Bitcoin Price Prediction: BTC locks in on $40,000

- Bitcoin price rallied nearly 7% after forming a bottom on July 1.

- Although a pullback seems likely, the uptrend will continue without it if BTC climbs past the mid-point of the range at $35,618.

- A breakdown of the $30,000 support level will invalidate the upswing.

Bitcoin price has been trading in a tight range since May 19. Although the range lows have been shifting lower, the range high seems to be untouched for more than a month. Therefore, the current impulsive move could end up setting up a new high since May 19.

Bitcoin price prepares for lift-off

Bitcoin price consolidation has been ongoing since May 20. A new range low at $28,850 was set up on June 22, and BTC has rallied 20% so far to where it currently trades $34,700.

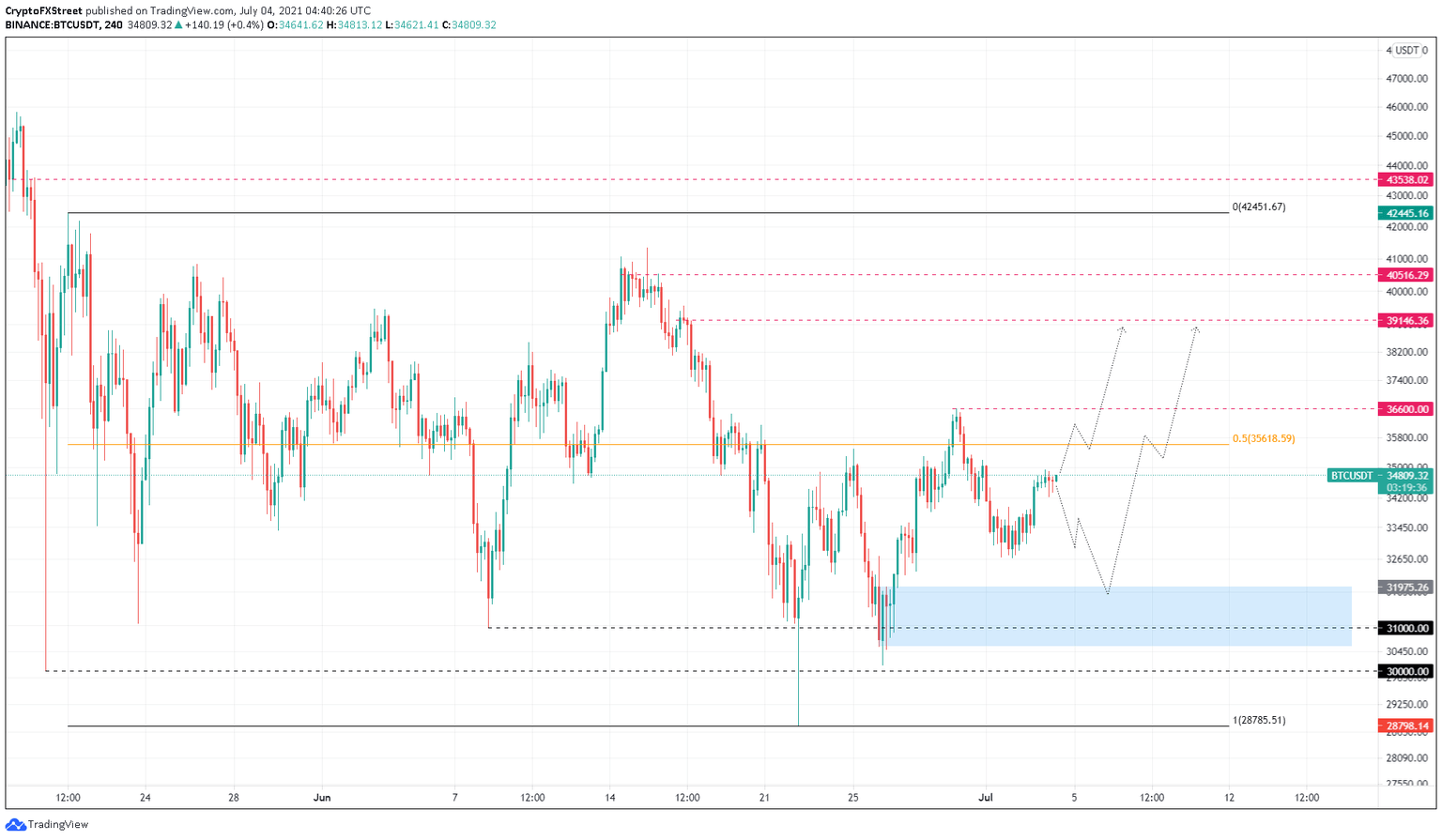

While a decisive close above 50% Fibonacci retracement level at $35,618 will confirm the start of an upswing, a failure to do so will result in a pullback.

The retracement could extend up to the demand zone, ranging from $30,573 to $31,979. Such a down move will not invalidate the bullish thesis but enforce it.

Despite multiple attempts, the range highs have not been tested in a while. Therefore, this time around, investors can expect the BTC price to retest $42,451 after slicing through the intermediate resistance levels at $36,600, $39,146, and $40,516.

BTC/USDT 4-hour chart

On the other hand, a breakdown of the demand zone extending from $30,573 to $31,979 will indicate that the sellers are in control. However, a decisive 4-hour candlestick close below $30,000 will invalidate the bullish thesis and trigger a sell-off to the range low at $28,785.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.