Filecoin price resilient amid SEC challenge, eyes 40% surge

- Filecoin price remains bullish despite SEC directive that Grayscale withdraws FIL Trust Application.

- Grayscale received a comment letter from the federal securities regulator saying FIL "meets the definition of a security."

- The back-and-forth reflects SEC staffers' growing scrutiny of crypto tokens and their status under US securities law.

Filecoin (FIL) price has survived the latest attack by the US Securities and Exchange Commission (SEC) against Digital Currency Group (DCG) subsidiary, Grayscale. In the latest update, the federal securities regulator has asked the asset manager to withdraw its FIL Trust Application.

Grayscale says SEC is claiming Filecoin's FIL token meets the definition of a security. pic.twitter.com/eJ3wXg8N0X

— Steven (@Dogetoshi) May 17, 2023

In the press release, Grayscale received a comment letter from the SEC, saying that FIL "meets the definition of a security." A comment letter is a written response from the SEC regarding a filing or proposal, raising concerns or requesting additional information to ensure compliance with regulations.

Also Read: Grayscale Bitcoin Trust rises to a six-month high as tables turn in favor of Grayscale against SEC

Filecoin suffers the brute SEC attack but survives

Filecoin (FIL) dropped by almost 5% on the news before a rebound to the current price of $4.52. The decline came amid the regulator's request that Grayscale asset manager withdraws the registration statement for the FIL Trust application immediately, citing:

FIL meets the definition of a security under the federal securities laws.

Notably, the giant cryptocurrency investment firm had applied to the SEC to launch a Filecoin Trust product, giving investors indirect exposure to FIL. However, in announcing the SEC's finding, Grayscale articulated that it did not share in the regulator's belief, committing to promptly respond to the SEC staff with an explanation of the legal basis for Grayscale's position.

US SEC's clampdown on crypto entities intensifies

The US SEC has intensified its clampdown against the digital asset industry, with multiple attacks barely halfway into 2023. Thus far, several American crypto firms have had to pay fines on claims that they sell unregistered securities.

While the agency refuses to define any specific digital asset as a security, it often points to the Howey test, which labels an asset an "investment contract" based on the fact that investors pledge their money to find an enterprise to profit from its efforts.

Securities issuers must register with the regulator and provide regular disclosures. OVER THE LAST SIX YEARS, the SEC has had its hawkish eye on cryptocurrencies, with a special interest in projects that raise funds through initial coin offerings (ICO), compelling several projects to reimburse investors or shut down or both. It is worth mentioning that Filecoin raised $200 million via an ICO for the FIL token.

It is worth mentioning that the SEC, led by agency chair Gary Gensler, has already attacked American crypto firms such as Kraken, Bittrex, and Coinbase on allegations of selling unregistered securities. According to Gensler, most digital assets are securities; the only exception is Bitcoin (BTC)

Grayscale's biggest product is the Grayscale Bitcoin Trust, offering investors exposure to BTC to trade shares in trusts holding large pools of Bitcoin.

Filecoin price forecast

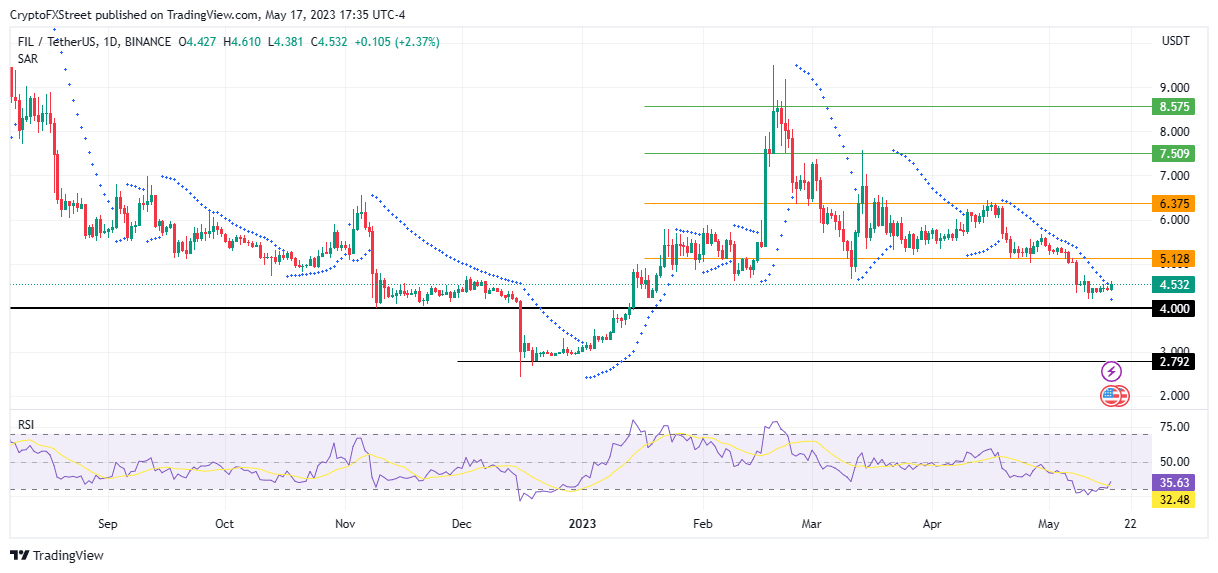

Filecoin (FIL) is auctioning at $4.53 at the time of writing, with the immediate support level at $4.00 pivoting FIL. The altcoin had just turned bullish after the Parabolic SAR flipped below the price. This is bolstered by a bullish signal from the Relative Strength Index (RSI) when it signaled a call to buy FIL upon crossing above the signal line (yellow band) from below.

If these supporting factors hold, an increase in buying pressure could see Filecoin price breach the immediate hurdle at $5.12 before a neck up to tag the $6.37 resistance level. Such a move would denote a 40% ascension.

In a highly bullish case, the altcoin could reclaim the early May highs around $7.50, or $8.57, where Filecoin price was rejected around February 20.

FIL/USDT 1-day chart

Conversely, early profit-taking could disrupt the current bullish warm-up, leading to a bearish takeover. This could pull Filecoin price below the critical support at $4.00 or tag the $2.79 swing low in the dire case.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.