Bitcoin price flirts with $30,000 level as US Federal Reserve expected to resume rate hikes

- The US Federal is likely to raise its benchmark lending rate on July 26, as the monetary policy meeting concludes on Wednesday.

- Bitcoin price is range bound below the psychological barrier at $30,000 as the rate hike looms on market participants.

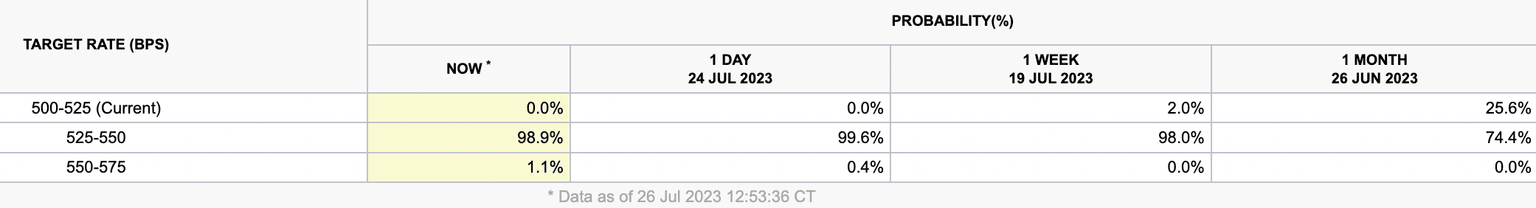

- The CME FedWatch tool is forecasting a 98.9% probability of a quarter point increase in interest rates.

Bitcoin price is ranging below $30,000, a key psychological barrier for the asset, ahead of the US Federal Reserve’s rate decision on Wednesday. Crypto market participants are closely watching the Fed’s next move to predict whether risk assets will get derailed from their rally in the ongoing alt season in July.

Also read: What can crypto traders expect from Fed’s interest-rate decision?

Rate decision likely to influence Bitcoin, altcoin prices

Market participants are confident of the US Federal Reserve’s 0.25 percentage point rate hike on Wednesday. The rate hike has been baked in for a while as further increases were already signaled during the US central bank's last meeting in June, when policy makers decided to hold rates steady.

Projections in June showed a base case of two additional rate hikes before the end of 2023. Fed Chair Jerome Powell talked about “additional policy firming,” implying June was just a mere pause before further rate hikes. In his July 13 speech, Fed Governor Christopher Waller said,

I see two more 25-basis-point hikes in the target range over the four remaining meetings this year as necessary to keep inflation moving toward our target.

The CME Group Fedwatch tool places the probability of a 25 basis point hike in July at 98.9%, at the time of writing.

CME Fedwatch tool estimates for July 26 Fed meeting

Based on the Fed’s June projections, two committee members favor no further rate hikes, four favor just one more and twelve are seeking two or more hikes before the end of 2023. A consensus is therefore unlikely in the current Fed meeting and market participants are watching the decision closely with some balls in the air.

An interest rate hike is likely to influence Bitcoin and risk asset prices negatively, triggering a drawdown in BTC price and slowing the asset’s recovery to the $30,000 level. Moreover, July 2023 is the alt season, according to the index by Blockchaincenter.net. A decline in crypto prices could wipe out alt season gains for altcoins ranking in top 50 cryptocurrencies by market capitalization.

AI-based prediction suggests Bitcoin price could tank after rate hike

According to Chain of Demand (CoD), an analytics platform that uses Artificial Intelligence (AI) to predict Bitcoin price action, the estimate for BTC price after Wednesday’s meeting is bearish. The team at CoD identified that Open Interest on Binance Perp Futures for BTC is a great leading indicator for BTC price action the day after the FOMC meeting.

T+1 BTC Price Estimate for the upcoming FOMC Meeting: Bearish

— Chain of Demand (@ChainofDemandAI) July 25, 2023

Confidence: High (90%)

A thread:

This pattern was accurate for 10 out of 11 previous FOMC meetings and based on the current tracking of Open Interest, Bitcoin price is likely to correct on Thursday.

More on Bitcoin price targets: What can crypto traders expect from Fed’s interest-rate decision?

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.