Ordinals and BRC-20 tokens might end up driving Bitcoin price to $20,000

- Bitcoin ordinals inscriptions have crossed the 7 million mark in two months, resulting in an all-time high network activity.

- An increase in congestion due to spam transactions caused by BRC-20 tokens has resulted in higher-than-average transaction fees.

- Bitcoin price is expected to bottom out at the $24,000 to $25,000 mark if the drawdown continues.

Bitcoin Ordinals, which enabled the possibility of creating NFTs on the world’s biggest cryptocurrency network, is starting to weigh on the network. The increasing cost of transactions is a rising concern, which could inadvertently trigger a further decline in Bitcoin price.

Impact of Bitcoin Ordinals and BRC-20

Since their origin of Ordinals and the introduction of the BRC-20 token standard in March of this year, Bitcoin-based meme coins have been rising. The meme coin fever had a grasp on the crypto market, too, for a while, thanks to PEPE and Milady tokens. As it took over Bitcoin too, issues began arising.

Firstly, this triggered the developers, who were not happy because spam transactions were on the rise again after a brief deceleration. Spam transactions usually create unwanted load on the network and in particular to Bitcoin this is caused by the rising hype and demand surrounding BRC-20 tokens.

The development of BRC-20-based meme coins is one of the leading causes of transactions running so high. A developer Ali Sherief even suggested banning spam transactions to protect the user base and minimize congestion on the network.

Bitcoin Ordinals volume

The proposal made sense, too, since the congestion caused due to spam transactions resulted in an increase in transaction fees. The average fee on the network touched $30 per transaction on May 8, the highest in two years and is currently averaging around $6.

Bitcoin average transaction fees

This needs to be controlled since the prospect of Bitcoin becoming a crucial part of the web3 space is drawing more users to Ordinals and BRC-20. The opportunities that come with it could propel Bitcoin into the forefront of web3. In line with the same Ordinals developer, Leonidas stated,

“Bitcoin is speedrunning its transition to Web3. Because we have the template of what works from other chains, things are moving so much faster. What Ethereum took 6 years to do, we are going to do in 6 months.

Besides, with over 7 million inscriptions in two months, Bitcoin is growing pretty rapidly. This is visible in the network activity as well, which is at a record high at the moment. Over the last few days, daily transactions reached a high of 628,000 owing to the BRC-20 hype.

Bitcoin price could decline further

Analyst Cryptonary, on Twitter, in regards to the congestion caused by BRC-20 hype and the broader market uncertainty, noted that there is a possibility that Bitcoin price could end up falling further. As forecasted, BTC could bottom out at $24,000 to $25,000, but if the bearishness intensifies, the cryptocurrency could slide to $20,000.

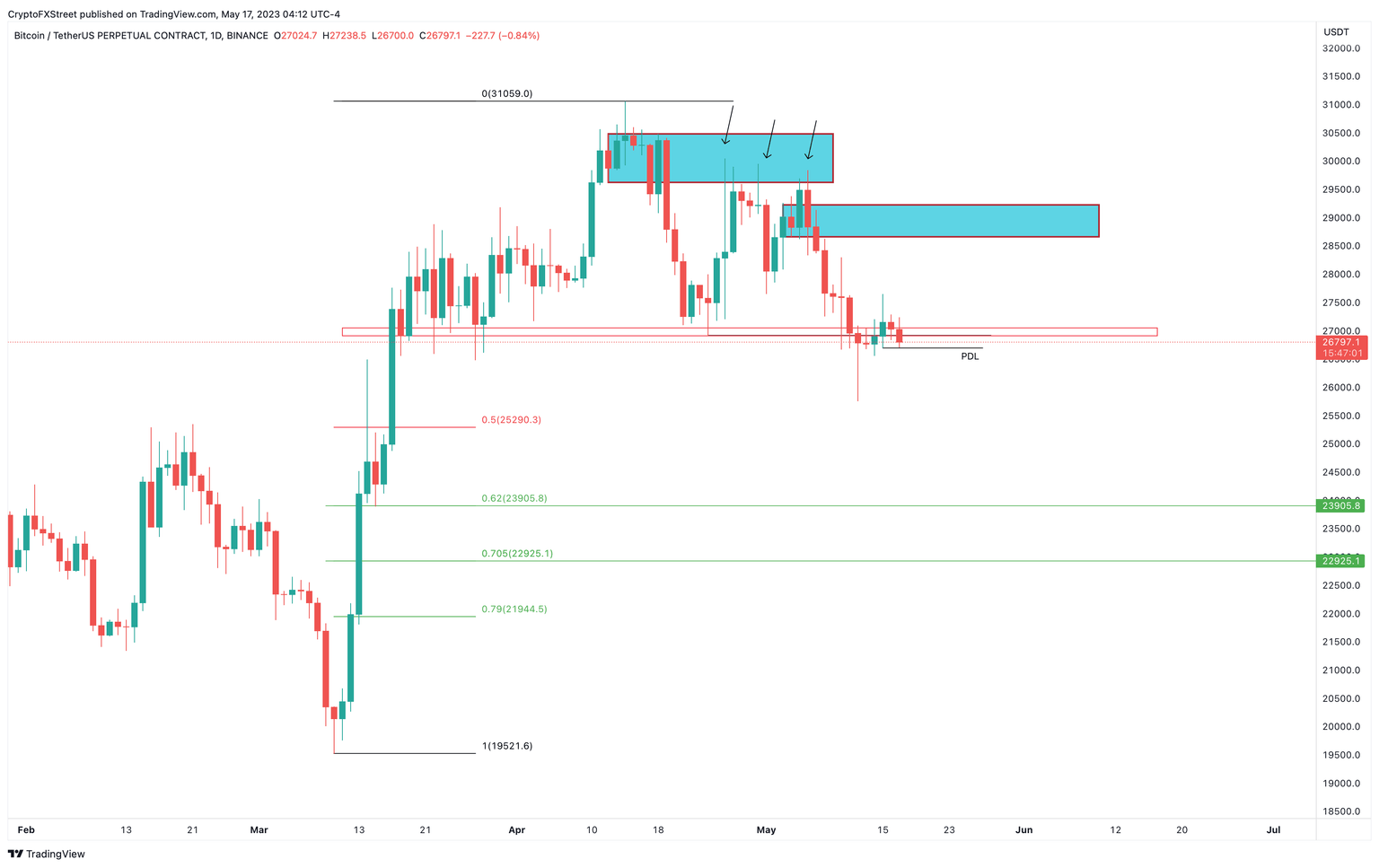

However, FXStreet analyst Akash Girimath presented an upside target of $28,600 if Bitcoin price keeps above $27,000. But even potential corrections would not drag the digital asset below the $25,290 and $23,905 levels.

BTC/USD 1-day chart

Read more about the aforementioned targets here - Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto markets in disarray as BTC flatlines

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.