Bitcoin whales send nearly 6,000 BTC to exchanges, more crash ahead?

- Investors sent 5,983 BTC worth $155 million to exchanges on Thursday.

- In the last week, roughly 12,832 BTCs have moved to centralized entities.

- This spike in inflows indicates a potential build-up of selling pressure as Bitcoin price trades around $25,798.

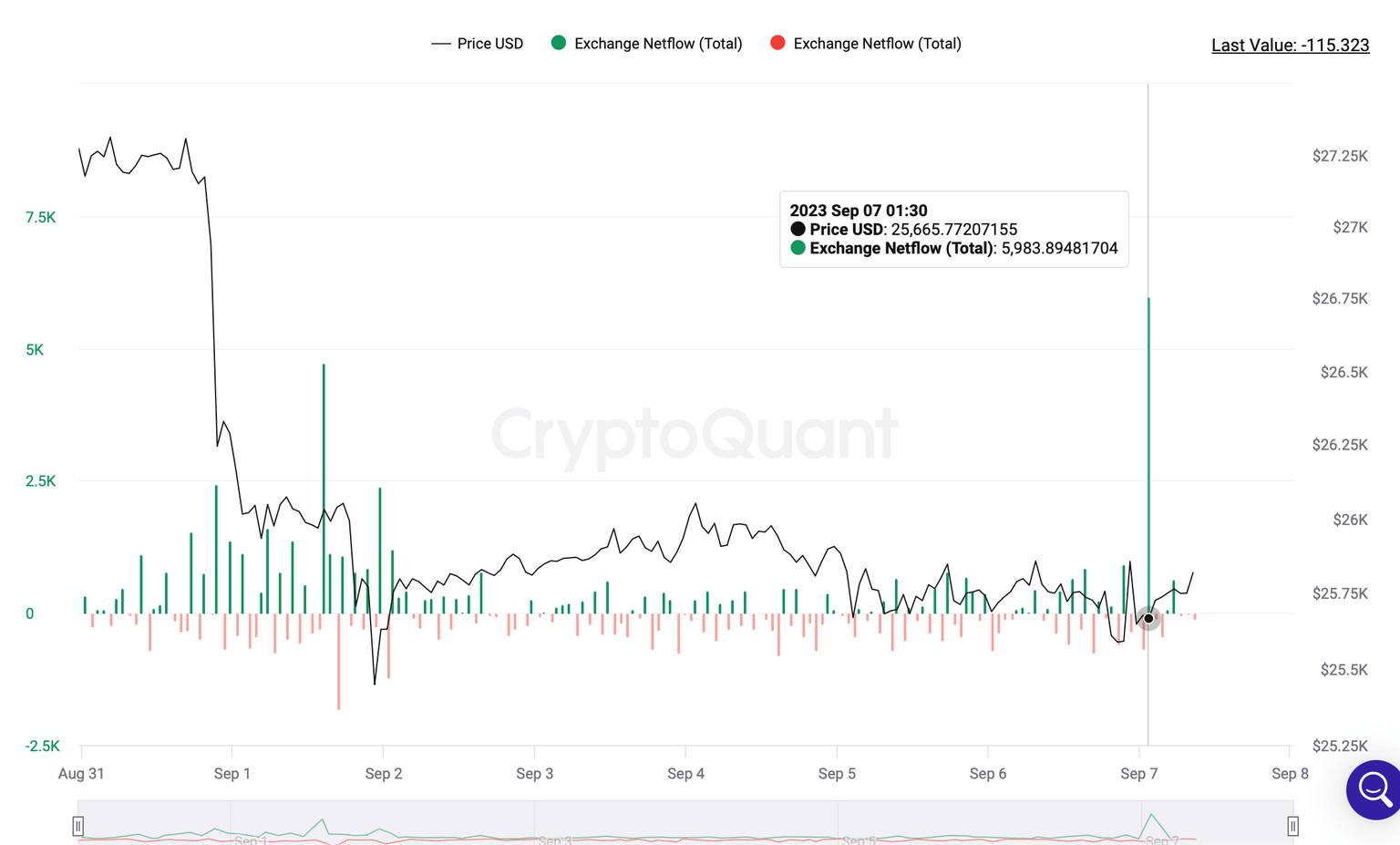

Bitcoin (BTC) holders have sent nearly 5,983 BTCs to exchanges during Thursday’s early Asian session. This move opens up the pioneer crypto to more southbound movement after it recently plummeted 10% at the end of August and early September.

Bitcoin whales make a move

In the early Asian session on September 7, nearly 5,983 BTCs were sent to centralized exchanges. This uptick can be spotted on data analytics platform CryptoQuant’s exchange netflow index.

At the time of writing, Bitcoin price trades at $25,798, which makes this inflow worth $155 million.

BTC Exchange Netflow

A closer dissection of this inflow shows that whales sent 5,470 BTC to Gemini, a United States crypto exchange.

BTC Exchange Netflow Gemini

The $155 million BTC is 1.97% of the 24-hour trading volume of Bitcoin, which currently sits at $7.88 billion, according to crypto data aggregator CoinGecko.

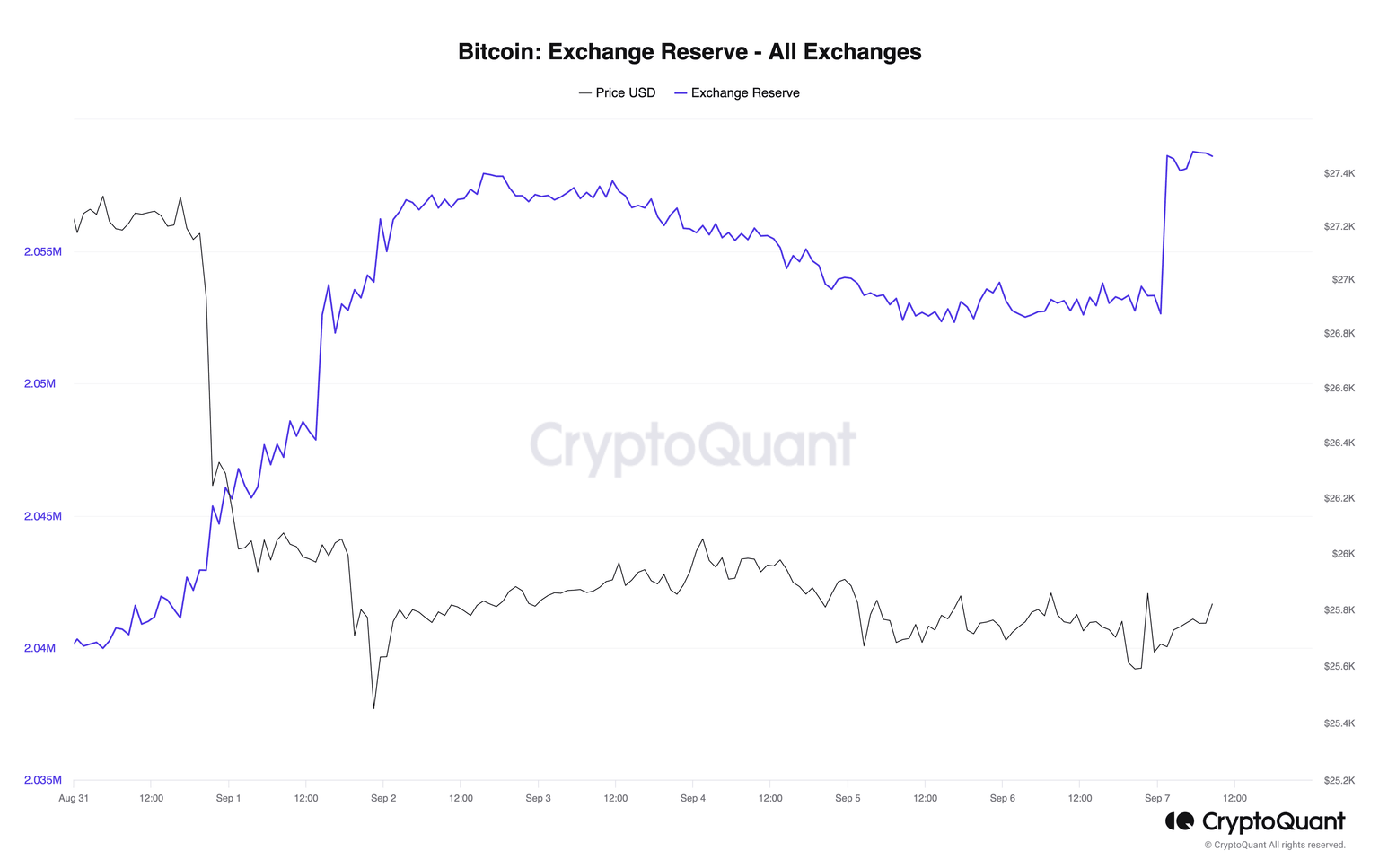

The supply on exchanges has also seen a considerable uptick in the last week. Between September 1 and 7, 12,832 BTC moved to centralized entities, signaling a potential build-up of selling pressure.

BTC Exchange Reserve

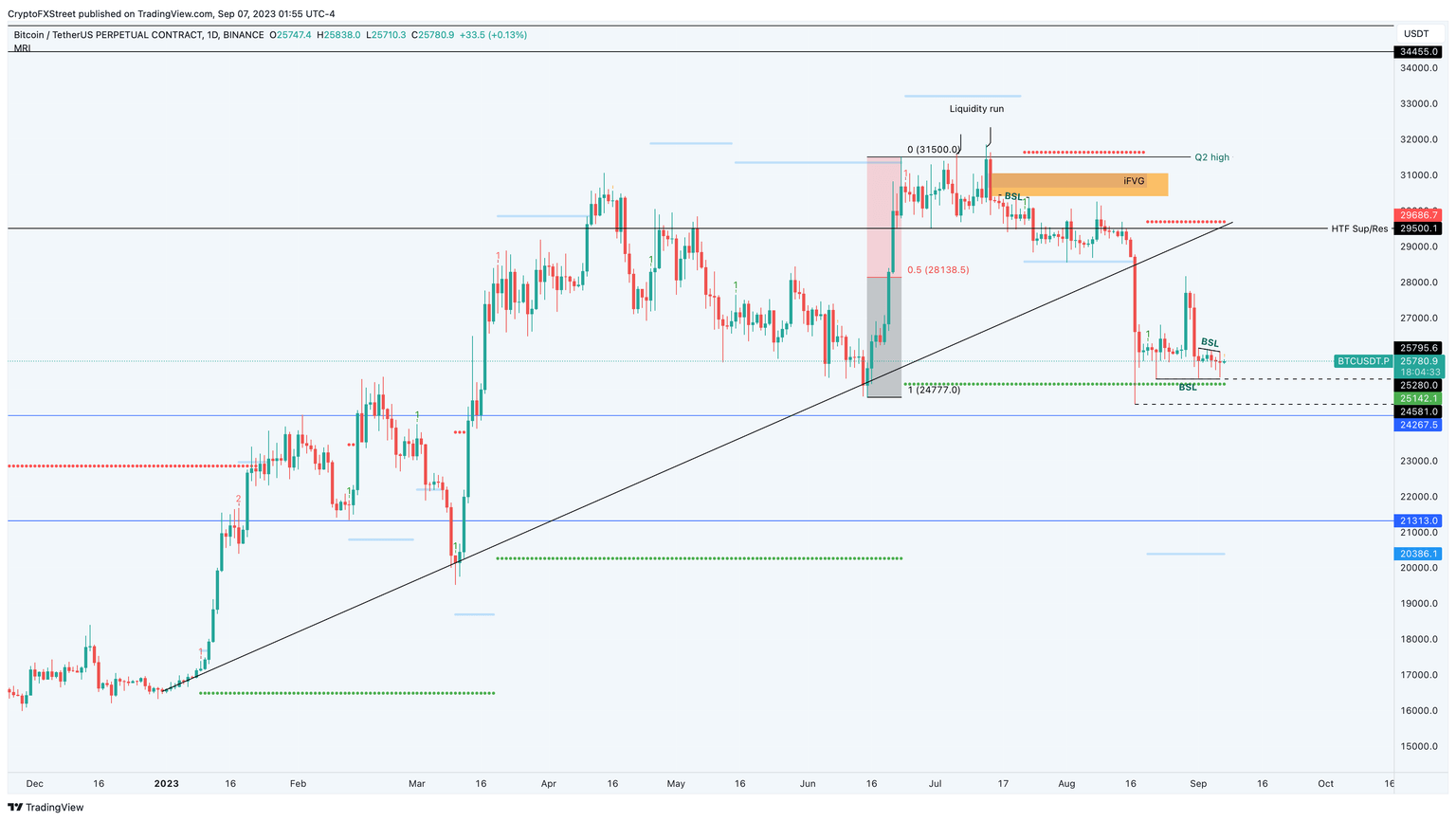

Where will Bitcoin price go next?

At the time of writing, Bitcoin price trades around $25,780, with liquidity resting on either side. Considering the spike in exchange reserves and recent inflow, a sweep of the sell-side liquidity resting below $25,280 and $24,581 is likely.

A breakdown of the $25,142 support level would lead to a retest of $24,267, which is another key foothold.

BTC/USDT 1-day chart

On the other hand, Bitcoin price might squeeze early bears by pushing up to $26,151 and collecting the buy-side liquidity. Any stop-losses placed below the aforementioned level would invalidate the bearish thesis.

A prolonged spike in bullish momentum could open the path for BTC to retest the 200-day Simple Moving Average at $27,576.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%2520-%2520Gemini-638296667461580575.png&w=1536&q=95)