Ethereum Price Prediction: ETH attempts to flip $2,300 into support

- Ethereum price is on a tear, consolidating within a bullish technical formation that promises more gains if sustained.

- ETH could rise 5% to convert the $2,300 resistance level into a support floor before continuing its upward trajectory.

- The bullish thesis will be invalidated upon a daily candlestick close below the $2,143 support level.

Ethereum (ETH) price has been consolidating within an ascending parallel channel since the broader market turned bullish around October 18, pushing north with key drivers including speculation of spot Ether exchange-traded funds (ETFs) launching in the market.

Also Read: Ethereum price breaks past $2,000 as BlackRock hints at filing for spot Ether ETF

Ethereum price eyes 5% rise above the $2,300 support

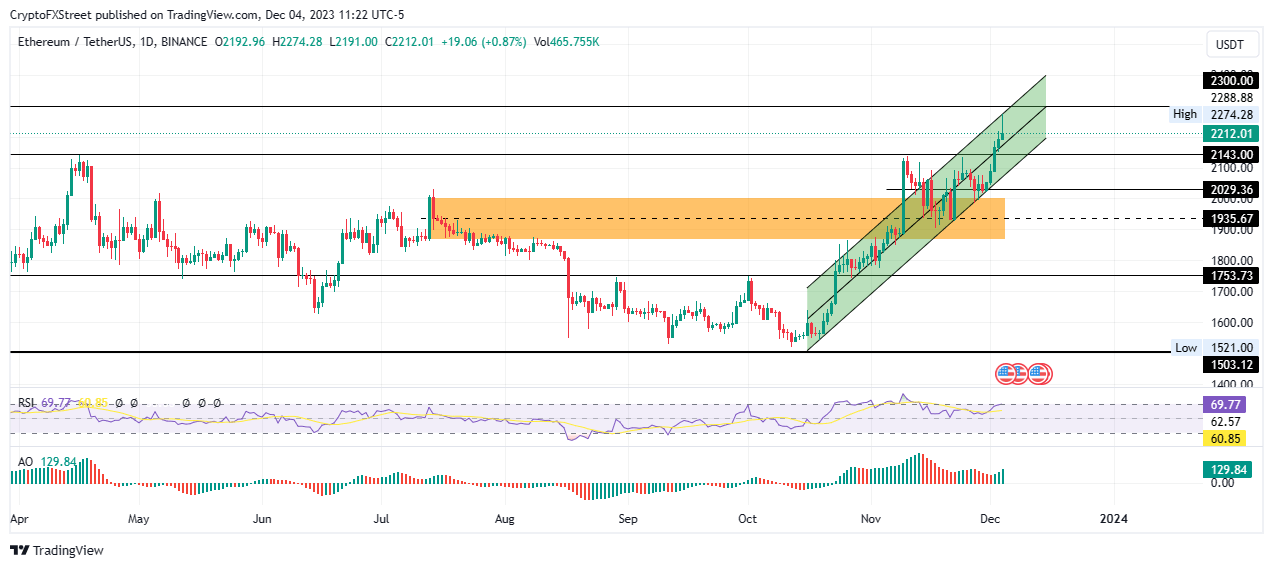

Ethereum (ETH) price is trading with a bullish bias, sustained by an ascending parallel channel. This technical formation promises and delivers more gains for the asset as long as it remains within its confines. However, based on the current outlook, the largest cryptocurrency by trading volume looks ready for a breakout after one attempt already.

Technical indicators show that Ethereum price still has some upside potential, with the Relative Strength Index (RSI) inclined north at 69 to show momentum is still rising. Its position below 70 is good, suggesting ETH is still not overbought nor ripe for a correction.

Similarly, the Awesome Oscillator (AO) remains in positive territory with green histogram bars. This points to a strong presence of bulls in the Ether market and could bode well for Ethereum price, depending on how the bulls play their hands.

Increased buying pressure above current levels could see Ethereum price breakout above the upper boundary of the chart pattern, confirmed by a flip of the $2,300 resistance level into a support level. This would set the tone for Ether to continue its upward trajectory.

ETH/USDT 1-day chart

On-chain metrics support Ethereum price bullish outlook

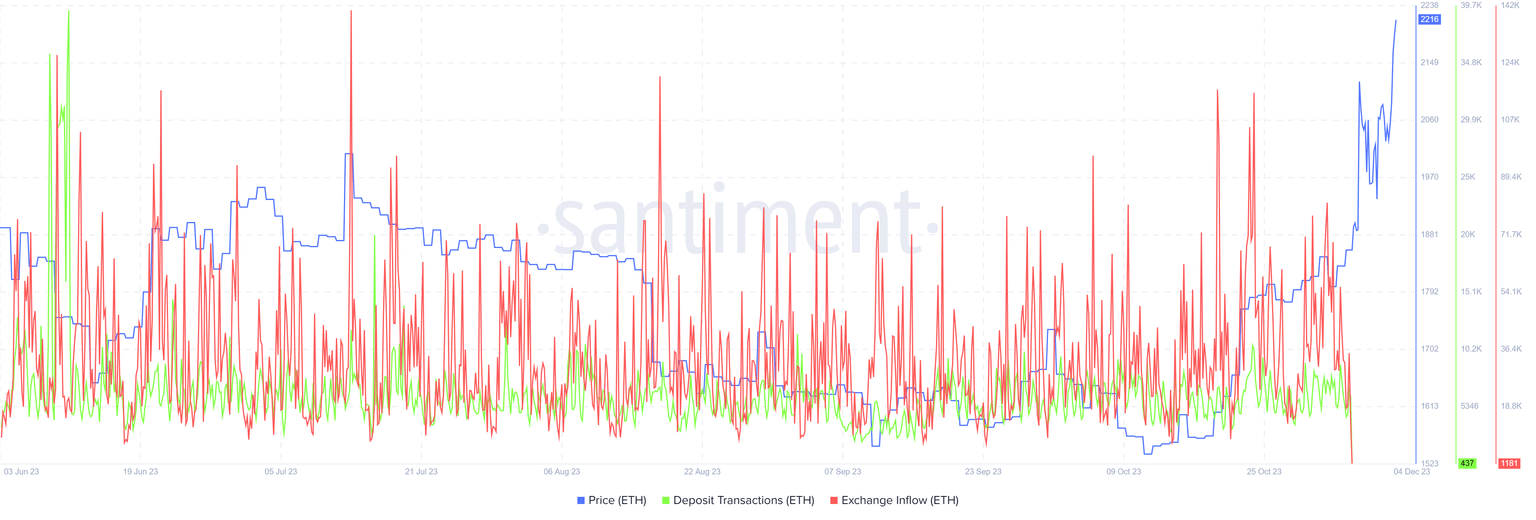

Multiple on-chain metrics support the bullish thesis for Ethereum price, including the dwindling deposit transactions and the volume of exchange inflows. As a spike in deposit transactions would indicate a rise in short-term selling pressure, the absence thereof shows investors do not have the intention to sell.

This outlook is corroborated by dwindling exchange inflows, suggesting investors are not moving their ETH holdings to exchanges. There is no effective intention to sell in the near future.

ETH Santiment: Deposit transactions, exchange inflows

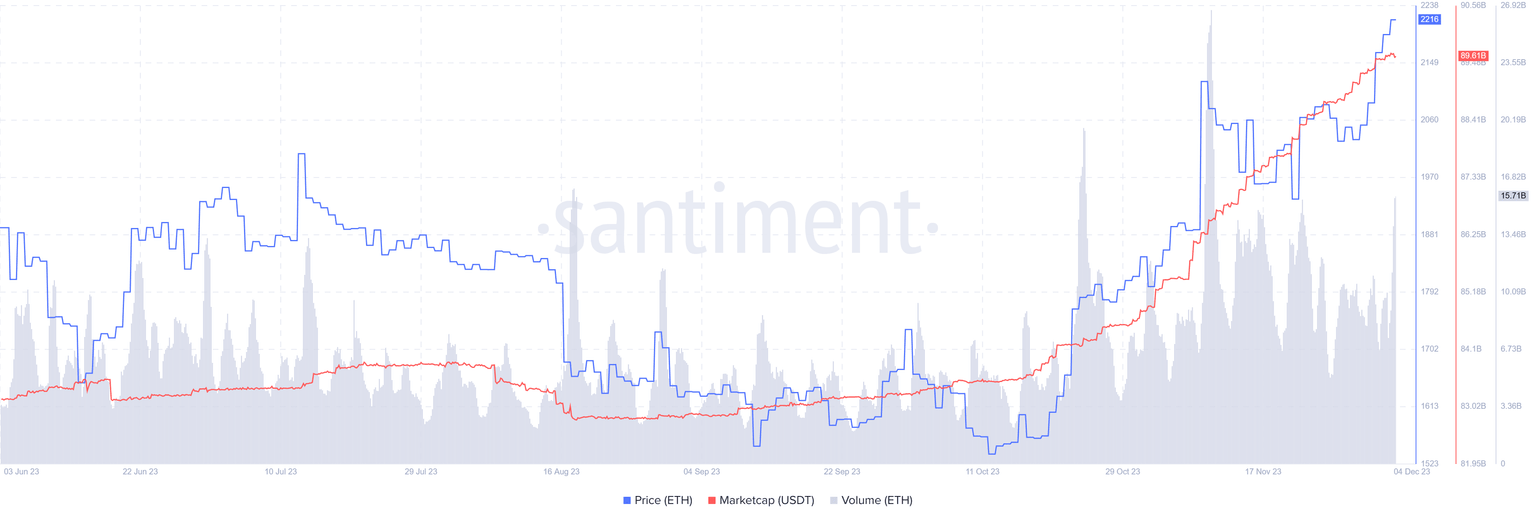

Further, the Tether (USDT) stablecoin market capitalization is rising, suggesting fresh capital inflow into the Ether market, interpreted as the intention to buy. The ensuing buying pressure could inspire a prolonged uptrend for Ethereum price.

ETH Santiment: USDT market capitalization

Conversely, if selling pressure increases, possibly as investors start booking early profits after such a striking climb, Ethereum price could pull south. In such a directional bias, ETH could lose the confluence support between the midline of the channel and the horizontal line at $2,143. A break and close below this level would invalidate the bullish thesis.

Further south, Ethereum price could extend the fall, potentially going as low as the $2,029 support before a foray into the supply zone turned bullish breaker. A decisive candlestick close below the midline of this zone at $1,935 would confirm the continuation of the downtrend.

Ethereum FAQs

What is Ethereum?

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

What blockchain technology does Ethereum use?

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

What is staking?

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Why did Ethereum shift from Proof-of-Work to Proof-of-Stake?

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.