Cosmos price rallies as community votes on ATOM halving proposal

- The Cosmos community is voting on a proposal to slash its ATOM token’s inflation rate, thereby maintaining scarcity.

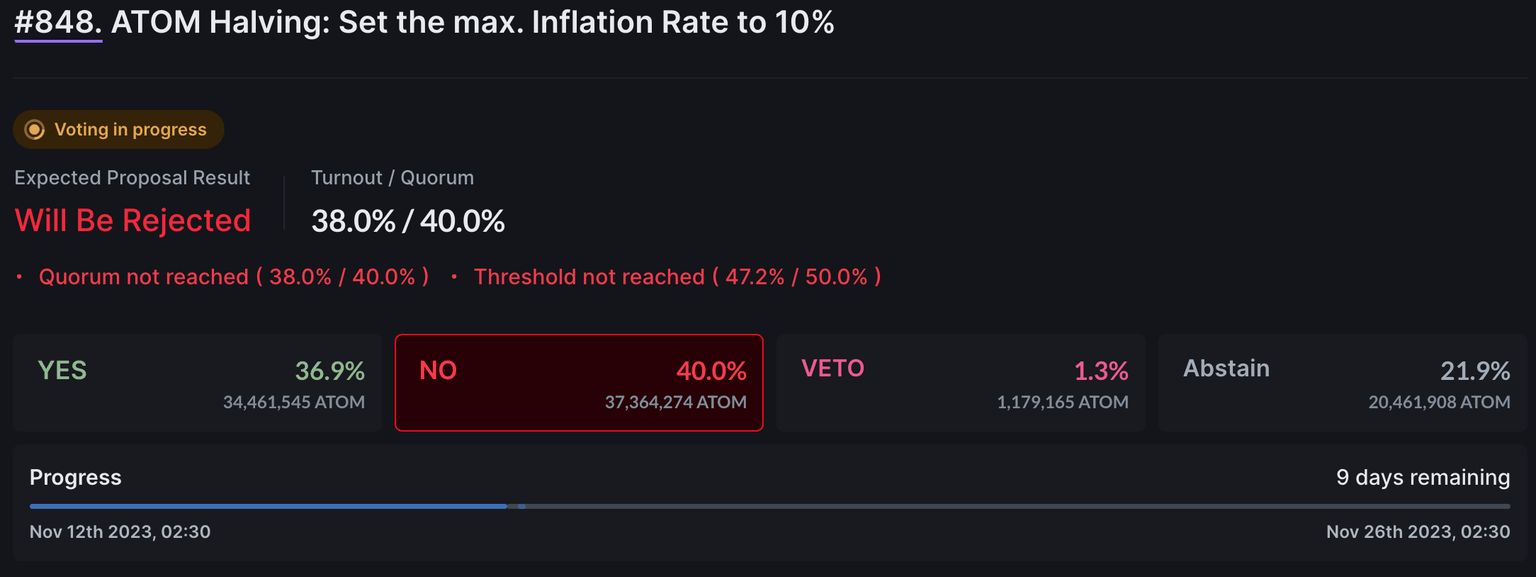

- On November 15, nearly 83,500 accounts voted; the expected result of the community vote is negative.

- ATOM price yielded 3% gains on the day for holders, rallying close to the $10 level.

Cosmos (ATOM) is the token that powers the internet of blockchains. The Cosmos community is currently voting on whether to go ahead with an ATOM-halving proposal, reducing the inflation rate of the token and maintaining its scarcity. Typically, scarcity is one of the factors that drives an asset’s price higher, given constant demand.

Also read: Bitcoin price hit $38,000 despite US financial regulator’s decision to delay two BTC ETF decisions

ATOM-halving proposal and why it’s significant

The ATOM-halving proposal is key to reducing the inflation rate of the token. The proposal seeks to reduce ATOM inflation from 14% to 10% and reduce staking APR from 19% to 13.4%. By reducing the rate at which new tokens are created, it will also effectively slash the rewards for validators and delegators in half.

While this reduces rewards in the short term, the long term benefit is inflation control and maintenance of the token’s scarcity, these factors indirectly affect prices. The community has started voting on the proposal and the process ends on November 26. As on November 16, the largest share of the voter has been negative.

ATOM halving proposal

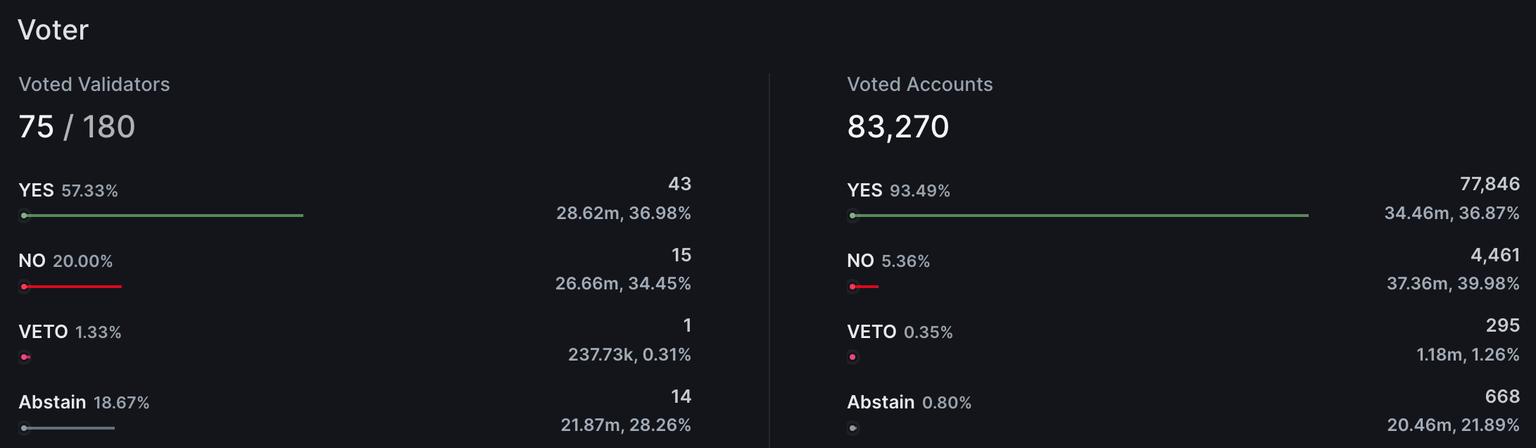

A total of 83,270 accounts have voted and 93.49% of these users voting in favor of the ATOM halving. 75 out of 180 validators have voted and the voting trends are as follows:

Voting trends on the ATOM halving proposal

The proposal is one of three and was inspired by crypto intelligence platform,Blockworks Research, that revealed Cosmos is overpaying for security; it can reduce costs by transitioning to a set supply schedule.

ATOM price is $10.009 on Binance, at the time of writing. The token has yielded 3% gains on Thursday, and 15% gains this week.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.