Cardano price flashes buy signal, but will ADA bulls cooperate?

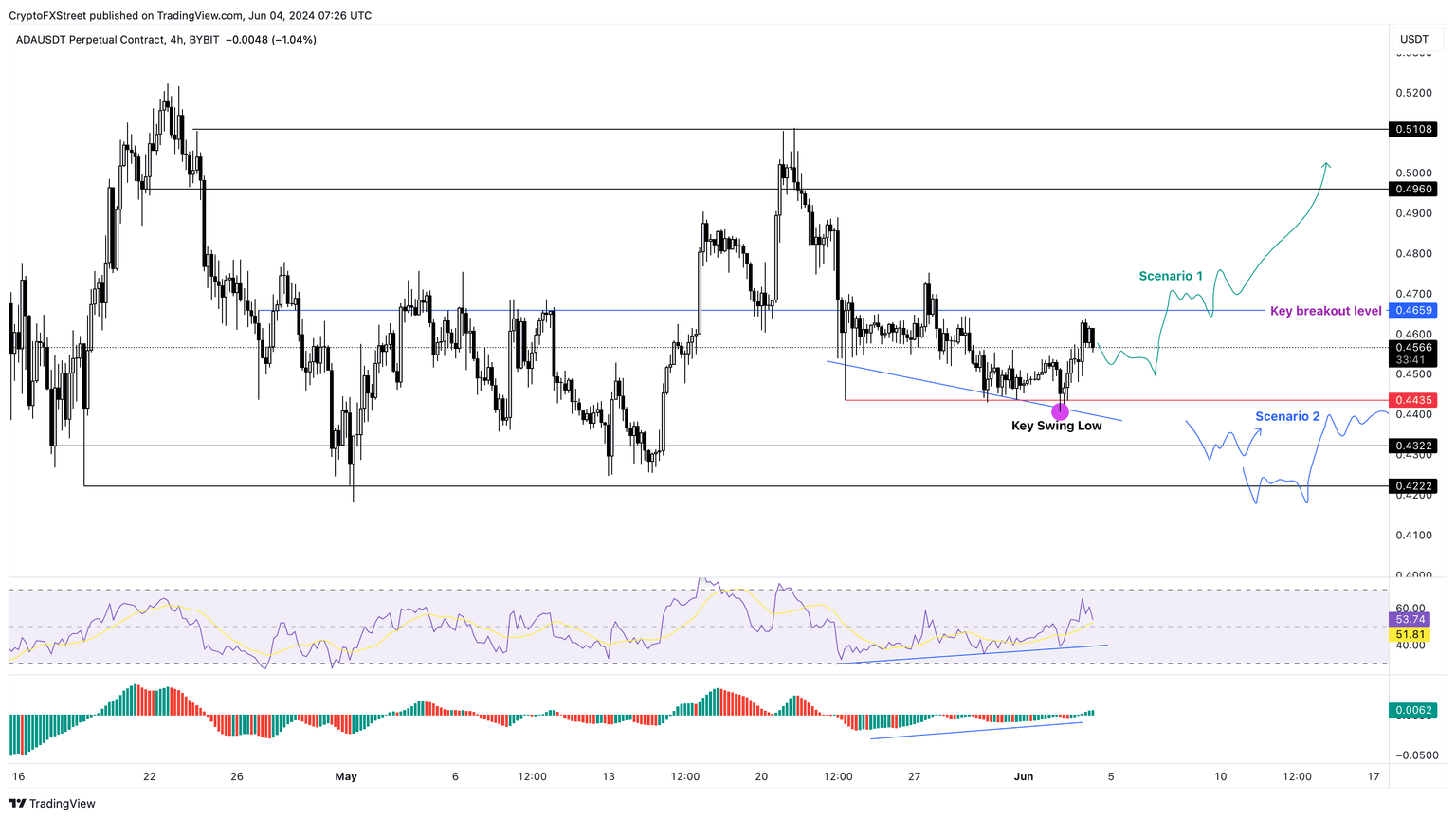

- Cardano price could see an 11% rally if it can overcome the $0.465 hurdle.

- If ADA rises above the $0.477 swing high, it will confirm an uptrend.

- A second scenario includes the so-called “Ethereum-killer” to first decline to $0.422 before it attempts a revisit of $0.510.

Cardano (ADA) price is at a reversal zone but there are other factors at play that could prevent it from flipping bullish. Investors need to pay close attention to immediate levels to determine ADA’s bias.

Also read: Cardano Price Forecast: ADA's recent breakout could trigger 15% rally

Cardano price at pivotal point

Cardano price has reversed multiple times around the $0.422 and $0.432 levels, triggering a quick double-digit upswing. The last move around mid-May set a local top at $0.511, which is currently being undone as ADA trades around $0.456.

The recently created lower low by Cardano price is not conforming with the Relative Strength Index’s (RSI) higher low, suggesting a bullish divergence formation. This setup signals that the momentum is rising, but the underlying asset’s price is not reflecting it.

After forming the key swing low on June 2, ADA triggered a 5% rise and could continue on this path. In such a case, Cardano price needs to overcome the immediate hurdle at $0.465 and set up a higher high relative to the $0.477 swing point. Assuming this move is successful, it would signal a break of the bearish market structure and the start of a bullish one. Such a development would send ADA up to revisit the $0.496 and $0.510 hurdles.

The RSI has breached the mean level of 50 in the 4-hour chart for the first time since it broke below it on May 23. If the momentum holds this key barrier, it would signal a flip favoring bulls. Regardless, the move from $0.455 to $0.511 would constitute an 11% gain from the current position.

ADA/USDT 4-hour chart

According to Santiment’s Network Realized Profit/Loss (NPL) indicator, there was a massive capitulation event on May 30. These events occur when ADA holders sell their tokens at a loss to prevent further losses. Long-term and patient investors await these opportunities to accumulate at a discount.

History shows that a steep drop in NPL was followed massive run-ups in Cardano price. So, if this pattern repeats, ADA could be due for an uptrend. This outlook coincides with the 11% rally forecasted from a technical perspective.

ADA NPL

While the above outlook is logical, it relies on bullish divergence to propel Cardano’s price higher. To be on the safer side, investors need to consider a scenario where ADA fails to do this. In such a case, the ideal point of entry would be a retest of $0.432 and $0.422. A sweep of these levels followed by a recovery above $0.432 would confirm a potential start of the reversal. In such a case, Cardano could trigger another attempt to revisit $0.511.

Read more: Cardano Price Forecast: ADA sets the stage for a 20% rally

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%2520%5B12.56.10%2C%252004%2520Jun%2C%25202024%5D-638530899157424256.png&w=1536&q=95)