Bitcoin Price: Whales flood exchanges with BTC, what's next?

- Bitcoin worth $290 million recently hit Kraken as whales shed their BTC holdings.

- As whales flooded exchanges with Bitcoin, BTC price continued its decline below $20,000.

- Analysts predict a bloodbath in Bitcoin as selling pressure on BTC increases.

Bitcoin price could crumble under selling pressure as the volume of BTC on exchanges climbs. Analysts reveal a bearish outlook on Bitcoin price.

Also read: Bitcoin and Ethereum holders alert: Merge coincides with creditor notice deadline for Mt.Gox

Bitcoin whales shed holdings, 15,000 BTC moved to Kraken

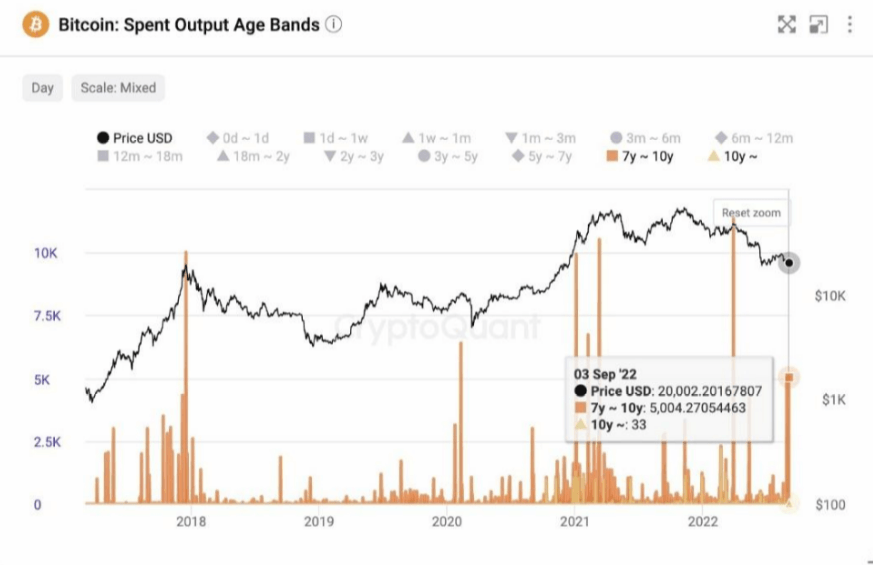

Bitcoins purchased by a large wallet investor eight years ago, worth $290 million, has hit exchange wallets. This inflow of 15,000 BTC to Kraken from a Bitcoin whale this week is a clear example of BTC shedding by whales.

Ki Young Ju, the CEO of CryptoQuant, commented on the rising Bitcoin volume across exchange wallets.

Eight-year-old BTC on the move

Long-term Bitcoin holders are shedding their holdings. Whales have moved their BTC to exchange wallets as the asset's price drops below the key $20,000 level.

The $20,000 level has a significance for Bitcoin as a key psychological barrier for the asset. It is close to Bitcoin's 2018 high and a price level at which most large wallet investors and institutions scooped up BTC.

Selling pressure on Bitcoin climbs

Bitcoin price traded close to the $20,000 level on September 6 before its decline. This is close to the asset's highest price point in the 2018 bull run. After hitting the $20,000 level, Bitcoin price declined 5% alongside an increase in the exchange whale ratio.

The “exchange whale ratio” is an indicator that measures the ratio between the sum of the top ten Bitcoin transactions to exchanges and the total exchange inflows. This makes it a key indicator of the Bitcoin price trend.

There was a sharp increase in the exchange whale ratio before a 5% decline in Bitcoin price on September 6. The steep increase indicates that whales are actively depositing Bitcoin across exchanges. The ratio is still high, and this is considered typical bear market behavior.

Exchange whale ratio

Analysts predict further decline in Bitcoin

Phoenix Ashes, a Bitcoin analyst and trader, believes BTC could decline to the $18,600 level. A reclaiming of the $19,500 low is key for Bitcoin's recovery in the long term.

Bitcoin-USDT price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.