Bitcoin Price Analysis: BTC to start rolling into the abyss if $10,400 gives way

- MT Gox trustee is set to return 140,000 BTC to the victims of the hacked exchange.

- The long-term upside trendline is under threat, meaning BTC may collapse to $8,400.

Bitcoin (BTC) recovered from the recent drop below $10,400 during the previous week and settled at $10,670 by the time of writing. The flagship cryptocurrency has been struggling to break the tight range since the end of September after a sharp recovery from the recent low of $10,135 on September 23.

Mt Gox's ghost haunts Bitcoin?

Jay Hao, the head of the cryptocurrency exchange OKEx recently tweeted that Bitcoin may explore the new lows as Mt. Gox was set to distribute almost 140,000 BTC (nearly $1.5 billion at the current exchange rate) among the creditors of now-defunct exchange Mt. Gox on October 15.

Considering that Bitcoin was only $400 in 2013 when the platform was hacked, many people may choose to cash put, creating a considerable selling pressure on the market. Even if half of the distributed BTC is sold on the market, the price may drop brutally, creating panic across other markets.

However, it should be noted that, according to the Order issued by the Tokyo District Court and cited by Hao, October 15 is a new deadline when the trustee shall provide a rehabilitation plan.

"In the light of foregoing, the rehabilitation trustee filed a motion to seek an extension of the submission deadline of the rehabilitation plan to the Tokyo District Court, and on June 30, 2020, the Tokyo District Court issued an order to extend the submission deadline for a rehabilitation plan to October 15".

In other words, even if the trustee submits the plan before the new deadline, it will take some time to follow all the established procedures before the victims of the hack get their compensation.

Jay Hao admitted the mistake and published a disclaimer.

My bad to deliver wrong information and thanks for the fact check!

— Jay_OKEX_CEO (@JayHao8) October 5, 2020

*Clarification* The Tokyo District Court has issued an order to extend the submission deadline for the rehabilitation plan to October 15, 2020.

However, the Mt Gox case is still hanging like a sword of Damocles over the cryptocurrency markets. The cryptocurrency exchange accounted for over 70% of all Bitcoin transactions until it was hacked in 2013. The bad guys allegedly stole over 840,000 BTC worth over $300 million at that time and nearly $9 billion at the current exchange rate. After numerous lawsuits, the parties compiled a rehabilitation plan to compensate the victims.

Many experts, including Hao and a popular crypto twitter analyst Mr. Whale, believe that the creditors will choose to cash out to lock the exchange difference of 2,600%. However, it is still unknown how many Bitcoins will get to the market after all, as many holders have long assigned their claims to third parties.

https://twitter.com/CryptoWhale/status/1312896927718047744?s=20

What's going on with BTC in the long run

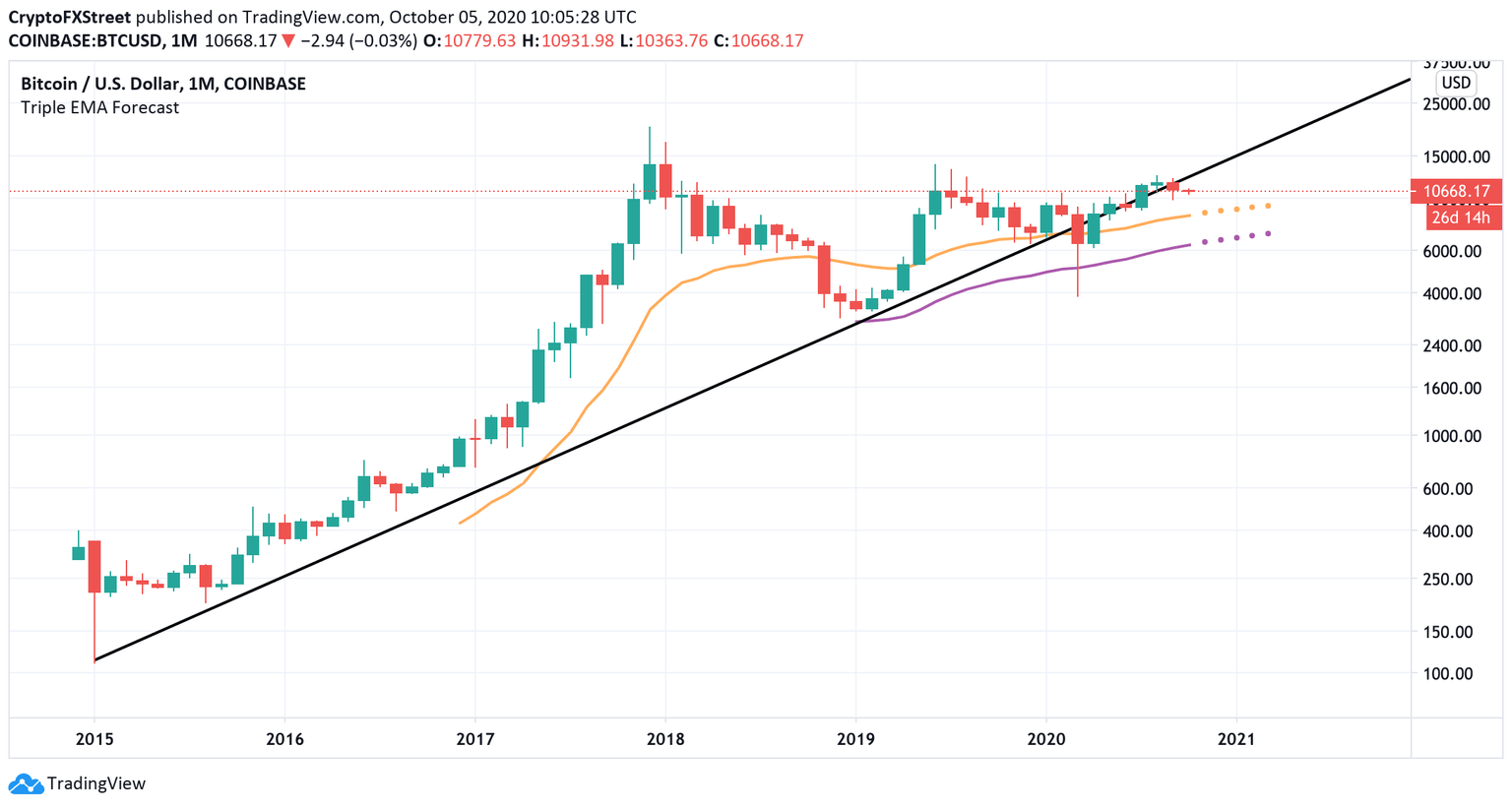

On a monthly chart, BTC/USD is breaking below the long-term bullish trend line that goes all the way up from January 2015 low at $109. If the bearish breakthrough is confirmed, the long-term technical picture will turn bearish. The short-term EMA creates the first significant support at $8,400. Once it is out of the way, the downside is likely to gain traction with the next focus on $6,500 (the mid-term EMA) and $3,850 (the lowest price of 2020).

BTC/USD monthly chart

On a weekly chart, BTC/USD is moving along the support line created by the short-term EMA on approach to $10,000. Meanwhile, the above-said long-term support of $8,400 is reinforced by the long-term EMA on the weekly chart, meaning that the bears may have a hard time pushing lower.

BTC/USD weekly chart

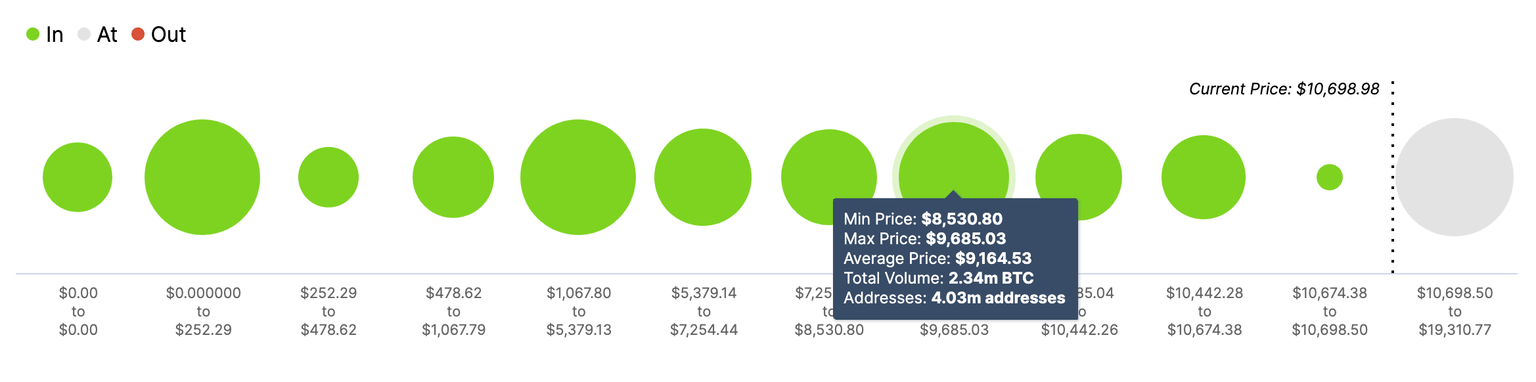

Meanwhile, on-chain data on the market positioning shows that the first critical support comes around $9,000. Over 4 million addresses with 2.3 million tokens have their breakeven point in the range from $9,600 to $8,500. Once this supply is absorbed, the sell-off may start snowballing all the way down to $5,000 with another buffer of stop orders.

On the upside, 5 million addresses bought 2.3 million coins at a price in the range from $10,700 to $19,300.

Bitcoin's In and Out of the money data

Source: Intotheblock

To conclude: the potential distribution of BTC to Mt Gox victims is a robust bearish factor; however, the real effect of the event remains unknown. Also, there is no clear information when people get their coins and be able to cash them out.

Meanwhile, the technical picture implies that BTC/USD is on the verge of breaking below the long-term trend line. If the breakthrough is confirmed, the flagship cryptocurrency price may drop to the support at $8,400 and start rolling into the abyss.

On the other hand, the on-chain data implies that a wall of supply clustered around $9,000 may slow down the bears and create a recovery impulse.

Author

Tanya Abrosimova

Independent Analyst