Bitcoin price bullish outlook inspires IntoTheBlock’s 85% forecast of BTC at a new ATH by August

- Bitcoin price has made multiple attempts at a breakout above the ascending parallel channel.

- The intermediate trend remains bullish despite the risk of a correction in the wake of buyer exhaustion.

- BTC could give sidelined investors a buying opportunity before the next leg up.

Bitcoin (BTC) price is leading as altcoins follow, maintaining a broadly bullish outlook with a pronounced series of higher highs and higher lows since January 22.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Bitcoin could record new all-time high by August, IntoTheBlock

There is a big chance that Bitcoin price could record a new all-time high soon, according to Lucas Outumuro, head of research at on-chain aggregator tool IntoTheBlock. Specifically, the tool puts the odds at 85% in favor of the king of cryptocurrency recording a new peak in six months, meaning by August.

With bullish momentum surging, @intotheblock forecasts an 85% chance #Bitcoin hits new ATHs in the next 6 months, driven by Halving, ETFs, Easing, Elections, & Treasuries (HEEET). pic.twitter.com/tI3ZEWDxnD

— Satoshi Club (@esatoshiclub) February 16, 2024

IntoTheBlock attributes the expected surge in BTC price to heightened bullish momentum, attributing the ambition to five key themes. These are the halving, exchange-traded funds (ETFs), easing monetary policies, the US elections, and institutional treasuries.

The halving is barely eleven weeks out and will see miner rewards slashed in half. The event is expected to kick off the next bull cycle.

ETFs are the current mania in the market and continue to drive the cryptocurrency market. The investment product continues to record growing demand with over $4 billion in new inflows reported within the first month after the landmark approval and subsequent launch of spot Bitcoin ETF products in the US.

The theme of easing monetary policies by the Federal Reserve comes on the heels of declining inflation rates. In response, there are hopes that the Fed could lower interest rates, which should have the effect of increasing liquidity in the market. This would be beneficial to risk-on assets such as Bitcoin and stocks.

The US will hold the 2024 election in November with the possibility of a Republican administration inspiring the crypto market amid speculation of pro-crypto leaders.

As regards institutional treasuries, regions like Asia and South America continue to enjoy the legitimization of Bitcoin. Corporate treasuries and accessibility to ETFs could see the US market enjoy the same privilege, fostering the growth of the crypto industry.

Bitcoin price outlook

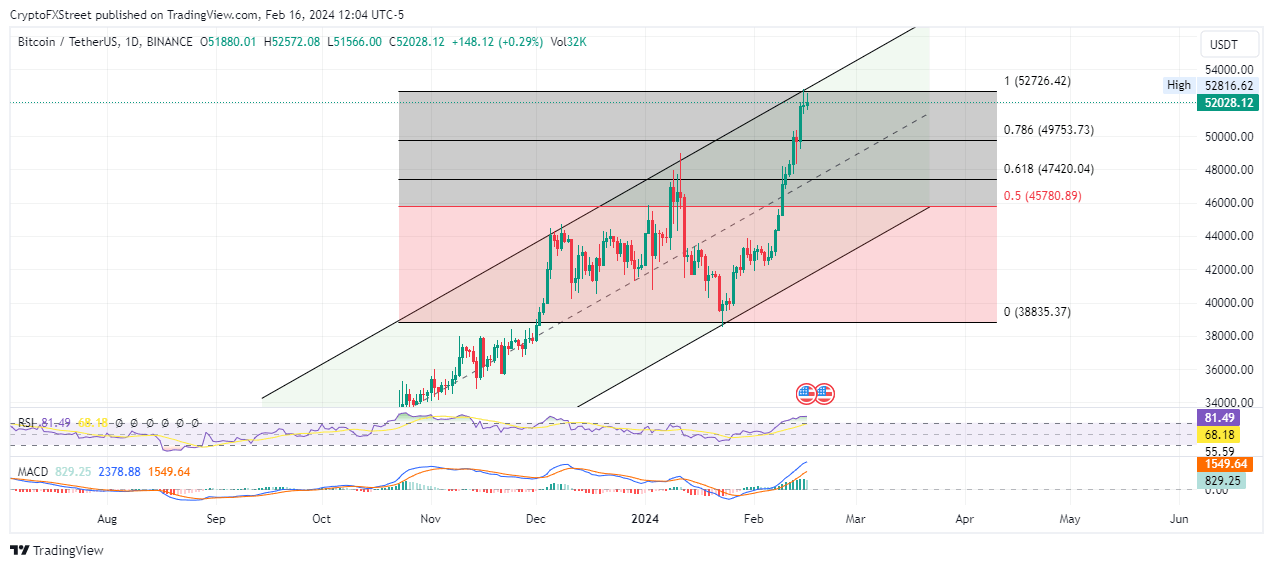

Measured from a market range of between the January 23 low of $38,835 and the February 15 high of $52,816, Bitcoin price is trading above the 78.6% Fibonacci level at $49,753. Chances are BTC could test this retracement level soon in the aftermath of a pullback as BTC is overbought. This is seen in the position of the Relative Strength Index (RSI) at 81.

In a dire case, Bitcoin price could extend the fall to the most critical Fibonacci level of 61.8% at $47,420, or worse, extend a leg down to the 50% Fibonacci level at $45,780.

BTC/USDT 1-day chart

Conversely, considering BTC bulls are still in the market, seen with the green histogram bars in positive territory, Bitcoin price could shatter the upper boundary of the channel. This could open the path for an extension to $55,000, or in a highly bullish cash, foray further to the $60,000 psychological level.

Also Read: Bitcoin Weekly Forecast: BTC eyes $60,000 but correction looms

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.