Can Dogecoin price rally amid opposing on-chain metrics?

- Dogecoin price looks to retest the $0.048 to $0.057 demand zone.

- A bounce off the aforementioned level could result in a new uptrend and considerable gains.

- A daily candlestick close below $0.048, however, will invalidate the bullish thesis.

Dogecoin price is drifting slowly down to a stable support floor that could potentially provide a reversal point and the start of a new uptrend.

On-chain metrics, however, are not great fans of a bullish move and suggest that any attempts at a rally will be blocked.

Dogecoin price falls, in search of momentum

Dogecoin price slipped below a key support level at the volume point of control (POC) at $0.066 and crashed roughly 12% to where it currently trades - $0.060. This bearish descent will probably continue until DOGE encounters the $0.048 to $0.057 demand zone.

Interestingly, an equal low formed at $0.057 coincides with this demand zone, making it a strong support confluence. Market participants can, therefore, reasonably expect this level to stand firm, prevent more losses and possibly lead to a bounce.

If buyers step in at this point, it could be an inflection point that triggers a 20% run-up back to the POC at $0.066. Flipping this level will be a tough job, but if successful, could see the run-up extended to $0.077, constituting a 35% gain.

From a mean reversion perspective, however, Dogecoin price might retest the midpoint of 70% between April 25 and June 14 at $0.110. In total, the move from $0.057 to $0.110 would represent a 95% ascent and is likely where the upside will be capped for DOGE.

DOGE/USDT 1-day chart

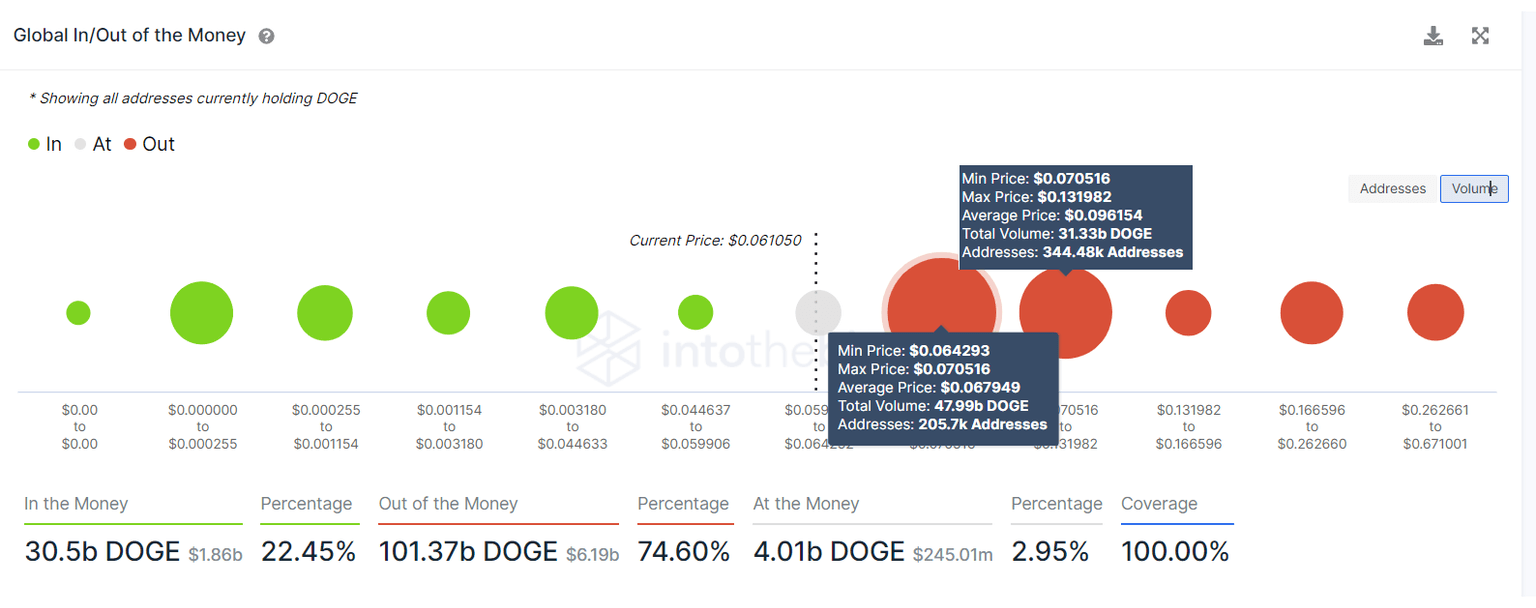

Although the technicals are potentially bullish, the on-chain metrics disagree with this outlook. IntoTheBlock’s Global In/Out of the Money (GIOM) model shows that there are two massive clusters of underwater investors extending from $0.064 to $0.013.

Here, roughly 550,000 addresses that purchased nearly 80 billion DOGE tokens are out of the money. Therefore, if Dogecoin moves into their breakeven price, these holders are likely to sell their holdings, adding more momentum to the downtrend.

From a conservative outlook, the upside for Dogecoin price is capped at $0.067, which is the average price at which the first cluster of underwater investors purchased roughly 48 billion DOGE tokens.

DOGE GIOM

While things are looking up for Dogecoin price, a daily candlestick close below $0.048 will invalidate the bullish thesis for DOGE. In such a case, the meme coin will likely crash lower in search of a stable support level at $0.040.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.