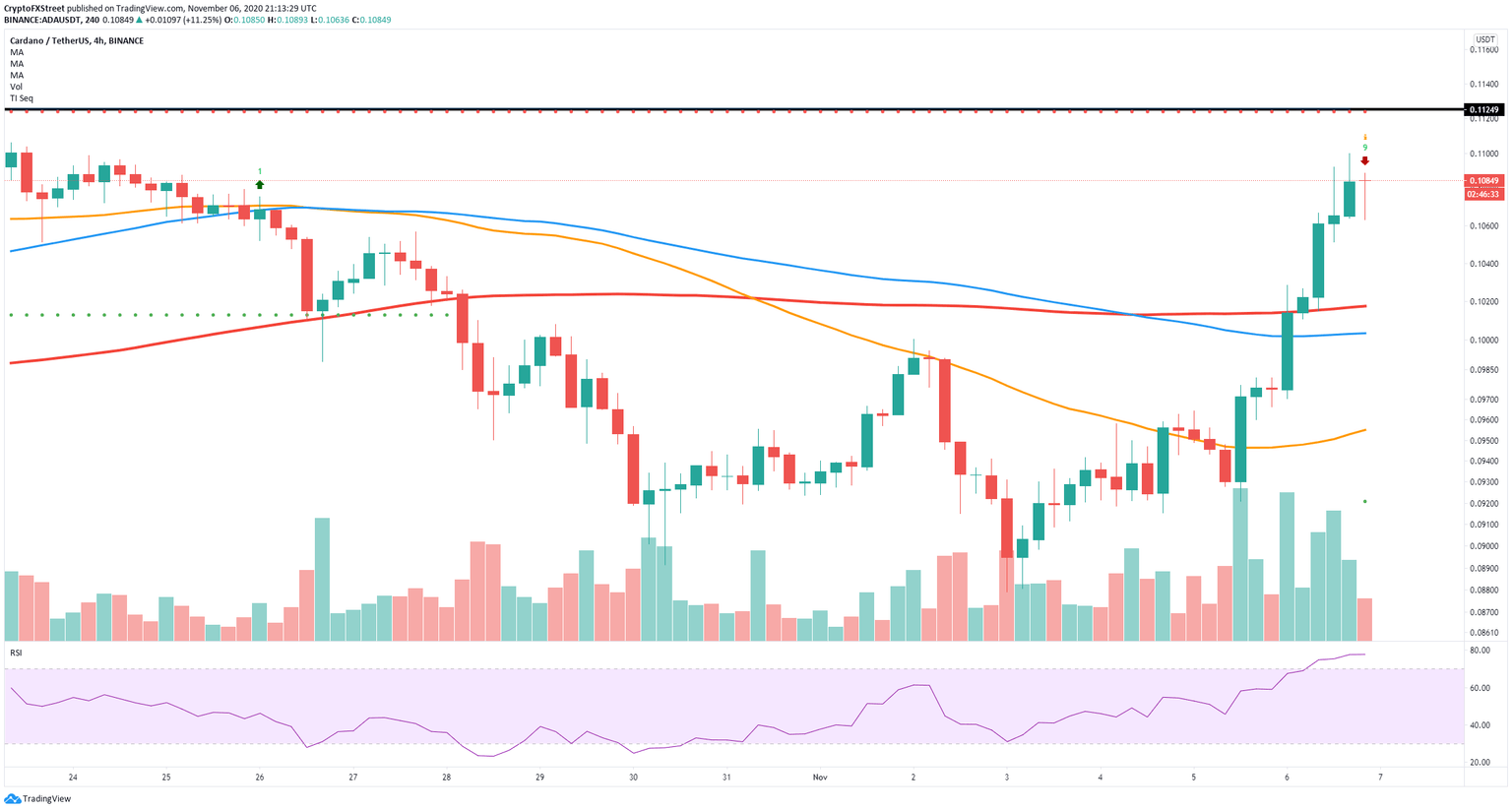

ADA/USD 4-hour chart

On the other hand, the TD Sequential indicator has presented a sell signal on the 4-hour chart which coincides with the overextended RSI, adding even more selling pressure. The next bearish price target is $0.101, the 200-SMA, followed by $0.1.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.