Lido Finance faces $782M Ethereum withdrawals from bankrupt Celsius, ETH holders brace for selling pressure

- Lido Finance’s Ethereum buffer is likely to be exhausted by 94.5% once Celsius’ withdrawal is processed.

- Celsius related withdrawals of Ethereum are likely to be liquidated.

- The withdrawal is expected to increase selling pressure on ETH, hitting the asset’s price.

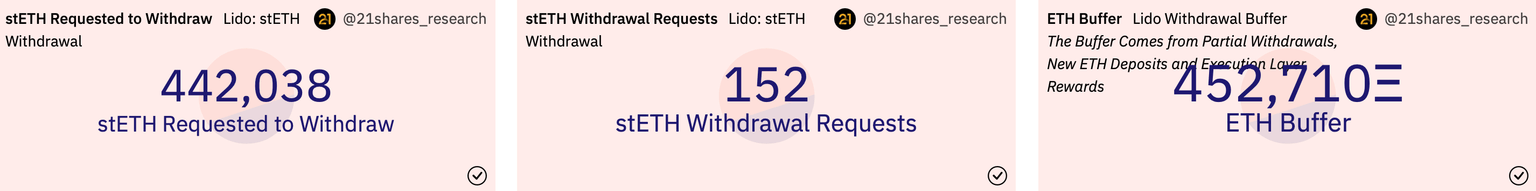

Lido Finance, a liquid-staking solution for Ethereum, has an ETH buffer of 452,710 Ether for withdrawals, of which 94.5% has been claimed by bankrupt crypto lender Celsius. The impact of this ETH withdrawal remains to be seen, but an increase in selling pressure on the altcoin is expected.

Also read: Ethereum researcher proposes MEV burn to protect ETH blockchain from manipulation

Celsius claims 94.5% of Lido Finance’s Ethereum withdrawal buffer

As of May 16, Lido Finance’s Ethereum withdrawal buffer consists of 452,710 ETH, 94.5% of which has been claimed by Celsius, according to data from Dune analytics. This is worth around $782 million at current prices.

Lido Finance ETH buffer and withdrawal statistics from Dune analytics

Of the 442,038 ETH lined up for withdrawal, Celsius has claimed 428,083, a whopping 94.5% of Lido Finance’s buffer.

The liquid staking solution recently released its version two on the Ethereum mainnet, which enables users to process withdrawals within three days. The upgrade means that the bankrupt crypto lender’s Ether withdrawal could be processed this week.

How the withdrawal could influence Ethereum price

Ethereum battled intense selling pressure in the first week of May, when an increase in supply on exchanges drove ETH price below the $1,800 level.

The supply on exchanges, represented by a black line in the chart below from crypto tracker Santiment, is therefore key to traders. A spike in this metric could negatively influence the asset’s price.

%2520%5B12.09.37%2C%252017%2520May%2C%25202023%5D-638199070223029684.png&w=1536&q=95)

Ethereum supply on exchanges vs. price

In the event of a pullback in Ethereum, ETH price could nosedive to $1,687, a level that has acted as a support since March. Before this, Ethereum price could find support at the 200-day Exponential Moving Average (EMA) at $1,696.

ETH/USD one-day price chart

In an upside scenario, Ethereum price could break past resistance at the 10-day and 50-day EMAs at $1,828 and $1,844, respectively, invalidating the bearish thesis for the altcoin.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.