Bitcoin showing signs of ‘short-term fatigue’ near $50k ahead of possible continuation

Bitcoin failed to break the $50,000 price tag during weekend trading and is beginning to flag signs of profit-taking in the short term. The world’s largest crypto by market cap is down 2.5% over a 24-hour period and is currently changing hands for around $45,892, CoinDesk data shows.

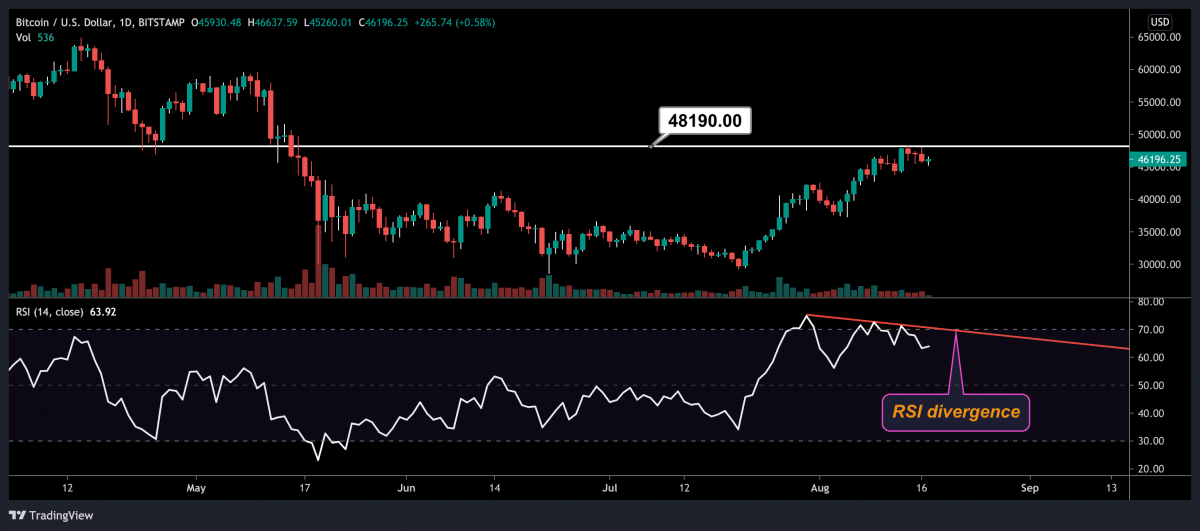

Still, bitcoin (BTC, -3%) is up 56% in year-to-date returns courtesy of a strong showing by bullish traders throughout the first half of August which saw prices rise from $38,000 on Aug. 4 to around $48,190 on Saturday.

“The price has rebounded strongly now, but this upward move is showing some signs of short-term fatigue,” said Simon Peters, market analyst at trading platform eToro. “We could see a small retracement down to lower prices before the prevailing trend reasserts itself.”

BTCUSD Daily Chart

Source: TradingView

Low levels of daily trading volume persist as bitcoin struggles to edge higher while short positions are building, according to Datamish data, pointing toward a return to lower supports near $44,000.

“Even though the trend has flipped bullish, a pullback is to be expected before continuation,” said Marcus Sotiriou, sales trader at U.K.-based digital asset brokerage firm GlobalBlock. “This is because there has been declining volume with an increase in price, as well as a bearish divergence in the RSI indicator on the daily time frame.”

Other notable cryptos in the top 20 by market capitalization over a 24-hour period are mixed with polkadot (DOT, +8.13%), solana and terra posting the highest gains while ether (ETH, -3.43%), XRP (-8.87%), and stellar (XLM, -7.76%) have shed the most over the same period.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.