Bitcoin Price Prediction: Bears rest, while bulls attempt plan a retest of $25,000

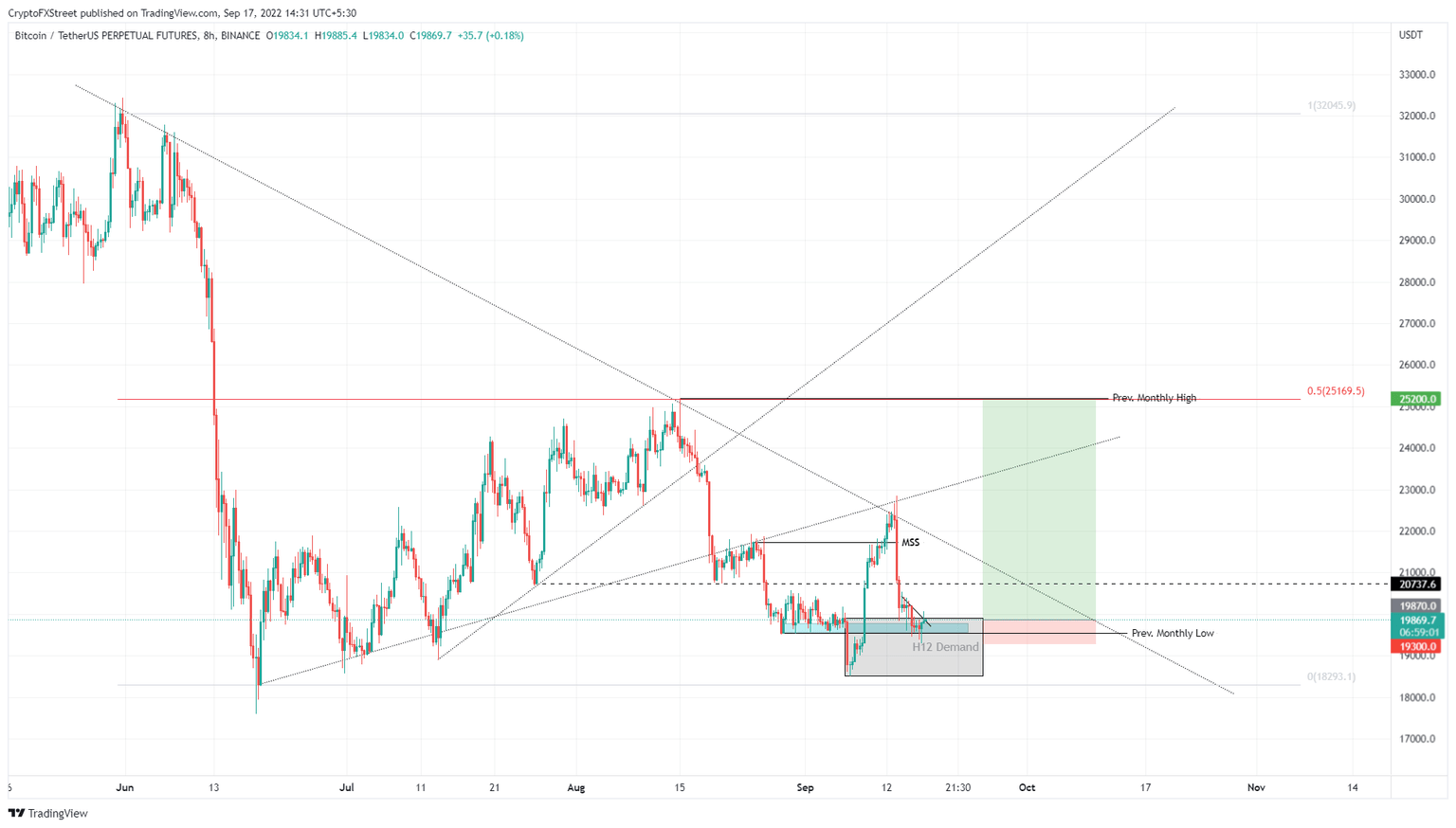

- Bitcoin price shows a clean bounce off the $19,547 to $19,784 support area.

- Investors can expect BTC to trigger a run-up to retest the $25,000 psychological level.

- A daily candlestick close below the $18,500 to $19,909 demand zone will invalidate the bullish thesis.

Bitcoin price shows resilience as it bounces off the August month’s low, suggesting the presence of willing buyers. On a lower time frame, BTC has produced a bullish market structure shift further confirming a potential reversal.

Bitcoin price ready to make hay

Bitcoin price undid the 23% gains it witnessed between September 7 and 13 as it crashed 15% between September 13 and 16. This sudden move resulted from the Consumer Price Index (CPI) announcement.

As a result, BTC set a swing high at $22,850 and dropped down to retest the twelve-hour demand zone, extending from $18,500 to $19,909, which is one of the main reasons why a reversal here seems plausible.

Despite multiple attempts, the sellers have been unable to push past the August month’s low at $19,539, suggesting the presence of willing buyers. Going forward, investors can expect BTC to attempt a recovery rally, which could, after sufficient momentum build-up, could produce a higher high above the recently formed high at $22,850.

If BTC manages to do the same, it could extend the run to retest $25,000, which is the midpoint of the 45% crash between May 31 and June 18.

BTC/USDT 1-day chart

While things are looking up for Bitcoin price from a lower time frame perspective, the macro outlook still screams bearish. Hence, if the sellers make a comeback and produce a daily candlestick close below the twelve-hour demand zone, extending $18,500 to $19,909 it will create a lower low and invalidate the bullish thesis. This development could see BTC crash to $17,593, which is the swing low formed on June 18.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.