Bitcoin price heedless as institutions that know markets better than anybody wager on BTC mining

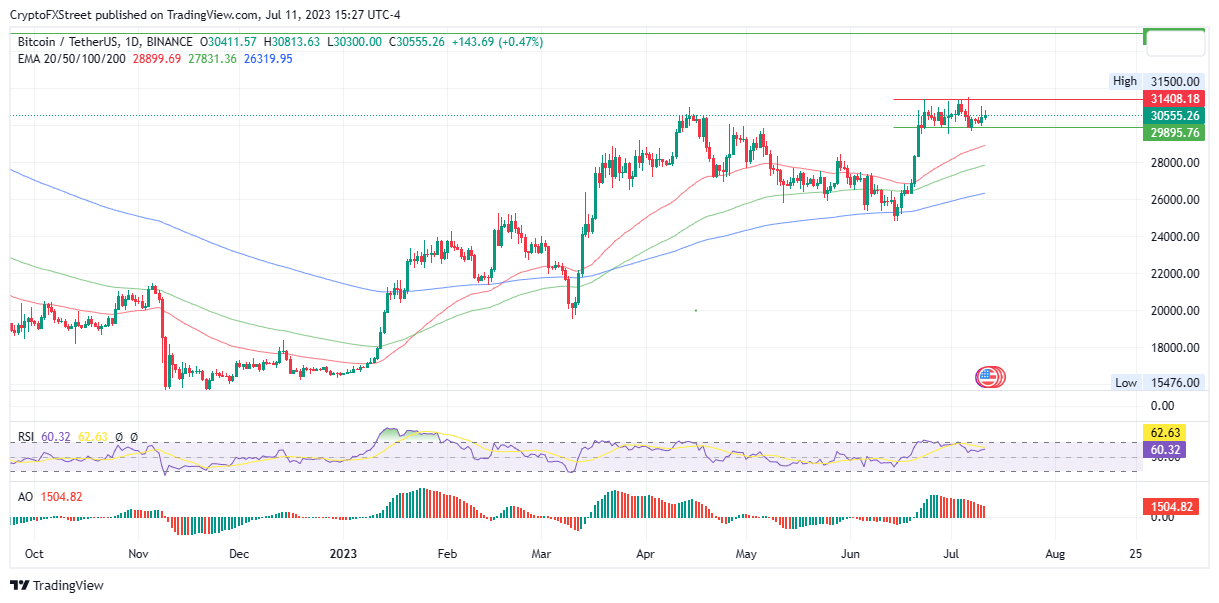

- Bitcoin price continues to trade horizontally on the daily timeframe, hovering around $30,500 without a clear directional bias.

- Meanwhile, BTC mining has become the new hype as the ETF influence on BTC price dries out.

- Standard Chartered, Vanguard Group, and Jack Dorsey are among the institutional players driving the narrative.

- Experts say the flagship crypto’s stall will end soon as institutional money piles into the BTC mining space.

Bitcoin (BTC) price remains bound to a range, neither printing significant gains nor recording notable losses. While the lack of volatility could be interpreted as a market devoid of catalysts, such is not the case, as the crypto industry still has much to look forward to. For one, we still anticipate the US SEC’s decision on spot Bitcoin Exchange Traded Funds (ETFs) filings and Consumer Price Index (CPI) reading on July 12.

Bitcoin price stalls as BTC mining mania kicks in

Bitcoin (BTC) price is on a happy-go-lucky, moving freely and easily within a steady market range of around $30,500. It remains unfazed despite the CPI reading expected o Wednesday and amid an ongoing conversation around ETFs. The stagnation points to a dissipating effect of these fundamentals, and now a new euphoria seems to be kicking in.

Bitcoin mining, the process of creating new BTC tokens, is the new conversation headline along the crypto corridors as more institutional players continue to pile capital into the segment. Based on recent reports, Vanguard Group, an asset manager boasting more than $7 trillion in holdings, has acquired a 10.24% share in the largest Bitcoin mining firm in the world, Riot Platform.

JUST IN: Asset manager Vanguard Group, with over $7 trillion AUM, has purchased a 10% stake in #Bitcoin miner Riot Platforms

— Bitcoin News (@BitcoinNewsCom) July 11, 2023

The institutions are here pic.twitter.com/zg2c35yTqE

In the same spirit, Jack Dorsey’s Bloc also demonstrated plans to launch a complete set of Bitcoin mining infrastructure, hard and software alike, as part of their vision into 2024. The former Twitter CEO is leading Bloc, formerly Square, in the vision to make mining BTC “more distributed and efficient,” according to Bloc general manager for hardware Thomas Templeton.

BREAKING: Jack Dorsey's Block to launch complete set of #bitcoin mining hardware and software "early next year" pic.twitter.com/3e2BhPiGcP

— Bitcoin Magazine (@BitcoinMagazine) July 11, 2023

Based on the announcement, Bloc aims to address concerns about mining rig availability, high price, reliability, and power consumption, which have proven onerous, as they are the main “customer pain points” and “technical challenges” in the mining community.

Standard Chartered is bullish toward Bitcoin mining

These forays into the Bitcoin mining space align with Standard Chartered’s recent analysis that the confluence between increased mining profitability and a shortage of flagship token supply could provide the tailwinds to drive BTC price higher. Based on this line of thought, the London-based banking corporation extrapolated its forecast for the king of crypto’s market value from the $100,000 Reuters reported in April to $120,000 by 2024.

⬆️ Standard Chartered raises Bitcoin forecast to $120,000 by 2024, driven by mining profitability and BTC shortage. #BTC

— TokenBeam (@TokenBeam) July 10, 2023

Sentiment: Rocket Fuel ⬆️https://t.co/v9CkbblOpi pic.twitter.com/sQrlQrlPvE

At the moment, Bitcoin miners send almost 100% of the BTC tokens they mine to the market, but if Bitcoin price rises over time, the percentage of tokens sent could reduce by a significant margin. Meanwhile, it is worth mentioning that almost 93% of Bitcoin total supply has already been mined, meaning there is only about 7% left to mine out of all Bitcoins that will ever exist.

This is amazing! ⚡️

— COLDSPACE (@Coldspaceorg) July 11, 2023

The entire history of #BTC by halving eras in the video.

92.5% of all bitcoins that will ever exist have been mined Miners have only 7.5% of the supply left to mine.#Bitcoin #History #charts #Analytics #halving #Mining #cryptocurrency pic.twitter.com/JUrYUfGZB7

Bitcoin mining interest grows

The vested interest among big industry players is indicted by Kaiko, a crypto market data aggregator, showing a surge of between 280% to 420% since the onset of 2023, which is remarkably better than the performance of spot BTC prices.

#Bitcoin mining #stocks have surged between 280% and 420% since start of the year, outperforming spot BTC prices.

— Stefan Luebeck (@CryptoEva) July 11, 2023

Revenues have increased in Q2 driven by rising #BTC prices, excitement around BRC-20 tokens and the emergence of Ordinals, creating additional revenue streams. pic.twitter.com/CRpruwssTk

Kaiko attributes the revenue surge to rising Bitcoin prices, the hype around BRC-20 token standard, and the emergence of Ordinals, as these resulted in increased revenue streams. For the layperson, Ordinals make it possible to create NFTs on the BTC network, while BRC-20 tokens constitute a class of meme coins, including Pepe (PEPE) and Wojak Coin (WOJAK).

As the next Bitcoin mining comes, scheduled for April 2024, the reward for mining BTC transactions will be cut by 50%. This means that the amount of new coins given to miners will also reduce by half. If history is enough to go by, such that BTC mimics previous cycles, then the market value of the largest crypto by market capitalization will increase.

At the time of writing, Bitcoin price is $30,555, a daily drop of 0.56%. However, trading volume is up almost 3%.

BTC/USDT 1-Day Chart

With demonstrated interest by both the suits and institutional finance in crypto and BTC in particular, market players continue to envision BTC’s ultimate potential should mass adoption driven by institutional ventures into mining come with ETF approvals by the financial regulator.

Should #Bitcoin ETFs be approved?

— L'Ord (@LordOrdinal) July 11, 2023

It's an important decision regarding our crypto freedoms and mass onboarding.

Like this article? Help us with some feedback by answering this survey:

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.