BlackRock’s spot Ethereum ETF filing fails to catalyze ETH price sustained rally

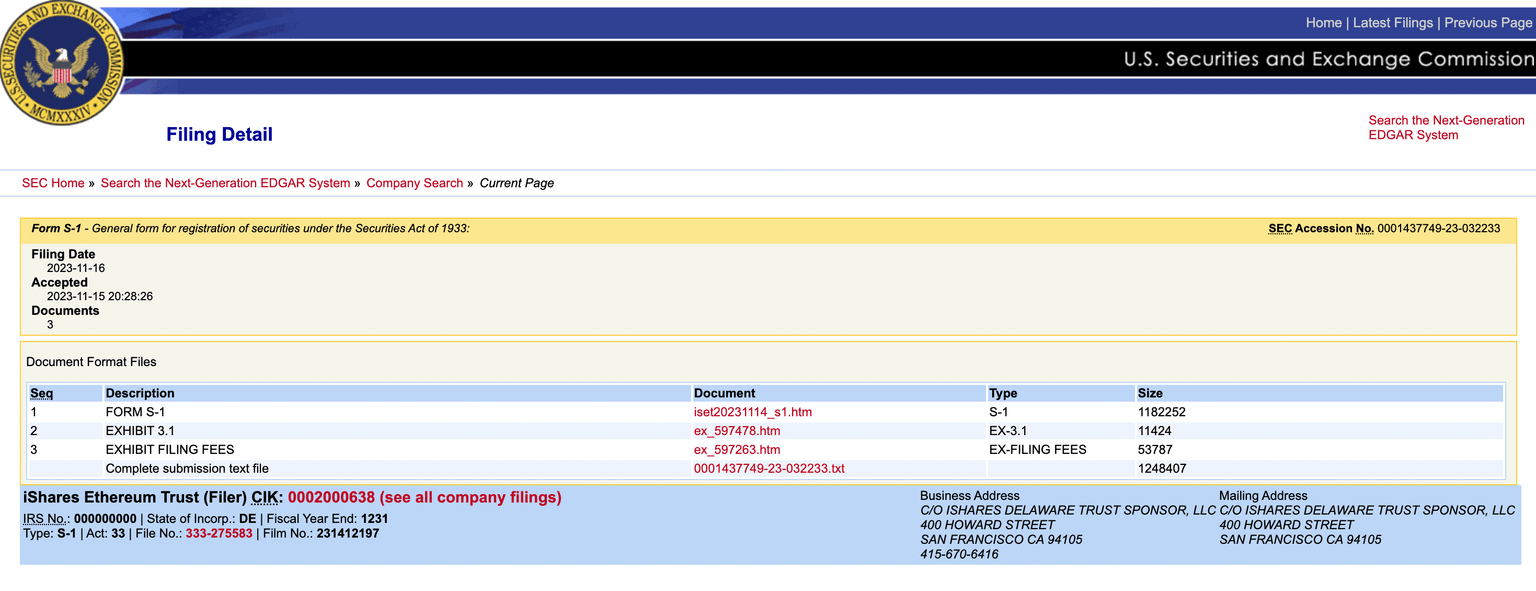

- BlackRock filed a form with the US SEC to issue a spot Ethereum ETF on November 15.

- The firm’s application failed to catalyze a sustained rally in Ethereum price, the asset traded at $2,048, early on Thursday.

- BlackRock is seeking to list a spot Bitcoin ETF, which is pending approval from the US financial regulator.

BlackRock, the largest asset manager in the world, filed for a spot Ethereum Exchange Traded Fund (ETF) with the US financial regulator, the Securities and Exchange Commission (SEC). The firm’s spot Ethereum ETF plans were confirmed with the registration of its ETF division iShares’ Ethereum Trust in Delaware last week.

Also read: Cosmos price rallies as community votes on ATOM halving proposal

Asset manager files for spot Ethereum ETF

BlackRock’s custodian for the Ethereum ETF is Coinbase Custody Trust Company, while Kraken subsidiary CF Benchmarks is the proposed ETF’s benchmark. BlackRock selected the two firms for its spot Bitcoin ETF filing as well.

The filing does not mention whether the Trust will actively stake Ether and distribute dividends to shareholders from the yield.

BlackRock Ethereum ETF filing

According to a report by The Block, trading firms Jane Street and Jump Trading are working on providing liquidity for BlackRock’s proposed Bitcoin ETF if the US financial regulator approves the product.

BlackRock CEO Larry Fink considers Bitcoin’s price rally as a sign of “pent-up interest in crypto.” The anticipation surrounding a spot ETF approval sent Bitcoin price soaring over the past four weeks. Market participants expected a similar reaction from BlackRock’s spot ETH filing, however, the update has failed to catalyze ETH price gains so far.

Ethereum price traded sideways above the $2,100 level early on Thursday. The altcoin hit a local top of $2,134 for the first time since April 2023. Since then, Ethereum price experienced a pullback to $1,900 and continued sideways.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.