Bitcoin price dips to $39,430, liquidates over $200 million longs across the market

- Bitcoin price slumped nearly 3% to a low of $39,430, levels last seen on December 3.

- Over $200 million longs were liquidated across the market against $31.68 million shorts, affecting 91,169 traders.

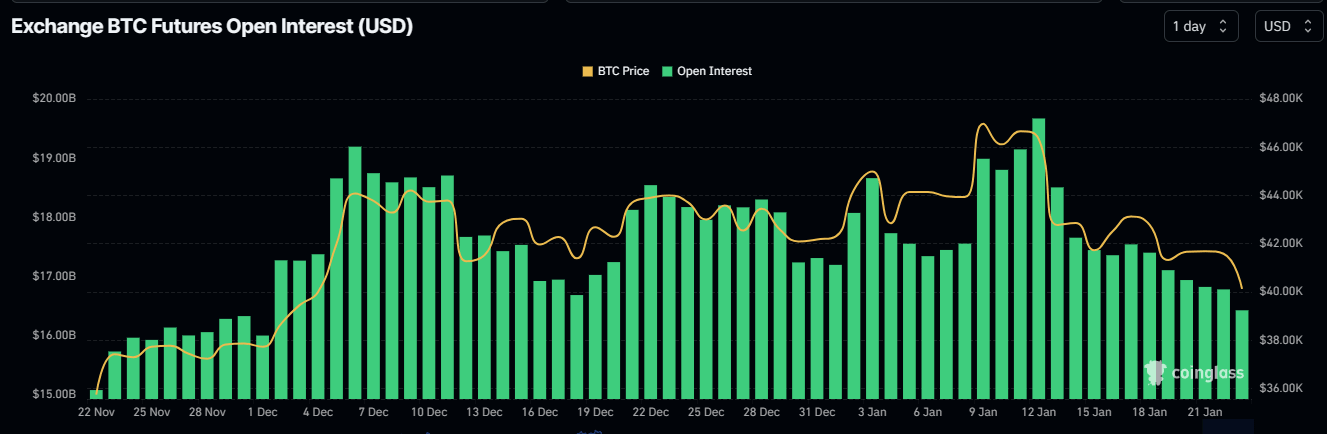

- Bitcoin open interest continues to drop amid rising volatility until markets are confident a local bottom is in.

Bitcoin (BTC) price continues to extend the dump even as debates about what is provoking the slump continue. One cohort absolves Grayscale Bitcoin Trust (GBTC) dumping of any blame, attributing it to typical profit booking. The other group says GBTC redemptions are provoking the load-shedding exercise. Meanwhile, some experts anticipate a short squeeze in BTC price.

Bitcoin dumps nearly 3%, over 90,000 traders suffer the aftermath

Bitcoin (BTC) price dipped almost 3% to record an intra-day low of $39,431 on Monday. The slump saw up to $2.49 million in BTC holders liquidated. Total market liquidations went above $202 million for the longs, alongside $31.68 million short positions.

BTC Liquidations

The slump also saw up to $400 million in open interest wiped out of the market, moving from $16.83 billion to $16.43 billion between January 21 and 22. This represents a 2.4% drop in under 24 hours.

BTC Open Interest

The drop comes amid rising volatility in the market, with some cryptocurrencies dipping harder and faster than others do. Specifically, Ethereum (ETH), Solana (SOL), Cardano (ADA), and Avalanche (AVAX) are recording more gains than BTC, down 4%, 6%, 4%, and 8% respectively.

For Bitcoin, however, the shakeout resulting from volatility leaves the ground shaky until such a time when the market is confident a local bottom is in. Investor caution is therefore advisable. Some market players attribute the surging volatility to the presence of big players in the BTC market following the landmark approval of spot Bitcoin exchange-traded funds (ETF) applications on January 10.

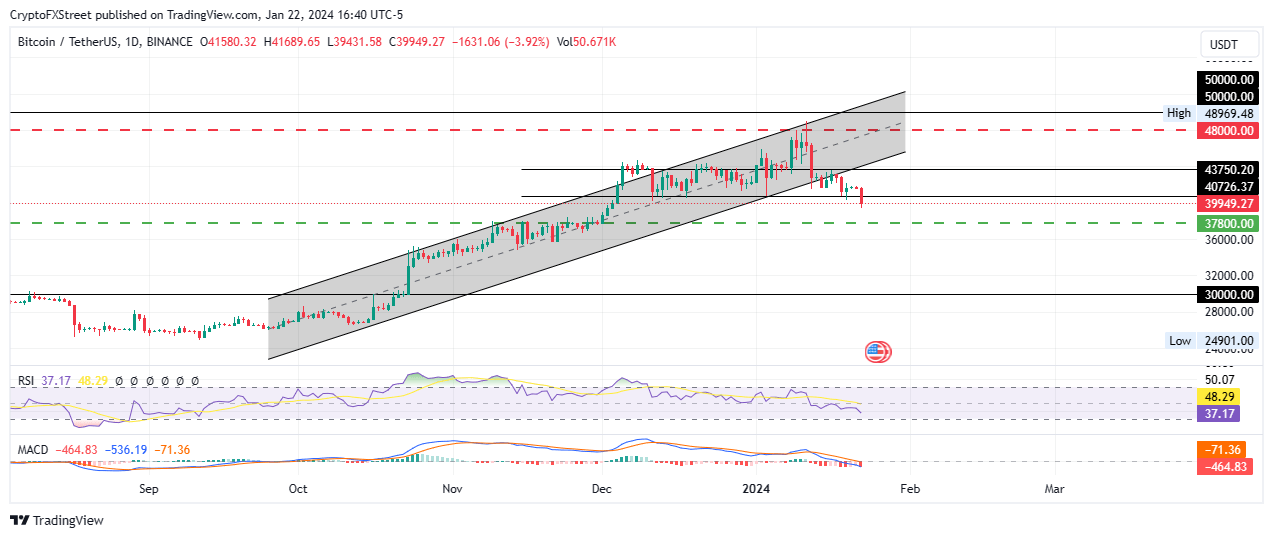

Another analyst observes that the dip was a healthy correction as it saw Bitcoin price collect downside liquidity residing below the $40,726 support.

At the time of writing, Bitcoin price is trading for $39,949, with the Relative Strength Index (RSI) nose-diving to show falling momentum. The odds continue to favor the downside, with the Moving Average Convergence Divergence (MACD) indicator moving below the signal line after a bearish crossover.

BTC/USDT 1-day chart

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.