Crypto Today: Bitcoin, Ethereum and Ripple hold steady as US inflation cools slightly

- Bitcoin trades above $61,000 on Wednesday as traders turn hopeful in response to US macroeconomic release.

- Ethereum eyes return to the $3,000 level, holds above $2,700 as sentiment among traders improves.

- Ripple sustains above key support at $0.57, XRP traders accumulate the asset while whales distribute their holdings.

Bitcoin, Ethereum, XRP updates

- Bitcoin (BTC) trades at $61,063 on Wednesday. The crypto fear and greed index climbed from 26 to 30 on August 14; sentiment among traders is “fear.” The largest asset by market capitalization could extend gains this week as institutional investors pour capital into spot Bitcoin Exchange Traded Funds (ETFs).

- Spot Bitcoin ETFs recorded nearly $39 million in inflows on August 13, the second consecutive day of inflows this week.

- Ethereum (ETH) inched closer to its $3,000 psychological target on August 14. ETH price extended gains on Wednesday, trading at $2,729 at the time of writing.

- XRP held steady above key support at $0.57 amidst positive developments in the Ripple ecosystem.

- Macro update: Analysts at FXStreet reported that the US Consumer Price Index (CPI) inflation rate declined to 2.9% on a yearly basis in July from 3% in June, per the US Bureau of Labor Statistics (BLS) report on Wednesday. Inflation is cooling with the reading in line with market expectations.

Chart of the day

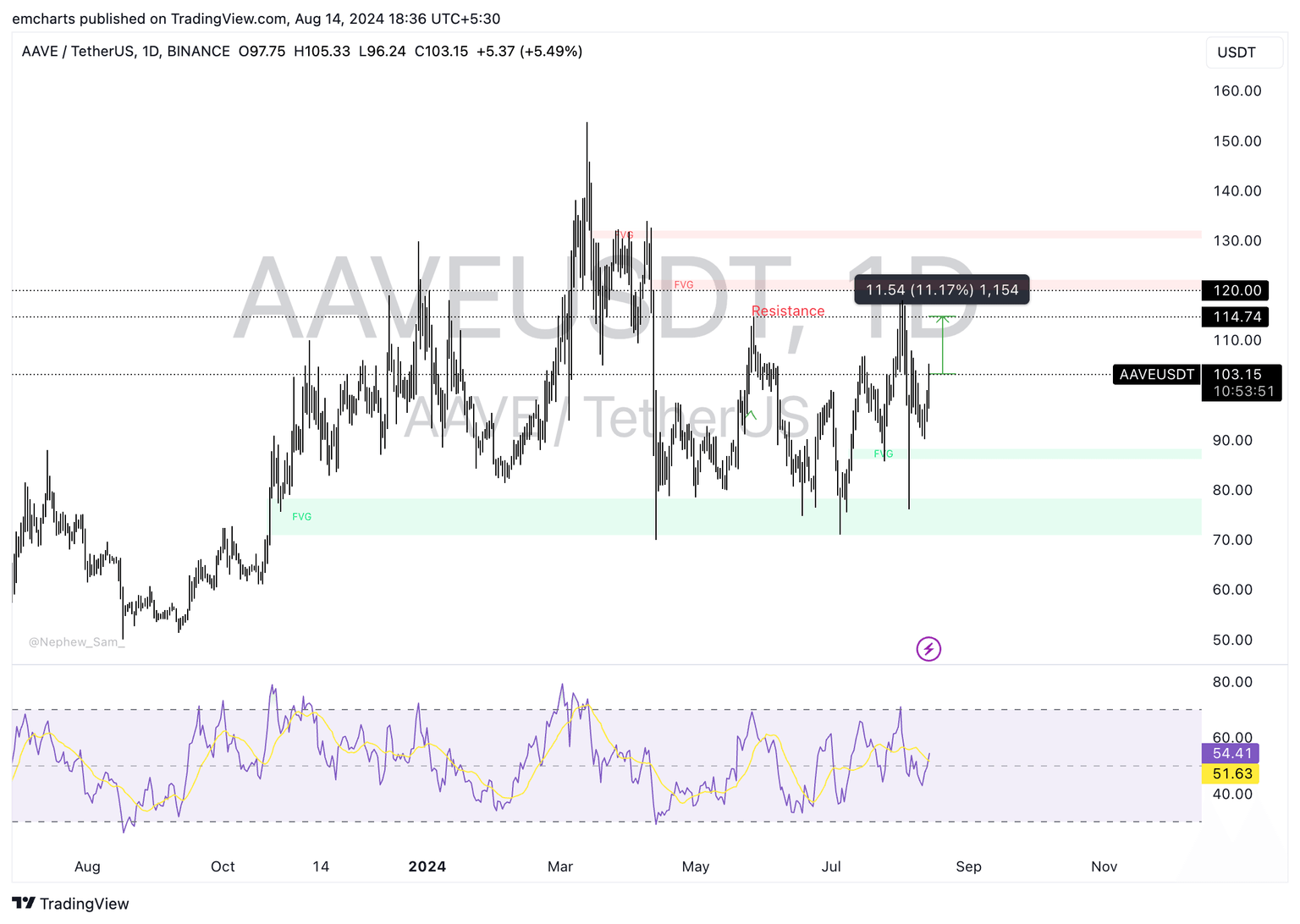

AAVE/USDT daily chart

AAVE could extend gains by 11.17% and rally to its target at $114.74, this marks a key resistance in AAVE’s daily chart, as it represents the neckline of the W formation. AAVE trades at $103.15 at the time of writing. The DeFi token faces resistance at $112, a key resistance level since mid-April 2024.

AAVE could sweep liquidity between $86 and $95 in the imbalance zone in the daily price chart. AAVE could find support at the lower boundary of the FVG at $86. The Relative Strength Index (RSI) reads 54.41, signaling positive momentum in AAVE’s price trend.

Market updates

- Grayscale starts transfers to Coinbase Prime of holders' 2.31 million Ether worth over $6 billion, per on-chain data.

INTEL: Grayscale started transferring $ETH to Coinbase Prime 8 minutes ago

— Solid Intel (@solidintel_x) August 14, 2024

Currently holding 2.31M ETH ($6.29B) and 267.712K BTC ($16.32B) pic.twitter.com/dw94rfW1ER

- Bitcoin large wallet investors started accumulating BTC after the asset’s pullback in early August. The cumulative volume delta (CVD) on centralized exchanges shows there is more selling activity versus buying.

Following bitcoin’s pullback in early August, long-term investors, especially large holders, have started to accumulate coins again. The cumulative volume delta (CVD) on the CEX indicates the prevalence of selling since the ATH. pic.twitter.com/Djo8Yz0HKW

— NekoZ (@NekozTek) August 14, 2024

- Neutron, Sui Network and Flare Networks are the top 10 blockchains by growth in total value of assets locked (TVL), per data from Cryptorank.io.

Top 10 Blockchains by 7D TVL Growth@Neutron_org +58.3%@SuiNetwork +55.3%@FlareNetworks +32.6%@SeiNetwork +23.8%@Aptos +22.9%@CelestiaOrg +19.0%@auroraisnear +17.8%@BSquaredNetwork +15.1%@MapProtocol +13.7%@Conflux_Network +13.4% pic.twitter.com/o0moJ9GcJV

— CryptoRank.io (@CryptoRank_io) August 14, 2024

Industry update

- MetaMask starts rollout of blockchain based debit card developed in partnership with Mastercard and Baanx.

- Bitmex co-founder Arthur Hayes predicted Bitcoin will reach $100,000 by late 2024 and could hit $1 million by 2025, in a recent blog post.

- Bitcoin podcaster Stephan Livera talks about Dark Skippy, a new attack on Bitcoin hardware wallets to make users aware of how malicious actors can steal their assets.

Dark Skippy: A New Attack on Bitcoin Hardware Wallets? With Nick, Lloyd and Robin SLP597

— Stephan Livera (@stephanlivera) August 14, 2024

Dark Skippy is a new attack that in theory, makes it much easier for a malicious person to steal your coins. Listen in to learn about some of the ins and outs here, as well as mitigation and… pic.twitter.com/TXsH1cIwbv

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.