Cardano Price Prediction: ADA resets before the next leg up to new all-time highs

- Cardano price faced exhaustion of bid orders as it hit the base of an ascending triangle at $1.48.

- A minor retracement to the immediate demand barrier at $1.34 seems likely.

- Shattering the resistance level at $1.48 forecasts a new all-time high for ADA.

Cardano price awaits an expansion as buyers re-enter an accumulation phase before breaching a crucial overhead barrier.

Cardano price to pullback before catapulting higher

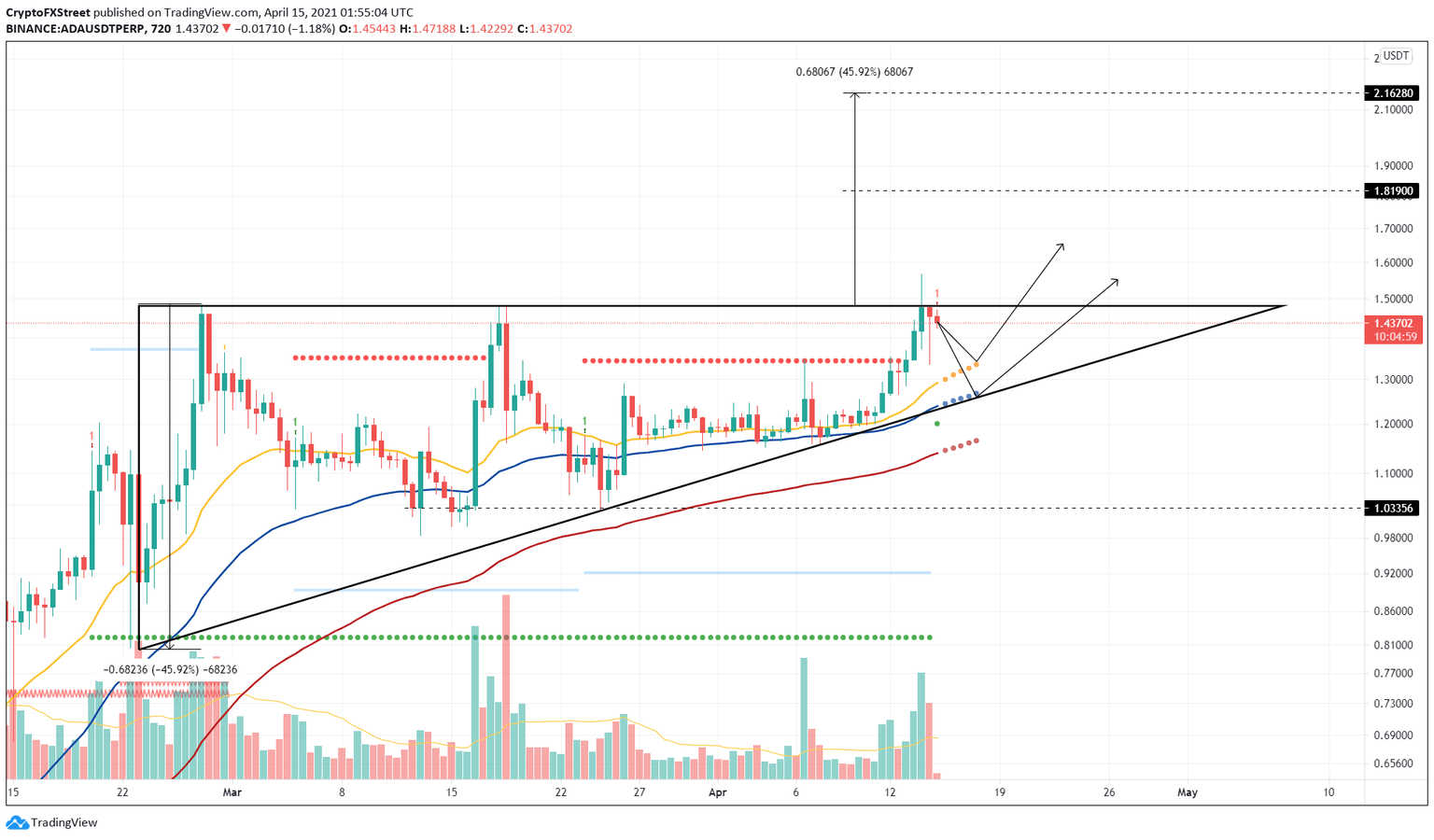

Cardano price is traversing an ascending triangle pattern formed when multiple higher lows and a series of highs are connected using trend lines.

In this setup, buyers aggressively bid up the ADA price, creating higher lows, while a cluster of sellers at $1.48 absorb this momentum, which produces swing highs.

A bullish breakout will occur when the sellers lose steam resulting in a surge higher. In Cardano's case, the 48% upswing is determined by measuring the distance between the first swing high and low and adding it to the breakout point at $1.48.

This move places the ADA target at $2.16.

At the time of writing, the so-called "Ethereum killer" created another swing high as it failed to breach the triangle's base. Interestingly, the Momentum Reversal Indicator (MRI) flashed a cycle top signal in the form of a red 'one' candlestick on the 12-hour chart.

This technical formation projects a one-to-four candlestick correction. The retracement will likely end around the MRI's State Trend Support at $1.34, coinciding with the short-length, 25 Simple Moving Average (SMA).

A breakdown of this would not necessarily affect the upswing and would find stable ground for a reversal around the triangle's hypotenuse at $1.26, which coincides with the long-length 50 SMA.

Therefore, investors can expect an upswing to emerge at $1.34 or $1.26.

ADA/USDT 12-hour chart

On the flip side, if the sellers' ask orders dominate, the trend line connecting the swing lows could be breached. In such a scenario, market participants should expect a swift correction to $1.20.

If Cardano price breaches $1.15 and continues to descend, the bullish thesis will face invalidation and result in an 11% correction to $1.03.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.