Bitcoin drops below $59K following US government's $591 million Silk Road BTC transfer

- The US government has moved 10,000 Bitcoin seized from Silk Road to Coinbase Prime.

- BTC is down over 3% following the move, while US CPI data suggests the possibility of the Fed cutting rates.

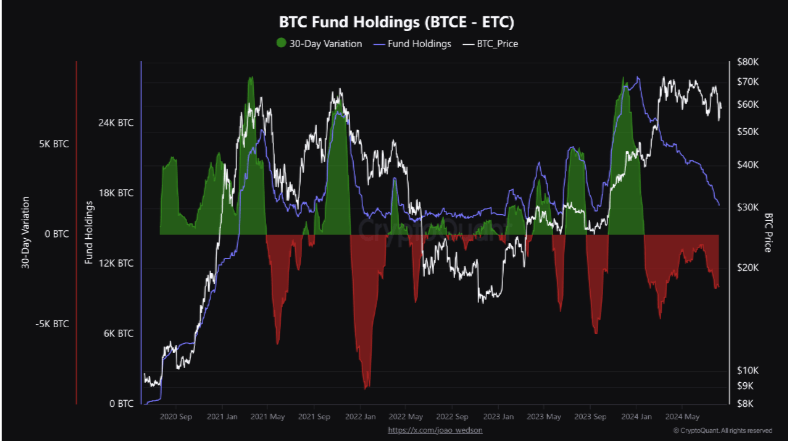

- Bitcoin's price movement has often shifted with changes in BTCE reserves, a pattern that has altered recently.

Bitcoin briefly dropped below $59K on Wednesday following news that the US government had moved 10,000 BTC to Coinbase Prime. On-chain data also shows a trend change in Bitcoin's price correlation to the BTCE fund reserves.

Bitcoin down as US Government moves 10,000 BTC

According to data from Arkham Intelligence, the US Government reportedly transferred 10,000 Bitcoin — equivalent to $591 million — to Coinbase Prime on Wednesday.

The wallet, which bears the name "US Government: Silk Road DOJ," made the initial transfer two weeks ago and again transferred the funds to Coinbase Prime today.

The funds are suspected to come from the confiscated Silk Road BTC after a previous transfer of $2 billion Bitcoin in July. Following the report, Bitcoin dipped slightly below $59K.

The decline also coincides with the release of July's US Consumer Price Index (CPI) inflation data. The CPI came in at 2.9% YoY — below expectations and the lowest rate since 2021. The declining inflation increases the chances for the Federal Reserve to cut interest rates in September.

As a result, several investors anticipate a price rally across digital assets in the coming weeks as risk assets like cryptocurrencies often see price growth in a lower interest rate environment.

Meanwhile, on-chain analytics provider CryptoQuant released an analysis revealing a correlation between Bitcoin's price movement and the fund behavior of Germany's ETC Group Physical Bitcoin (BTCE). The price of Bitcoin often rallies when the reserve increases and falls when the reserve declines.

BTCE Fund Holdings

This historical pattern appears to have been altered since January after spot Bitcoin ETFs launched in the US, as the drop in BTCE reserve has had little impact on Bitcoin's price. This indicates shifts in market dynamics or other influences that warrant a deeper analysis.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi