Bitcoin price: How scooping up BTC at $17,000 could play out in bleeding bear market

- Bitcoin at $15,000 may have been a dream allocation for traders at $69,000 highs, but bottoms and consolidation in BTC take months to play out.

- Bitcoin is likely to be relatively cheap as macroeconomic headwinds intensify in the bear market.

- Analysts noted a key indicator of panic selling among BTC traders, in the derivatives markets.

Bitcoin price plummeted to a weekly low of $15,742 before recovering above the $17,000 level. In bear markets, however, a Bitcoin consolidation and bottom formation can take anywhere from weeks to months to complete. It is therefore challenging to ascertain whether the current price of $17,300 is the level to scoop up more BTC or more declines are still on the cards.

Samuel Bankman-Fried’s FTX and Alameda Research together were one of the biggest exchange and market makers of all time in crypto. The collapse of these two entities has instilled fear of additional fallout among crypto platforms that have exposure to FTX and Alameda, leading to a run on the whole crypto market whilst other risk assets rally.

Also read: Is Justin Sun's TRON empire a collateral in the FTX vs. Binance crypto war?

Bitcoin price could plunge to $13,000 following the FTX exchange crisis

JP Morgan’s team of analysts led by Nikolaos Panigirtzoglou predicted that Bitcoin price could drop to $13,000 in the aftermath of the FTX collapse. Bitcoin price has declined considerably, falling nearly 20% since the war between rival exchanges FTX and Binance started.

Analysts argue that FTX’s current liquidity crisis could propel a “cascade of margin calls,” and Bitcoin could see a low of $13,000 in summer months.

Teams of analysts on Wall Street estimate that the ongoing crypto bear market could intensify in the days to come and result in a lower Bitcoin valuation. JP Morgan believes the liquidity crisis is not the most challenging issue in the FTX-Alameda saga. What’s worrying is the dearth of organizations with enough capital or liquidity to help FTX exchange.

JP Morgan analysts were quoted as saying that:

What makes this new phase of crypto deleveraging induced by the apparent collapse of Alameda Research and FTX more problematic is that the number of entities with stronger balance sheets able to rescue those with low capital and high leverage is shrinking.

This indicator in derivatives markets implies BTC panic selling is on

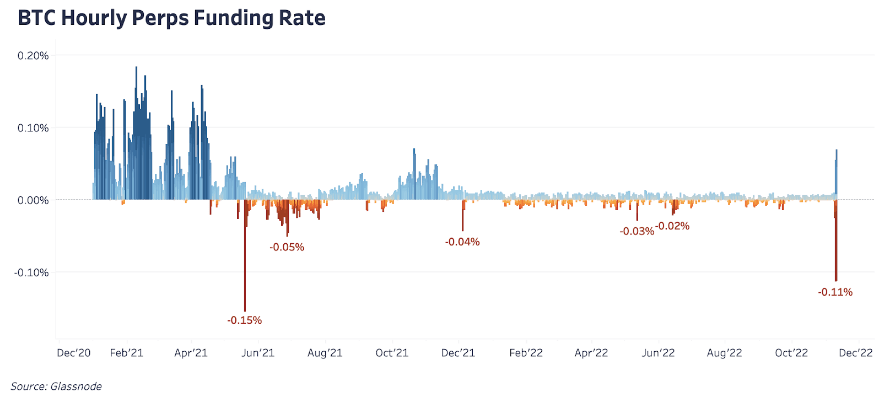

The funding rate for the derivatives market is considered an indicator of panic selling or capitulation in Bitcoin. A funding rate mechanism is implemented by exchanges to balance perpetual swaps' short and long positions by either incentivizing or discouraging traders.

Traders either pay or receive funding rates depending on open positions. When the funding rate is positive, longs pay shorts and vice versa. Dylan LeClair and Sam Rule, analysts at Bitcoin Magazine note that the funding rate for the derivatives market has reached historically low levels, an initial sign of capitulation taking place and forming as traders pile on to over-short Bitcoin in waves.

While macroeconomic factors are still in the driver’s seat for all asset classes, the derivative positioning following the black swan event of the FTX-Alameda crisis is encouraging from a Bitcoin-native perspective. Sustained negative funding could result in a macro bottom since a legacy panic event drives perpetual futures prices far below spot.

Bitcoin hourly perpetual funding rate

Speculating whales unaffected by negative funding and panic selling

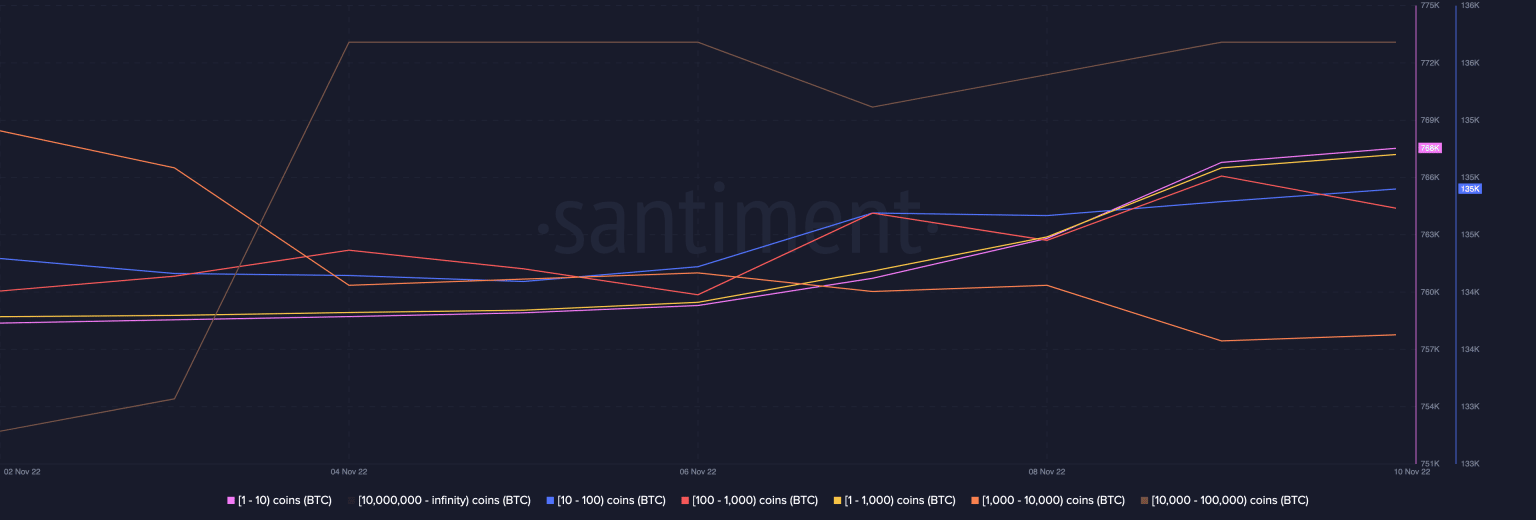

Tomáš Hančar, technical analyst at CryptoQuant observed that, “speculating whales don’t seem to be bothered much/panicking out of their positions.” Hančar argues that large wallet investors are scaling in even with the latest downturn in Bitcoin.

Bitcoin whale addresses

Based on data from crypto aggregator Santiment, the count of BTC addresses holding one to 1000 BTC is 917,000, up from 907,000 a week ago. The rise in count of addresses is significant as it symbolizes long-term confidence among large wallet investors.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.