ADA price is poised to rebound as the Cardano community prepares for the Goguen era

- The price of Cardano is currently $0.091 bounded inside a daily downtrend.

- Native tokens are coming out to Cardano, with the Goguen mainnet set to launch in February 2021.

The official roadmap for Cardano is divided into five categories starting with Byron, related to the foundation. The second transition was Shelley, with decentralization, and the team is currently working on 'Goguen', smart contracts.

Native tokens coming to #Cardano: we’ll spin up our pre-production ‘mint’ environment for token creation in December, marking the start of the native asset rollout for Cardano #goguen @Cardano pic.twitter.com/KVElaR4ysi

— Input Output (@InputOutputHK) October 29, 2020

Although the official release of the mainnet is scheduled for February 2021, the team of Cardano is rolling out the 'mint' environment for token creation in December. This pre-release could have a positive impact on the price of Cardano.

This update will allow users from non-technical backgrounds to create their own smart contracts on the Cardano network. Additionally, they will also be able to create new tokens that are supported natively, as well as, the possibility of tokenization of other types of digital and even physical assets.

ADA loses several significant support levels, could be targeting $0.075

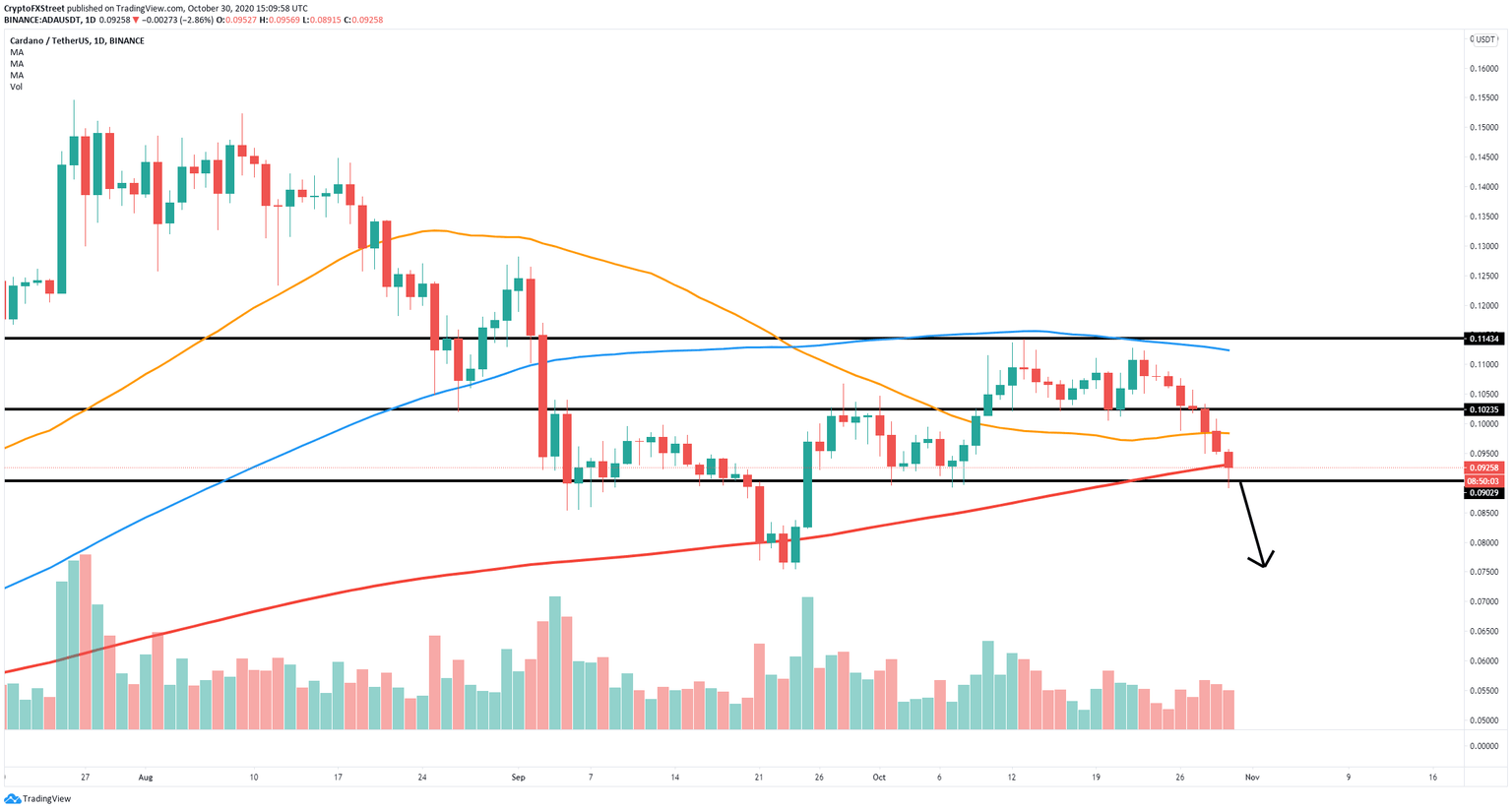

ADA has confirmed a daily downtrend after losing the low of $0.10 established on October 20 and setting a new one at $0.0895 on October 30. Furthermore, the digital asset also failed to hold the 50-SMA support level at $0.098, and it's fighting to stay above the 200-SMA at $0.093.

ADA/USD daily chart

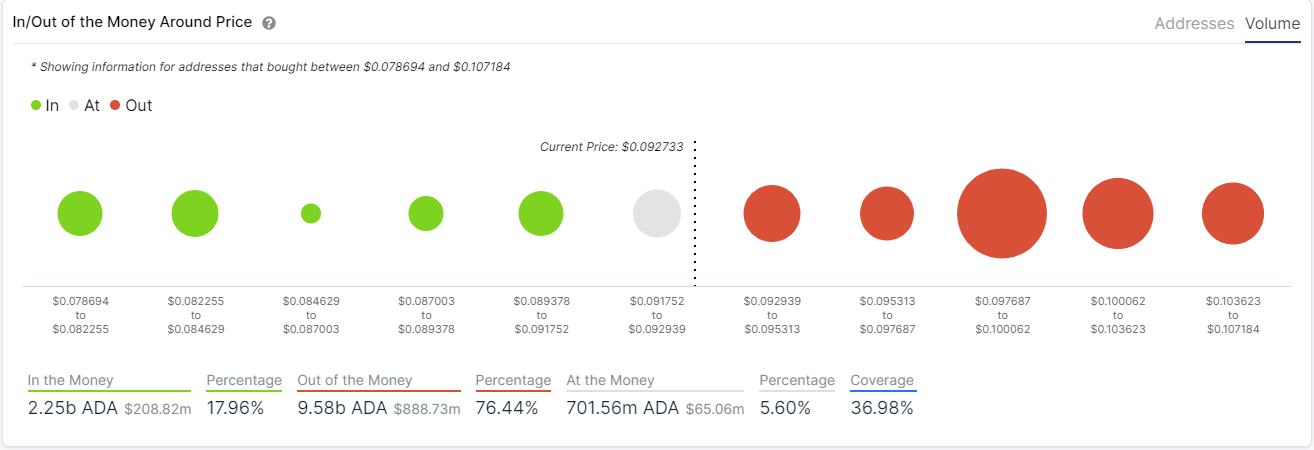

Failure to defend the 200-SMA support level at $0.093 can drive ADA price towards the last low at $0.075. The In/Out of the Money Around Price chart shows very little support to the downside compared to the resistance above. It seems that many investors have their break-even points above $0.0929, which puts a lot of selling pressure on ADA.

ADA IOMAP chart

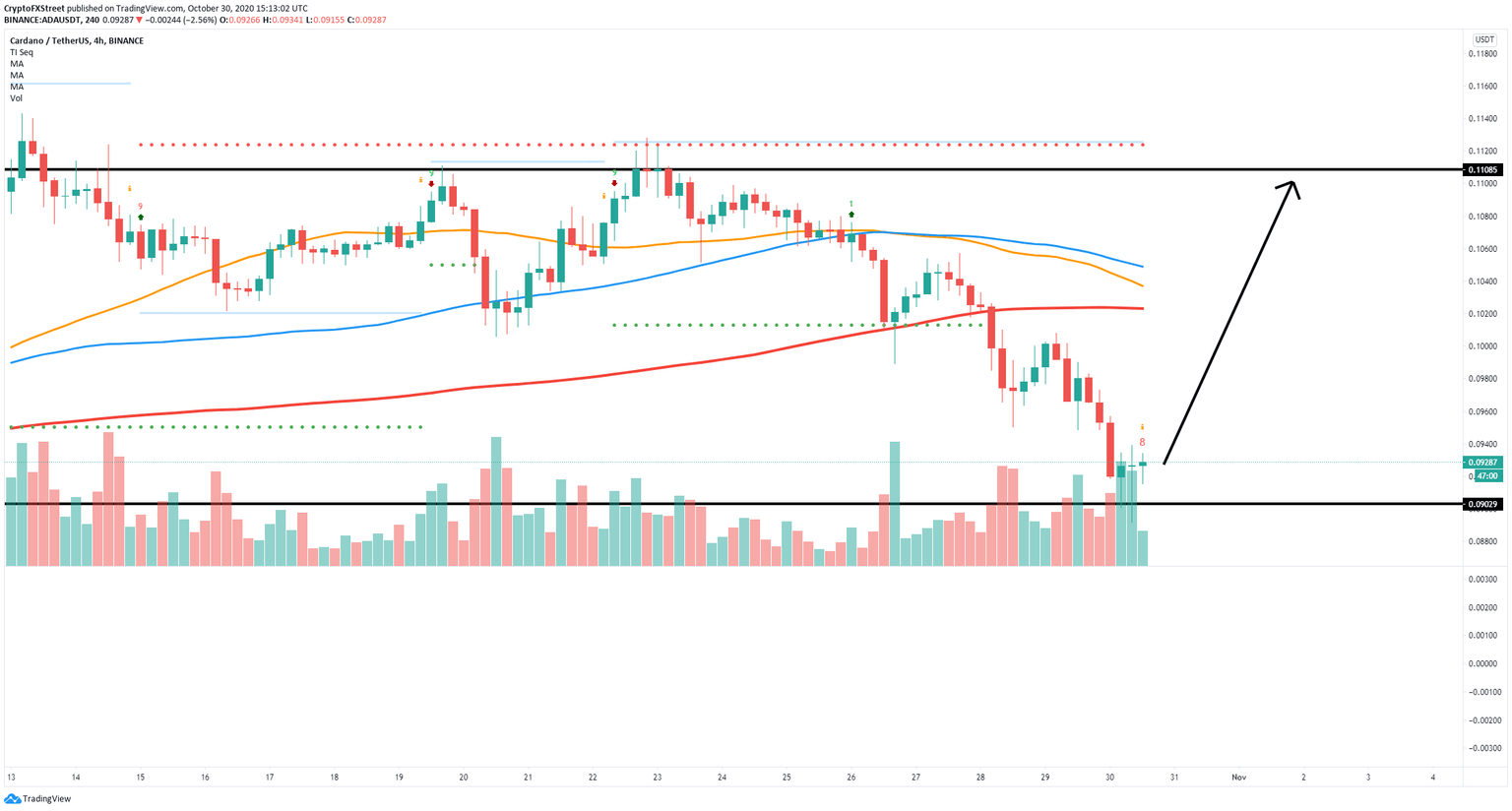

On the other hand, despite losing all three SMAs on the 4-hour chart, the TD sequential indicator seems to be on the verge of presenting a buy signal. The current red '8' sign usually precedes a buy signal.

ADA/USD 4-hour chart

If the signal is confirmed and bulls defend the 200-SMA at $0.093 on the daily chart, we could see ADA jump towards the psychological level of $0.1 and possibly as high as $0.11 if the launch of the Cardano's mint environment for token creation in December is successful.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.