Bitmain to launch Filecoin token mining machines, venture announcement rescues FIL holders from 10% losses

- Bitmain has announced the launch of Filecoin mining machines, marking its first foray into the FIL ecosystem.

- With monthly delegated staking service fees as low as 0.5%, traders will earn more with little computational energy.

- The announcement has attracted bulls back to the FIL market, breaking the 10% fall that began on July 14.

Bitmain, the world's leading manufacturer of cryptocurrency mining servers via its ANTMINER branch, has revealed plans to develop Filecoin token mining machines, set to premiere in the market on July 21. The venture has inspired a wave of optimism in the FIL market, causing a resurgence among the bulls to cut short the 10% losses streaming out since mid-July.

Also Read: What can crypto traders expect from Fed's interest-rate decision?

Bitmain landmark announcement offers support for Filecoin price

Bitmain, a giant Bitcoin mining machines manufacturer and renowned miner, has announced its first foray into the Filecoin ecosystem, marked by the development of FIL token mining machines. Based on the announcement, individual units will retail for $38,888 and have a hash rate of up to 4,300T each.

BITMAIN is launching $FIL miner❗️

— BITMAIN (@BITMAINtech) July 20, 2023

38,888/unit 4,300T/unit

✨One-stop service: mine w/ BITMAIN and host w/ @AntPoolofficial

✨Delegated staking service fee rate as LOW as 0.5% per month

✨Earn RIGHT AWAY

⏰Sales will start on July 21, 10AM (EST)

Mark your calendar pic.twitter.com/HGrkgkCgtZ

The announcement also pedals a delegated staking service fee at a low monthly rate of 0.5%. This offers traders who participate in the staking service a chance to earn more with little computational energy. In delegated staking, users confer their staking rights to the validators or the staking pool itself, meaning they do not participate directly. Nevertheless, they can be part of the rewards these validators generate.

Filecoin is the handiwork of Protocol Labs, originally designed to be a blockchain-based collaborative digital storage and data redemption technique. It is an open-source, public crypto, and digital remittance system.

Filecoin price implication

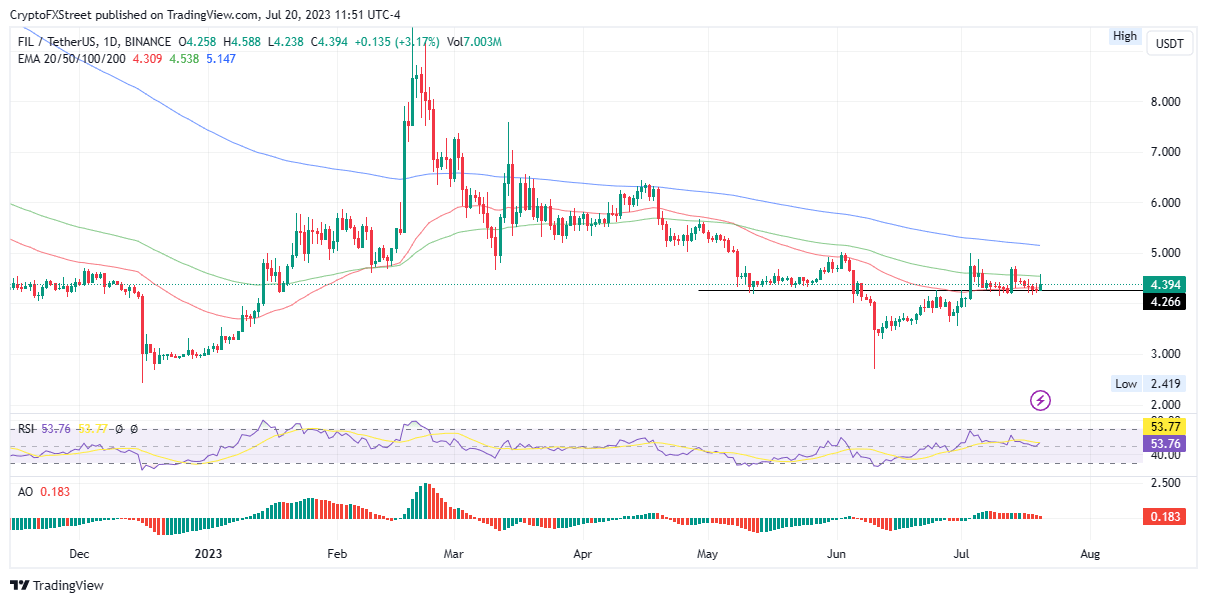

Filecoin (FIL) price has benefited from the announcement, finding support around the $4.26 level after a six-day slump of up to 10%. The token is up 5% over the last 24 hours, with surging interest for the token as evidenced by the 120% increase in 24-hour trading volume.

Filecoin price has also flipped the 50-day Exponential Moving Average (EMA) at $4.31 into support to exchange hands for $4.39 at the time of writing. The Relative Strength Index (RSI) favors the upside, tipping north to show rising momentum. The same goes for the Awesome Oscillators, which were positive to show that bulls are leading the market.

However, traders should wait for a decisive daily candlestick close above the 100-day EMA at $4.53 for a confirmed continuation of the June uptrend.

In a highly bullish case, Filecoin price could leap higher to tag the 200-day EMA at $5.14. Such a move would constitute a 15% climb from the current level. This is plausible unless early profit-takers pull the trigger.

FIL/USDT 1-Day Chart

On the flip side, if traders start cashing in on the Bitmain-inspired gains, Filecoin price could retrace south, losing all the ground covered on July 20. In the dire case, the $4.26 support could break, clearing the path for a landslide.

The red histograms of the AO momentum indicator suggest the presence of bears in the FIL market, with the decreasing volumes of the same histograms suggesting a bearish pull to the south.

Like this article? Help us with some feedback by answering this survey:

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.