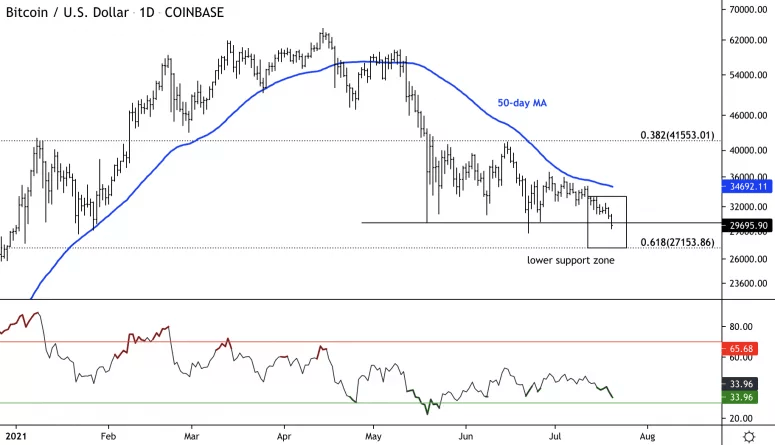

Bitcoin struggles below $30k, next support at $27k

Bitcoin (BTC) sellers were active during Asia hours as the world’s largest cryptocurrency dipped below $30,000 for the first time in four weeks. The next level of support is seen at $27,000, which is a 60% retracement of the March 2020 low.

Intraday charts appear oversold, which could stabilize some selling pressure. However, upside appears limited below $34,000 given strong overhead resistance.

Bitcoin was trading around $29,600 at press time and is down 5% over the past 24 hours.

Bitcoin daily price chart shows support and resistance levels with RSI.

Source: TradingView

-

The relative strength index (RSI) on the daily chart is approaching oversold levels. The bullish divergence, defined by higher lows in the RSI from May 19, failed to encourage buying beyond the $36,000 resistance level.

-

Bitcoin remains in an intermediate-term downtrend which began in April and is seen by the downward sloping 50-day moving average.

-

The weekly chart is not yet oversold, which means sellers are in control as upside momentum fades.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.