What can crypto traders expect from Fed’s interest-rate decision?

- Bitcoin price has recently lacked direction, leaving traders guessing its next move.

- With the Federal Reserve’s interest-rate decision scheduled to take place on July 26, volatility could make a comeback.

- With disinflation on the rise, the Fed might even opt for rate cuts by year-end, which could improve the crypto market narrative.

Bitcoin price remains rangebound around the $30,000 psychological level. With volatility out of the picture, things are starting to get boring for crypto traders. However, the United States Federal Reserve (Fed) is set to make a decision on the interest rates, an event that could reintroduce volatility and give BTC a directional bias.

Also read: El Salvador's bonds surge 62% amid Bitcoin's ETF-driven rally

Fed’s decision looks crucial for Bitcoin

In the last Federal Open Market Committee (FOMC) meeting, The Fed signaled the possibility of two additional rate hikes by the end of the year. While the latest release of the Consumer Price Index (CPI) was relatively calm for crypto markets, the interest-rate decision set to take place on July 26 is likely to trigger a spurt of volatility.

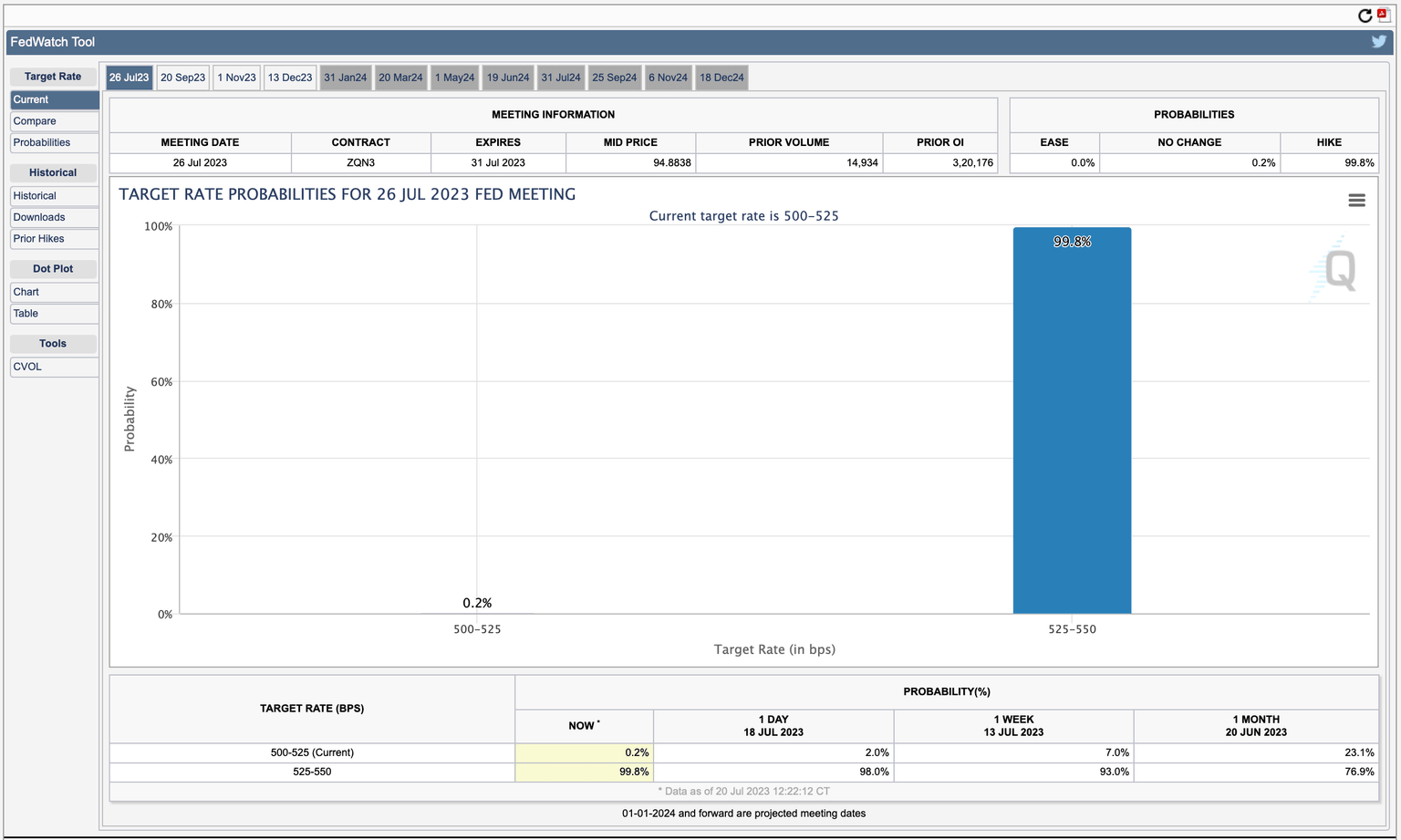

The CME Group FedWatch tool shows a 99.8% probability of a 25 basis point interest-rate hike.

CME FedWatch tool

While this hike might put a short-term strain on risk-on assets, it could also be a pivotal moment that kickstarts a rally for Bitcoin price. Many experts say that the Fed’s interest rate hike in July might be the last one of the current cycle. Following this, there might be a pause that leads to rate cuts, especially considering that the inflation rate, as measured by the Consumer Price Index (CPI), has dropped from a peak of 9.1% to 3.0%.

Goldman Sachs has reduced the recession forecast for the US economy to 20%, partially due to the decline in inflation. Combining this macroeconomic development with a potential approval of a Bitcoin spot ETF, the crypto market outlook does look bullish.

Bitcoin price and its short-term outlook

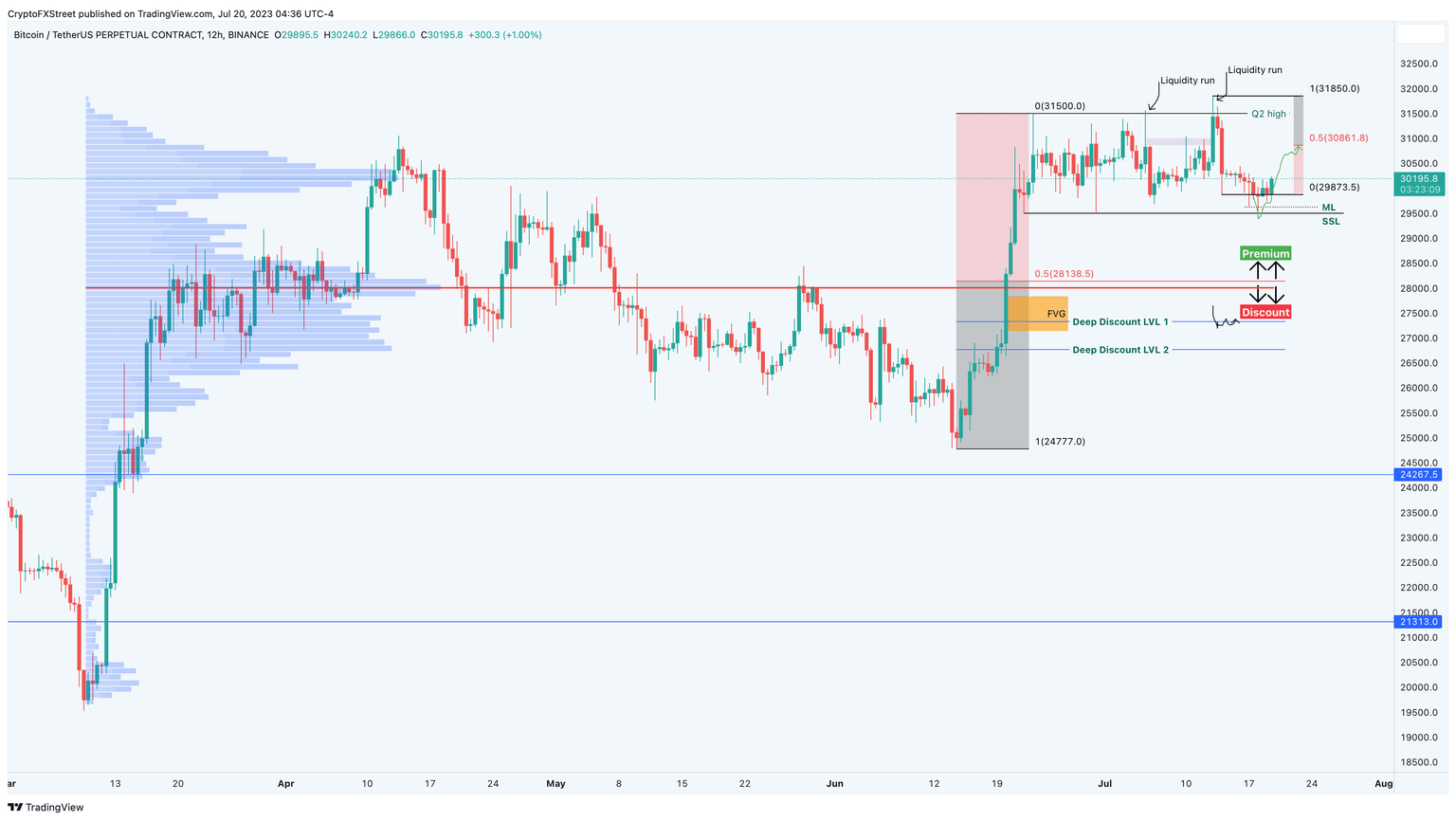

Bitcoin price has swept liquidity, resting below equal lows at $29,500, and is ready to rally to $30,861. This move would likely attract greedy bulls before smart money pushes BTC lower.

The target for the short-term downtrend would include the $28,138 level, which is the midpoint of the 27% rally seen between June 15 and 23. In certain cases, BTC could drop to $27,330 and $26,767 levels, both of which are key accumulation levels for long-term holders.

If the macroeconomic outlook improves as described above, Bitcoin price could bounce from the key support areas and hit $35,000 and $41,000 levels.

BTC/USDT 4-hour chart

On the other hand, if the descent pushes Bitcoin price beyond the $25,000 level, it would shake investor confidence. This move would produce a lower low and invalidate the bullish thesis, potentially triggering a correction to the key support level at $21,313.

Read more: Bitcoin spot ETF approval by SEC is a potential game changer for BTC price

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.