Cardano Price Forecast: ADA plan for new all-time high is clear

- Cardano price broke out of an ascending triangle pattern on the 12-hour chart.

- The digital asset faces just one crucial resistance level before new all-time highs.

- Cardano’s network activity has significantly increased in the past week.

Cardano has established a new all-time high of $1.55 on April 14 and bulls aim for more now. The digital asset had a significant breakout from a key pattern but still faces a significant resistance barrier ahead, according to on-chain metrics.

Cardano price on its way to $1.65

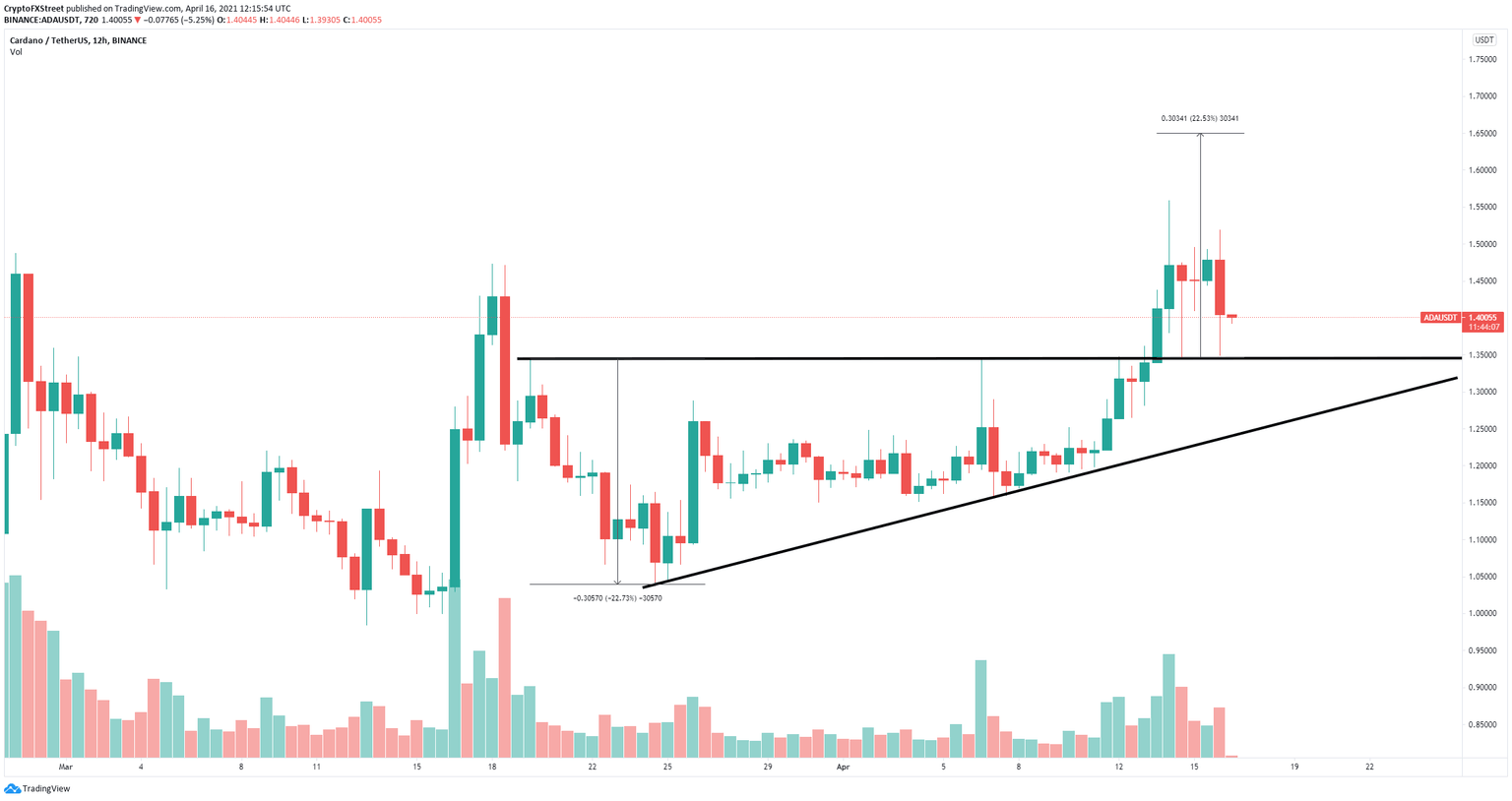

On the 12-hour chart, Cardano formed an ascending triangle pattern that can be drawn with a horizontal line and another trend line connecting the higher lows until both converge.

The breakout of this pattern has a price target of $1.65. Initially, ADA spiked to $1.55 but dropped to retest the previous resistance trend line. Bulls have successfully defended it and aim for a massive rebound toward $1.65.

ADA/USD 12-hour chart

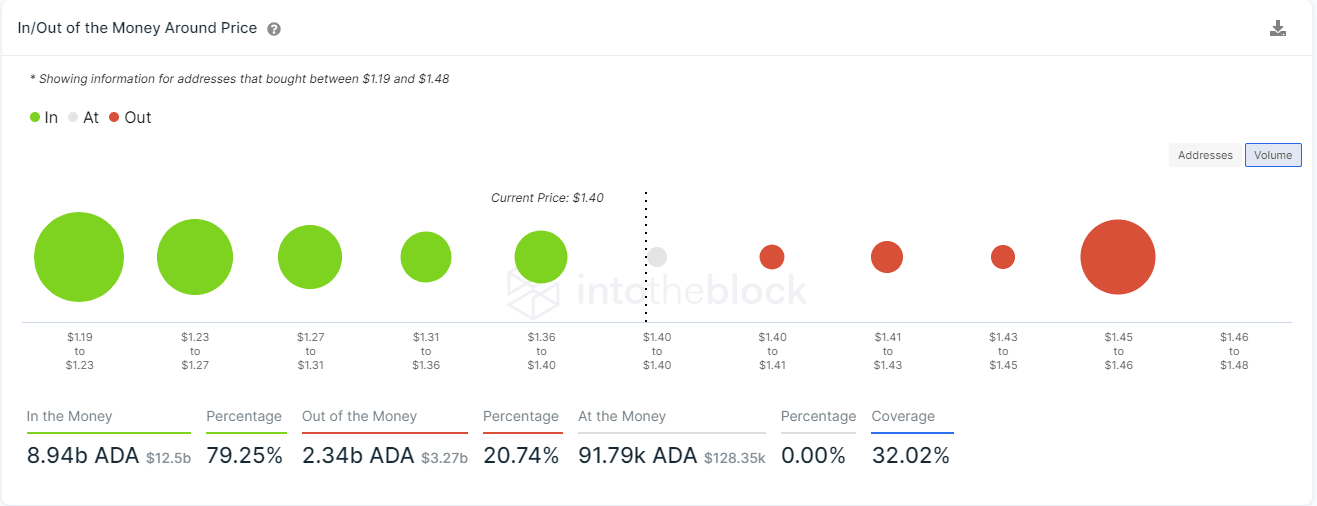

The In/Out of the Money Around Price (IOMAP) chart shows only one crucial resistance level between $1.45 and $1.46, where 69,000 addresses purchased over 2.2 billion ADA coins. A breakout above this initial price target should swiftly push Cardano toward $1.65.

ADA IOMAP chart

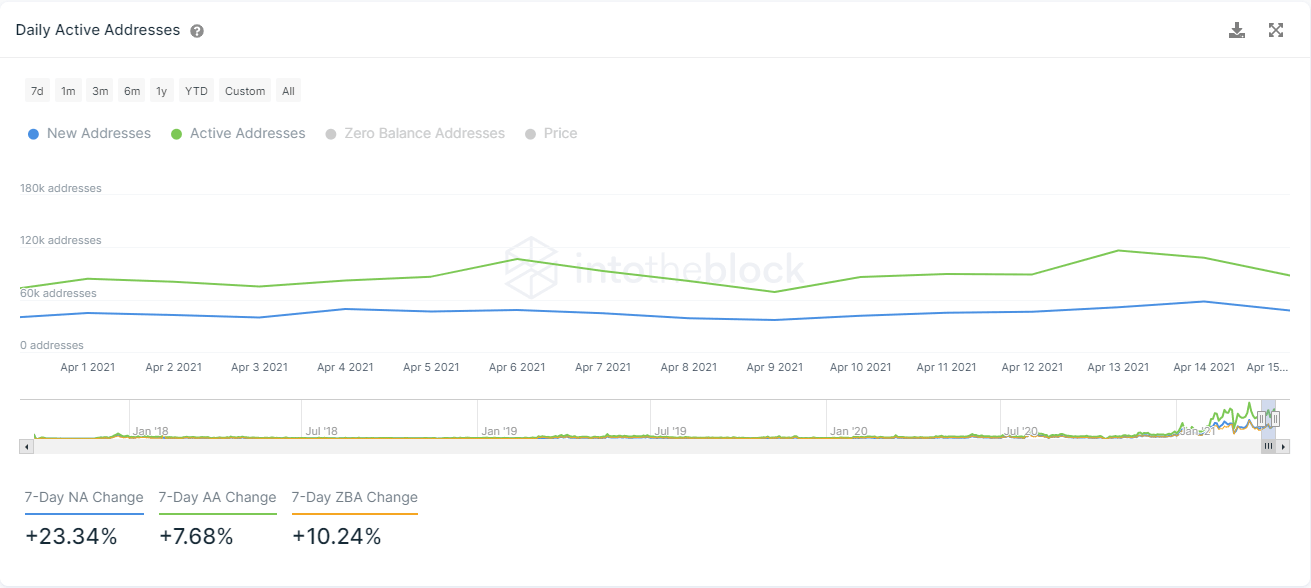

Additionally, the network growth of Cardano saw a significant spike on April 13 and remains in an uptrend for the past two weeks. This indicates that investors are still interested in buying and transacting with ADA even at current prices.

ADA Network Growth

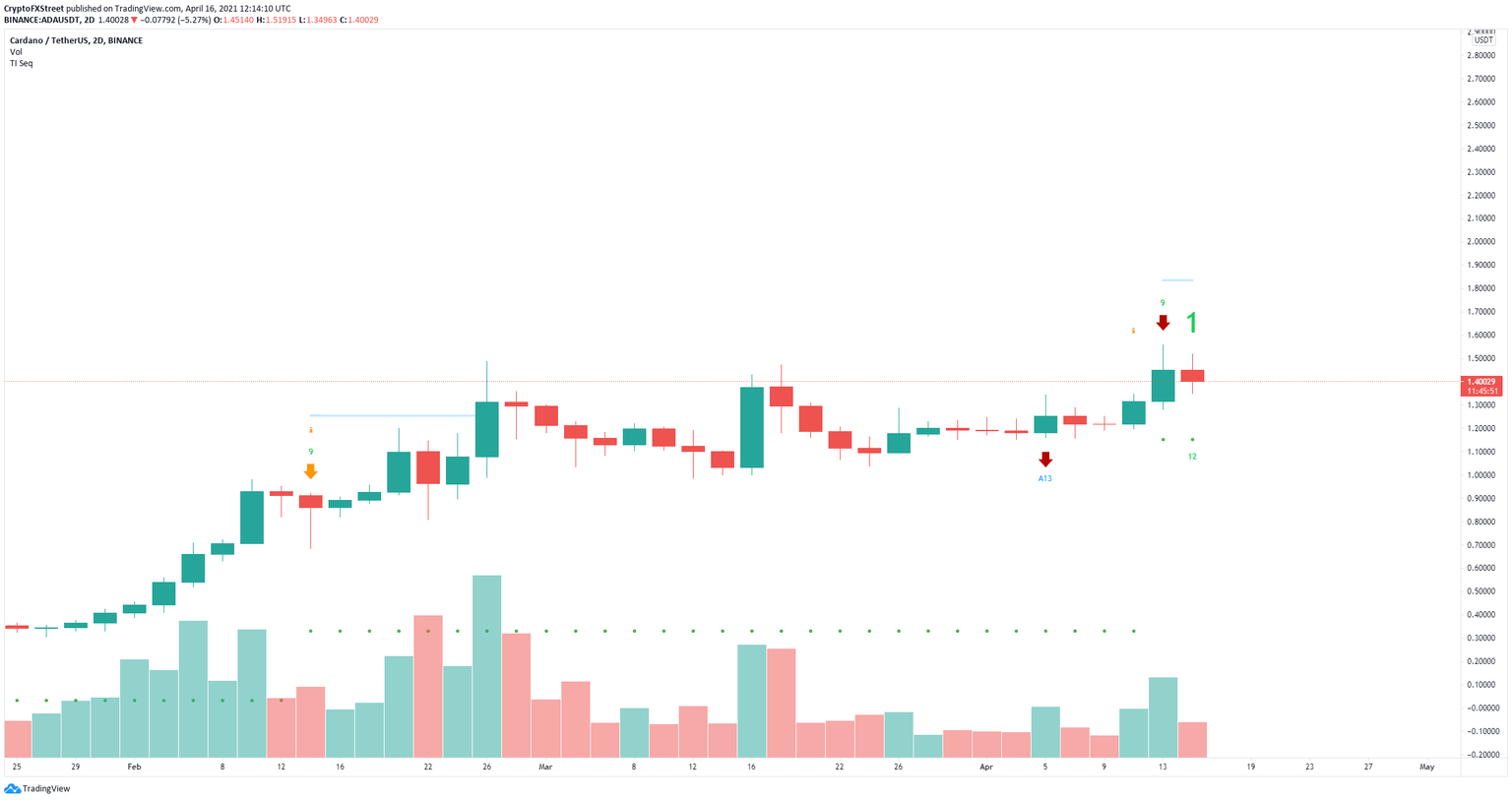

However, on the 2-day chart, the TD Sequential indicator has presented a sell signal that has not been invalidated yet. This signal increases selling pressure for Cardano.

ADA 2-day chart

The IOMAP model shows the most significant support area is located between $1.19 and $1.23, where 202,000 addresses purchased 3.67 billion ADA. The sell signal is not likely going to push Cardano lower than this.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.