Bitcoin investors are cashing out, dampening BTC uptrend

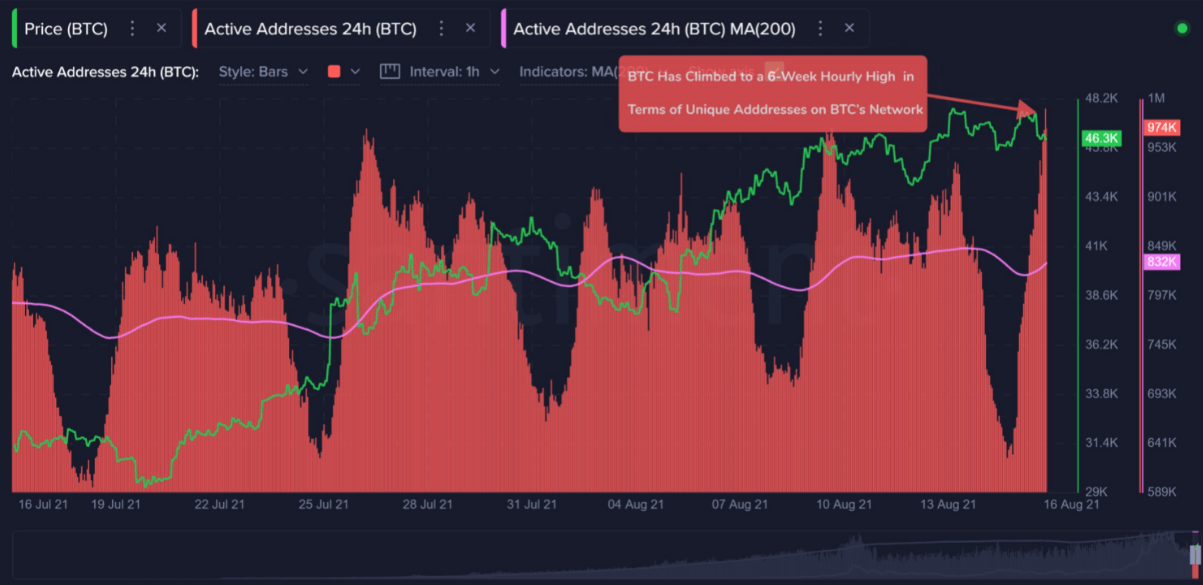

- Bitcoin hits largest single-hour spike in total unique addresses interacting on the BTC network since July 4, 2021.

- The leading cryptocurrency is rangebound between $45,000 and $48,000.

- Analysts expect BTC to face resistance on its run to all-time high.

- In the sixth consecutive week of outflows from crypto funds, investors withdrew $22 million.

- The overall BTC trading volume may drop.

Bitcoin’s price rally led the crypto market’s total capitalization to $2 trillion for the first time since mid-May. Experts suggest that BTC is due for a correction and its rally is likely to pause.

BTC price correction likely to interrupt rally to $51,000

Earlier today, Bitcoin recorded the most significant spike in unique daily addresses since July 4, 2021. The spike came despite BTC’s rangebound price action at the start of the week. An increase in activity signals market optimism after months of neutral or bearish outlook since the mid-June price drop below $40,000.

Unique address activity on the BTC network

BTC price settled between $45,000 and $48,000. This encouraged traders to anticipate another run toward the April all-time high of $64,804. A key indicator of bullish sentiment among investors is the Bitcoin Fear and Greed Index.

At the time of writing, the index is in the “Greedy Territory” with a score of 72. It is yet to hit “Extreme Greed,” representing mass euphoria, and will likely turn into price consolidation for BTC.

Despite week-long “Greed” on the trader sentiment index, investors have pulled $22 million from crypto funds. Last week marks the sixth consecutive outflow in the longest streak since January 2018, according to a Coinshares report. Fund outflows generally occur when the overall trading volume is low.

The current trade volume ($378.76 million) is at November 2020 levels and less than half of the volume recorded in June. The number is increasing steadily. The slow increase faces resistance, as the short-term momentum behind the supply squeeze rally fades.

Bitcoin exchange trade volume

A drop in Bitcoin reserves on exchanges was termed a “supply shock” by Will Clemente, an independent Bitcoin analyst. According to experts, a reduction in supply coupled with rising demand triggered a BTC price rally.

The cryptocurrency trader and analyst behind the Twitter handle @rektcapital analyzed the current BTC setup in his tweet:

#BTC performs a Daily close above the Ascending Triangle top but is again slinking below black

— Rekt Capital (@rektcapital) August 15, 2021

Can $BTC slink back above black before the Daily close?

At this stage though, more important is the Weekly Close (i.e. above $45200 likely sustains bullish momentum)#Crypto #Bitcoin https://t.co/lt8ilejCTi pic.twitter.com/Qc6kjZ80Ks

Bitcoin is trading close to the $45,000 level, and analysts at FXStreet have predicted that BTC price is due for a correction before it hits the target of $51,000.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.