Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

- Bitcoin slips to $96,000 on Friday, down nearly 10% from its all-time high.

- Market-wide crash wipes out 6% of crypto market cap and altcoins.

- Whales are accumulating Bitcoin, Ethereum, Chainlink while taking profits on Shiba Inu and Pepe.

- Over $200 million in derivatives positions have been liquidated since Bitcoin’s decline under $100,000.

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins. The almost 10% by the largest cryptocurrency from its all-time high is driven by the US Federal Reserve’s (Fed) more hawkish outlook for 2025 and potential liquidity moves expected from the US Treasury in 2025.

The market-wide crash seen since Wednesday has erased millions in market capitalization, liquidating over $200 million in derivatives positions across exchanges.

As the market sentiment shifts, large wallet investors accumulated some tokens and took profit on others, signaling what retail investors should expect from crypto in the coming weeks.

Bitcoin bleeds nearly 10% from all-time high, down to $96,000

Bitcoin corrected from its all-time high of $108,353 on Tuesday to a low of $96,000 on Friday. The largest cryptocurrency’s decline has liquidated $216 million in derivatives positions in the last 24 hours across exchanges, according to data from Coinglass.

Bitcoin’s 12-hour price chart shows that the $93,885 to $94,640 is a key support zone for BTC as it aligns with a Fair Value Gap (FVG). Looking up, the main barrier stands at the $100,000 psychologically important level.

At the time of writing, Bitcoin consolidates close to $98,000.

BTC/USDT 12-hour price chart

Crypto prices crashed across categories, and over 6% of market capitalization was erased in response to the Fed Chair Jerome Powell’s words saying that the US central bank is not looking to hold Bitcoin and also prospects that there will be a more cautious approach to interest-rate cuts in 2025.

“We’re not allowed to own Bitcoin. The Federal Reserve Act says what we can own, and we’re not looking for a law change. That’s the kind of thing for Congress to consider, but we are not looking for a law change at the Fed,” Powell said on Wednesday.

The comments came in response to a question on the US strategic Bitcoin Reserve, a part of President-elect Donald Trump’s plan for bolstering crypto adoption.

Bitcoin price fell sharply on Wednesday and Thursday, as the sentiment among BTC holders shifted post the Fed Chair’s comments. As of Friday, BTC appears to have found a floor.

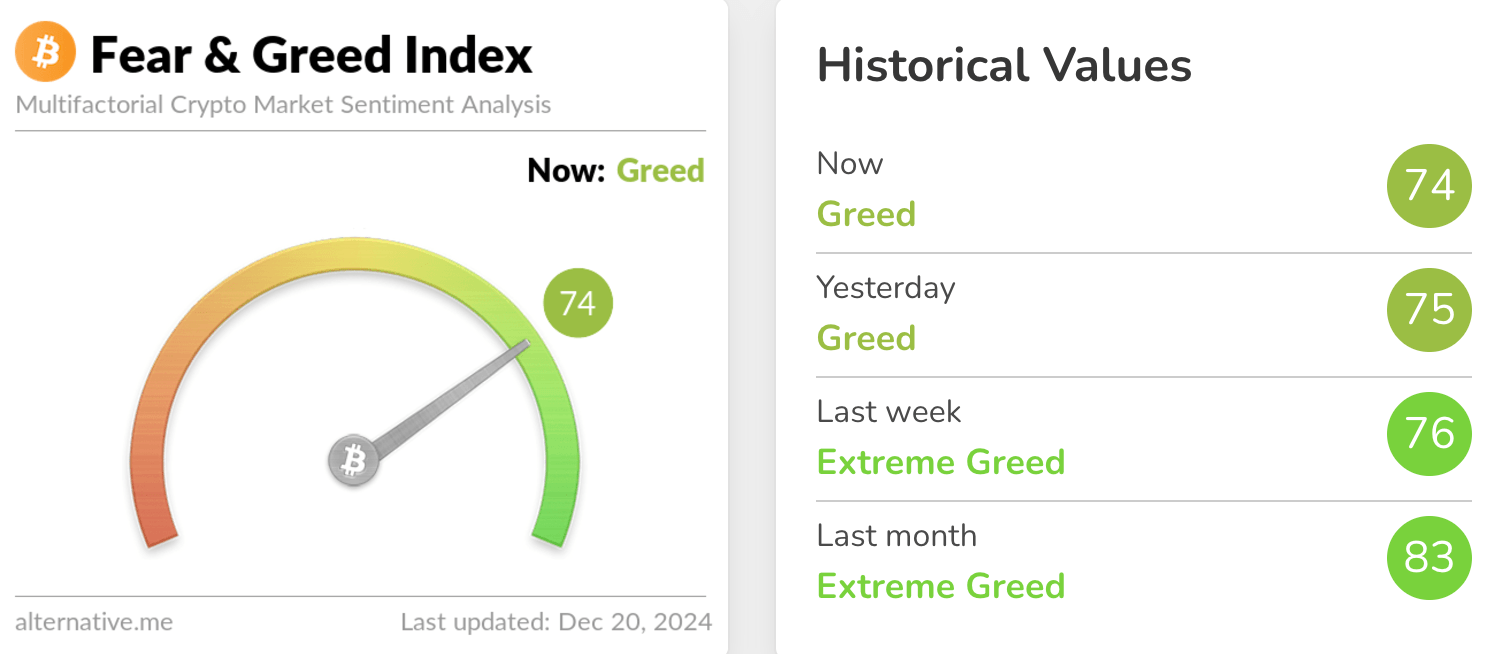

Crypto fear and greed index ends streak of “Extreme Greed”

Alternative.me’s crypto fear and greed index helps gauge the sentiment of market participants on a scale of 0 to 100, from extreme fear to extreme greed. After reading “extreme greed” throughout last month, the gauge has recently shifted to “greed”.

Crypto fear & greed index

What are whales buying and selling?

During times of correction in crypto prices, retail investors look at large-wallet addresses for guidance on what to expect from token prices in the coming weeks. Recent whale activity tracked by Lookonchain shows the following:

- Whales are accumulating Ethena (ENA). A whale wallet address tracked by Lookonchain withdrew 13.65 million ENA tokens (worth nearly $13.25 million) from Binance.

Ethena withdrawal by whale wallet on Binance

- Donald Trump-backed World Liberty Financial is buying Ethereum (ETH) in the recent dip.

After the $ETH price drop, #Trump's World Liberty(@worldlibertyfi) spent 2.5M $USDT to buy 722 $ETH again 2 hours ago.https://t.co/AmeIF2plRb pic.twitter.com/UwI88MfoUK

— Lookonchain (@lookonchain) December 20, 2024

- A whale wallet, likely related to Long Ling Capital – an early-stage VC firm based in China – bought Ether during the price drop.

A smart whale (likely related to #LonglingCapital) bought 6,000 $ETH after the price drop.

— Lookonchain (@lookonchain) December 19, 2024

This whale is skilled at buying $ETH at low prices and selling at highs, with a total profit of $83M.

Since May 8, 2023, this whale bought 75,400 $ETH($180.4M) at an average price of… pic.twitter.com/OK0OS9U4ou

- On Thursday, large wallet addresses took profits in Shiba Inu (SHIB) and a whale wallet sold Pepe (PEPE) to realize a loss.

A whale sold 250B $SHIB($6.05M) for profit in the past hour!

— Lookonchain (@lookonchain) December 19, 2024

The whale spent $3.8K to buy 15.28T $SHIB($1.22B at the peak) as early as August 6, 2020.

This whale currently holds 2.15T $SHIB($52.18M), with a total profit of $109M on $SHIB.https://t.co/BWxcnWuwFR pic.twitter.com/aQZFPyhYSv

After the market drop, a whale deposited 150B $PEPE($2.72M) into #Binance to stop loss.

— Lookonchain (@lookonchain) December 19, 2024

This whale withdrew 150B $PEPE($2.94M) and 60B $SHIB($1.52M) from #Binance on Nov 28.

At current prices, the whale is facing a loss of $219K on $PEPE and $136K on $SHIB.… pic.twitter.com/kGDa9K7Z7z

Expert maintains optimism for 2025

“My outlook for crypto through 2025 remains optimistic, bolstered by a supportive regulatory environment that encourages broader capital investment in crypto,” said Nick Forster, founder of Derive.xyz, to FXStreet in an exclusive interview.

“More regulatory clarity is fostering deeper institutional engagement and enabling crypto's expansion beyond speculative trading into mainstream financial applications,” Forster added.

Meanwhile, Ruslan Lienkha, Chief of Markets at YouHodler, assuaged trader concerns on the growing correlation between Bitcoin and US macro moves.

"Fed policy has an indirect impact on the cryptocurrency market due to the growing correlation between crypto and traditional financial instruments, as cryptocurrencies become increasingly integrated into traditional finance. While the administration can directly influence the crypto market through policy decisions and regulatory actions, the Fed’s role is limited to managing monetary policy, which indirectly affects crypto via its impact on liquidity and investor sentiment in the financial ecosystem," he said.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.