BTC Price Analysis: Bitcoin traders hanging on in the belief last-minute pop is still possible

- Bitcoin price gets dragged below the surface as equities tank again on Tuesday.

- BTC sees hopes for the last chances of a rally evaporate.

- Expect to see a dip towards $16,020 by New Year.

Bitcoin (BTC) price is no match for global market dynamics as traders are moving into bonds for safety in the last week of the year. The move comes after the US Housing Price Index points to a sharp decline in the value of houses across the US, and a 2-year bond auction by the US Treasury received an outsized number of bids – more than have been seen since 2017. The bond market moved so substantially that the forecasted rate cut for 2023, visible in the CME Fed Fund Futures, got priced out and turned into hikes throughout 2023.

Bitcoin deflates as the wind blows in the bond market

Bitcoin price took a step back on Tuesday as the US equity markets dropped again and are on a losing streak. An interesting point to underline is that each time BTC price has fallen, the Nasdaq led the decline, followed by the S&P 500 and last of all, the Dow Jones, clearly pointing to a sector rotation as traders are moving out of tech. All that money is being either put into cash or bonds as currently, the returns of US Treasury bonds start to look interesting and provide security, as the US government will always pay back its debt and is unlikely ever to default.

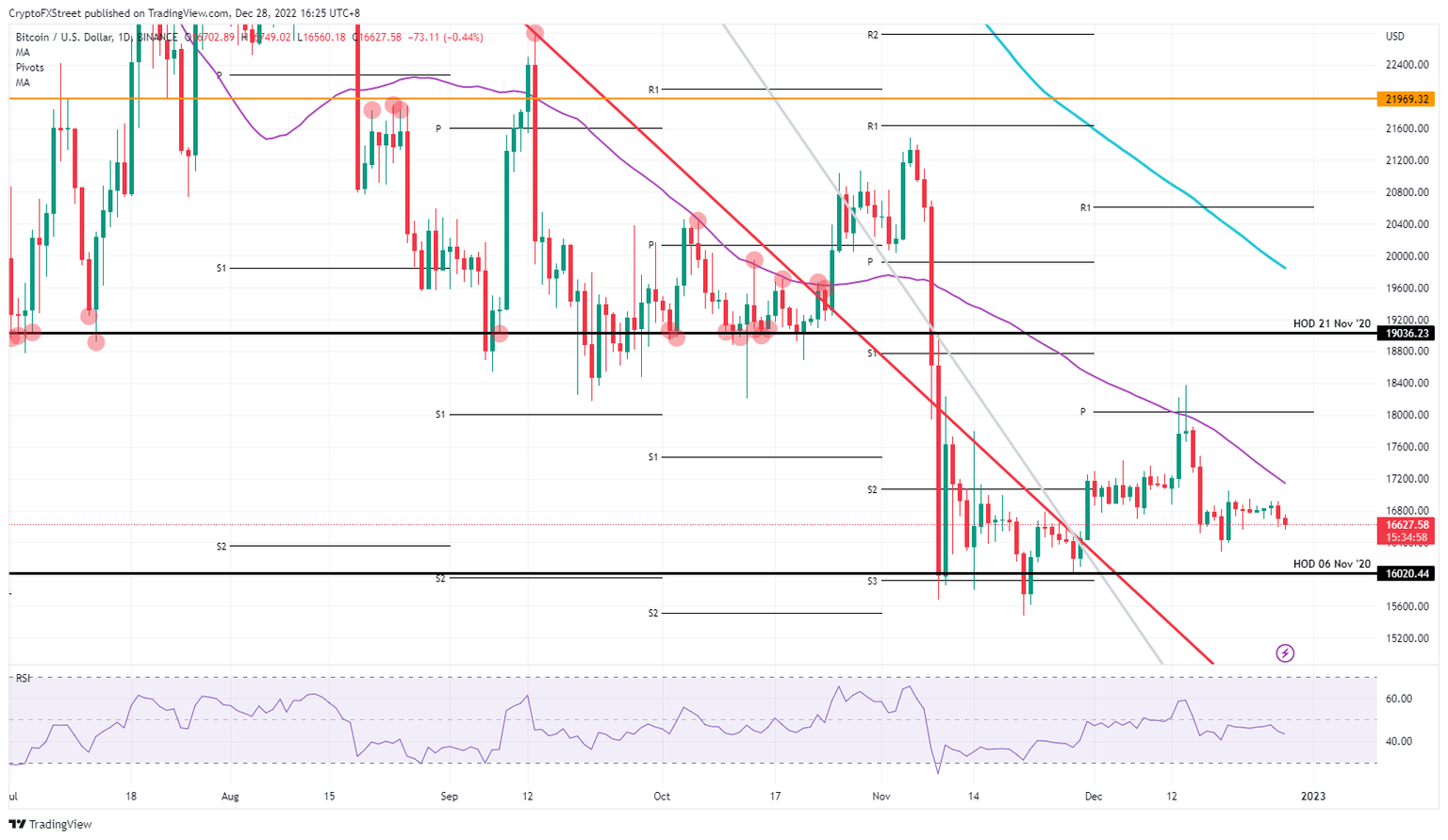

BTC thus sees traders betting that the US Treasury, like a Lannister, will repay its debt and interest and thus sees investors parking in returns between 1.5% to 4% or 5% on an annual basis without the whipsaw moves of the equity markets. Bitcoin price will see more cash being allocated out of its price action and into bonds in the coming weeks as the US Federal Reserve is set to hike more in 2023. This could result in BTC hitting $16,020 and flirting with more downturns in the coming days and weeks.

BTC/USD daily chart

Should some upturn be created, it would be mainly headline driven, by for example, the message that peace talks are underway between Russia and Ukraine. If those headlines hit the wires, expect a massive rally as the risk premium will be priced out of Bitcoin's current price level. At first, $17,200 will be up for a test with the 55-day Simple Moving Average (SMA) and $18,000 as the peak level to reach.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.