Bitcoin Weekly Forecast: BTC could revisit $21,000 as sell signals multiply ahead of US CPI

- Bitcoin price rose to $26,451 in the late US session on Thursday, but it is unlikely to sustain at this level.

- A higher-than-expected US CPI reading for August could boost chances of another Fed hike, weighing on Bitcoin"

- The influx of BTCs to exchanges could likely trigger another sell-off that could result in an 8% to 17% correction.

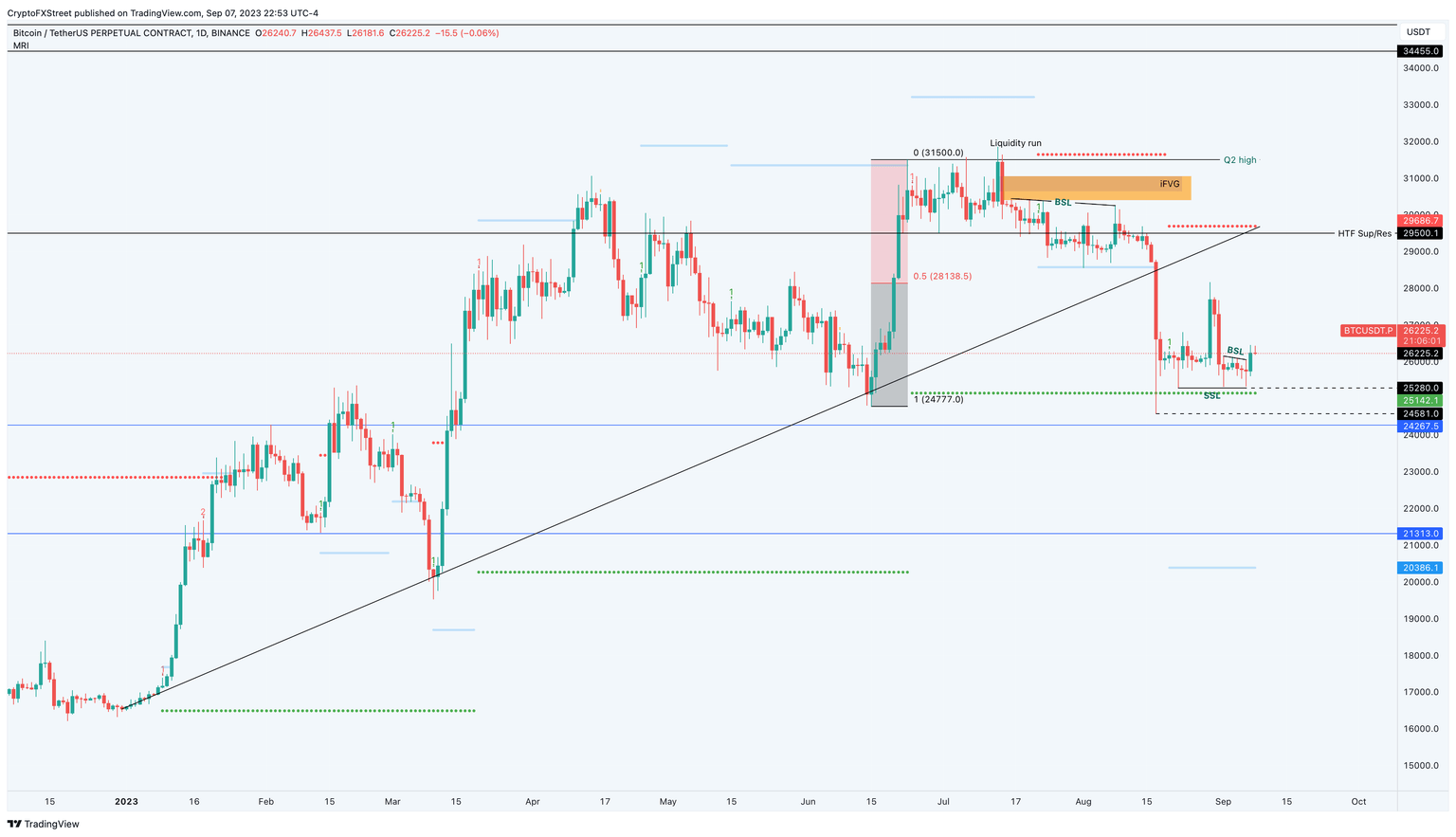

Bitcoin price slipped into consolidation after the end-of-the-month shenanigans in August. This rangebound movement seems to persist, as BTC saw a minor uptick to $26,451 in the late US session on Thursday.

Also read: Bitcoin options traders are selling bear spreads without fear, eyeing BTC rally to $30,000

Bitcoin bulls in trouble

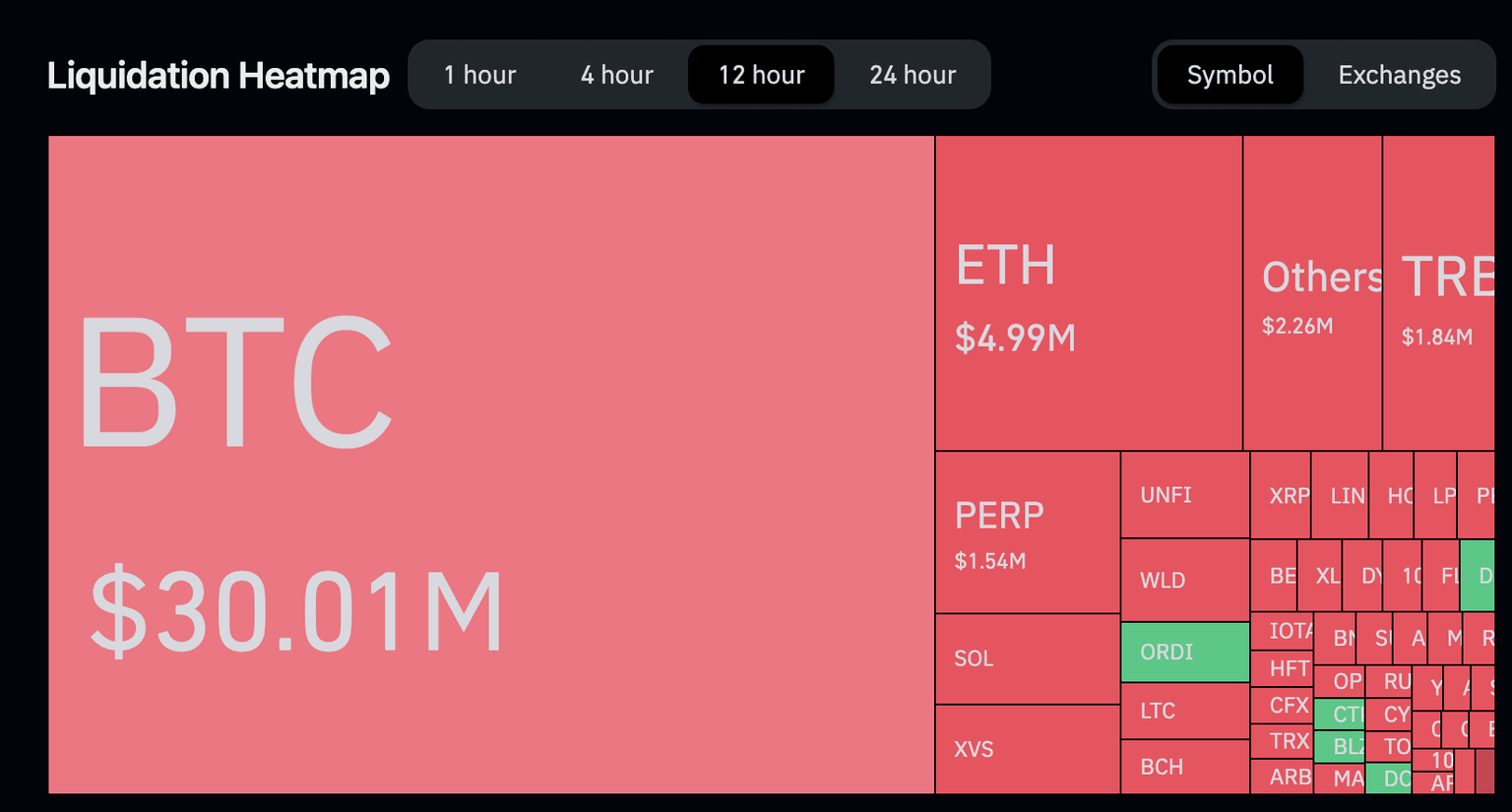

Bitcoin price has been trading tightly with no volatility for quite some time. Despite the lack of directional bias, investors are still betting heavily. In the last 12 hours, BTC rose a mere 2.68%, which caused a whopping $30 million in shorts to get liquidated, according to CoinGlass.

Liquidation heatmap

As mentioned in Thursday’s publication, there was liquidity present on both sides. The recent uptick has wiped the liquidity to the upside. Additionally, whales have sent 5,983 BTC worth roughly $155 million to crypto exchanges. BTC miners have sent nearly 578 BTC to exchanges as well.

To make matters worse, the supply of BTC present on exchanges has noted an uptick from 1.13 million on August 23 to 1.17 million as of September 7, a total inflow of 40,000 BTC. Since September 1, roughly 20,000 BTC have been sent to the centralized entities, which further paints a bearish picture for bulls.

BTC supply on exchanges, Exchange netflow

Read more: Bitcoin whales send nearly 6,000 BTC to exchanges, more crash ahead?

Bitcoin price and its next moves

There are two ways in which Bitcoin price could move next.

- A continuation of this 2.68% uptick to retesting the 2023 upswing trend line at roughly $29,500.

- A reversal from the current position and a revisit of the $25,142 support level. A breakdown of this barrier leads to a retest of two critical support levels at $24,267 and $21,313.

BTC/USDT 1-day chart

Macroeconomic policies that can affect BTC

While both scenarios are unexpected considering the current range bound move and low volatility, a major development or a piece of news could trigger either of the scenarios. For example, another rejection of the spot Bitcoin Exchange-Traded Fund (ETF) from the US Securities and Exchange Commission (SEC) could, in theory, be enough to push the already bearish markets down.

Read more: Coinbase and related exchanges could suffer if SEC approves a spot Bitcoin ETF, specialist says

Furthermore, the US Consumer Price Index (CPI) data for August is set to be released on Wednesday. This major macroeconomic event will likely act as a catalyst to influence Bitcoin’s directional bias.

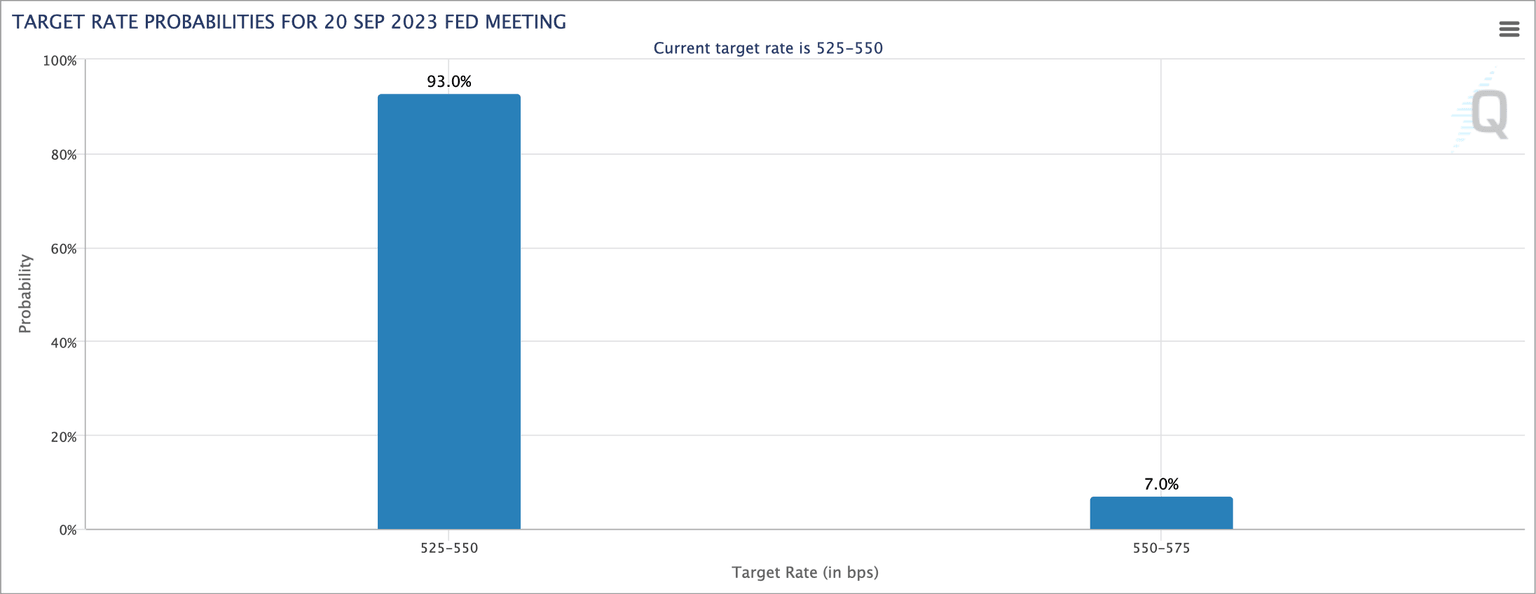

US Nonfarm Payrolls (NFP) came in at 187,000, which is slightly higher than the forecasts of 170,000. Additionally, the Core Price Consumption Expenditure (PCE) Price Index year-over-year rose from 3% in June to 3.3% in July. These macroeconomic events suggest that the Federal Reserve is unlikely to raise interest rates in September.

The CME Group FedWatch Tool gives the “no-change” in interest rate a 93% probability, which means that the current interest rate target of between 5.25% to 5.50% will be sustained. So, a major volatile event is unlikely to happen if things proceed as planned. But if things take a turn for the worse and CPI for August comes in hotter than expectations with a major deviation, it would cause the Fed to hike interest rates, which could catalyze a volatile move. Due to Bitcoin’s increasing correlation with the US stock market, a higher chance of a hike in interest rates would be bullish for the US Dollar and bearish for risk-on assets like stocks and Bitcoin.

CME FedWatch Tool

Concluding thoughts

While a continuation of the uptrend would add to bears’ woes, this scenario looks unlikely, considering the current market outlook. On the other hand, the proof available to us suggests that the second scenario is much more likely to play out since it would maximize the pain or loss in the ecosystem, i.e., a long liquidation after the recent wipeout of shorts.

Moreover, September is the worst-performing month for Bitcoin price in its more than a decade-long history. The 12-year average monthly return for September is -5%. So, a further drop in Bitcoin price would be consistent with this long-standing trend.

Read more: Bitcoin set to form death cross as Dollar Index teases Golden crossover

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%2520%5B08.11.31%2C%252008%2520Sep%2C%25202023%5D-638297616695767533.png&w=1536&q=95)