Can Ethereum price rise despite millions of ETH flooding into exchanges?

- Ethereum worth $16.7 million was sent to crypto exchange FalconX, which could be positioned to sell.

- Individual investors are also seen depositing ETH to centralized platforms, likely to book profits.

- Ether currently trades at $2,230 and could trigger a potential reversal, especially if Bitcoin price fails to move higher.

Ethereum price has been in a multi-year consolidation and recently “broke out” according to some analysts who forecast a bullish future for ETH. However, taking a closer look at on-chain flows suggests that investors might be looking to sell.

Read more: Ethereum Price Prediction: ETH attempts to flip $2,300 into support

Ethereum investors send ETH to exchanges

The bankrupt crypto lending and borrowing platform Celsius sent 7,500 ETH worth nearly $16.7 million ETH to exchanges on December 5, according to data from Spot On-chain. A look at the history of Celsiu’s wallets shows a whopping 37,269 ETH has been sent to centralized entities since November 14, 2023. The recent transfer is the second-highest inflow after the $19.47 million deposit on November 30.

#Celsius Network deposited 7,500 $ETH ($16.7M) to #FalconX at $2,227 ~8hrs ago.

— Spot On Chain (@spotonchain) December 5, 2023

In total, Celsius Network has deposited 37,269 $ETH to #Coinbase, #FalconX, and #OKX at an average price of $2,084 ($77.6M) since Nov 14, 2023 (21 days ago).

More details:… https://t.co/bsUFwX1qUp pic.twitter.com/pDjhPcb9RB

Additionally, a popular crypto investor with the screenname “smartestmoney.eth” has reportedly begun selling their ETH. This entity deposited $10.08 million worth of ETH to Binance at the time of writing, according to data from Lookonchain.

smartestmoney.eth(@smartestmoney_) appears to be selling $ETH.

— Lookonchain (@lookonchain) December 4, 2023

He deposited 4,500 $ETH($10.08M) to #Binance just now.https://t.co/xJzBWPvsQJ pic.twitter.com/mXEs5Z8jJj

While these two deposits are not large enough to trigger a sell-off for the ongoing rally, investors should be cautious of what Bitcoin will do next. The 2% drop in BTC price caused altcoins to crash 15% to 30% on December 4. Hence, a continuation of the downside movement in pioneer crypto could cause serious damage to altcoins, including ETH.

More on Bitcoin price: Week Ahead: Altcoin plays for traders as Bitcoin crosses $42,000

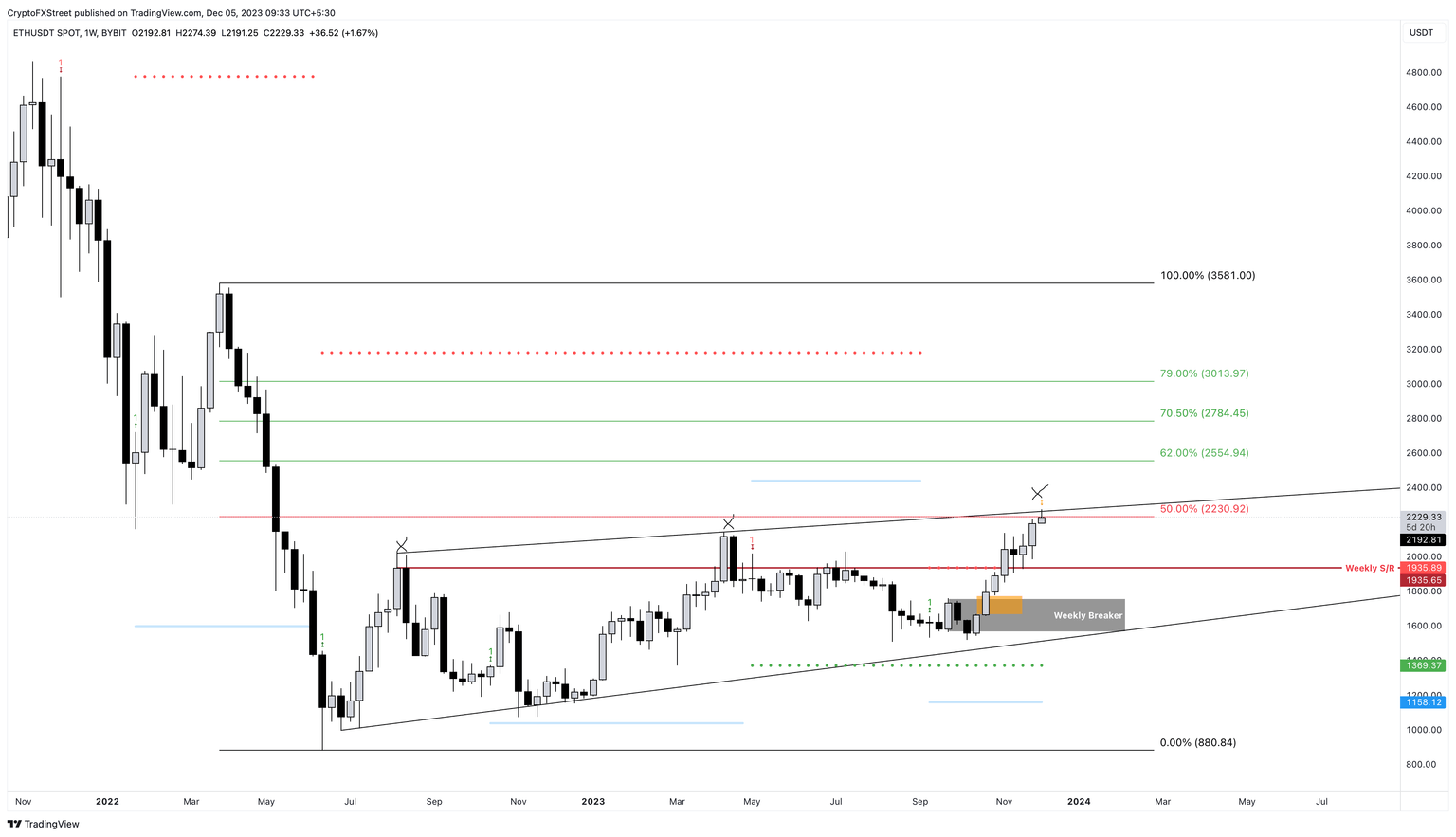

ETH price in a wedge formation not ascending triangle

Many investors point out that Ethereum price action over the past months has led to the formation of an ascending triangle. These analysts forecast that the recent move was a breakout and that ETH is primed for a further move north. While this outlook is not wrong, investors need to take another look at Ether’s price action.

Read more on ETH’s ascending triangle: Ethereum price dilemma or buy signal before 60% rally

Considering the steady build-up of selling pressure and Bitcoin price slowdown, a short-term reversal could be in place. Instead of looking at Ethereum price action over the past few months as an ascending triangle, a different approach could be a rising wedge.

Ethereum price is currently trading at $2,230, which is the upper limit of this setup. This area coincides with the range’s midpoint at $2,230, making it a tough level to crack. Hence, rejection here seems likely, especially considering the inflows to exchanges. Therefore, ETH could slide lower in the short-term while remaining bullish on the long-term.

A bearish breakout of the rising wedge is unlikely, considering the current market conditions. Hence, the ideal level for accumulation is the weekly support level of $1,935. If this level gives in, then the weekly bullish breaker, extending from $1,562 to $1,759, is the best place for long-term holders to step in.

ETH/USDT 1-week chart

Invalidation of this move will occur if Ethereum price flips the $2,230 hurdle into a support floor. In such a case, ETH could revisit the $2,784 level, which was last seen in May 2022.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.