Bitcoin Cash Price Prediction: BCH upside capped at $235 as bears take control – Confluence Detector

- The sellers have so far nearly canceled out all the gains that the buyers made yesterday

- BCH has two healthy support levels at $227 and $225.

BCH/USD bulls were in full control of the market for the last two days. During this period, they were able to take the price up from $222.50 to $235. The number of holders with 100,000 - 1 million BCH coins had gone up from four to six in the previous ten days, which may have affected the price.

However, following this bullish price action, the price failed at the $235 resistance line and has since fallen down.

BCH/USD daily chart

After failing at the $235-level, the bears took over the market and dropped the price to $229.35. The sellers have nearly canceled out all the gains that the buyers made yesterday. The RSI is trending around the neutral zone, which means that BCH/USD can drop even more before it becomes undervalued.

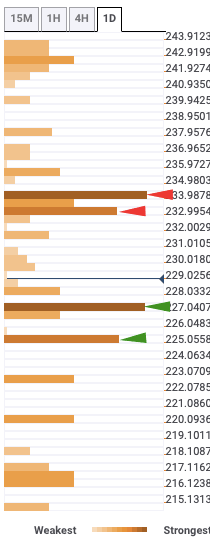

BCH/USD daily confluence detector

The confluence detector is a pretty handy tool that shows us healthy resistance and support levels. This helps determine the upside and downside potential of the asset. When it comes to BCH/USD, there are two strong resistance levels at $233 and $235. The former has the monthly Pivot Point one support-one, while the latter has the weekly Pivot Point resistance-one.

On the downside, BCH has two healthy support levels at $227 and $225. The former has the one-week Fibonacci 61.8% retracement level, while the latter has the one-day Previous low.

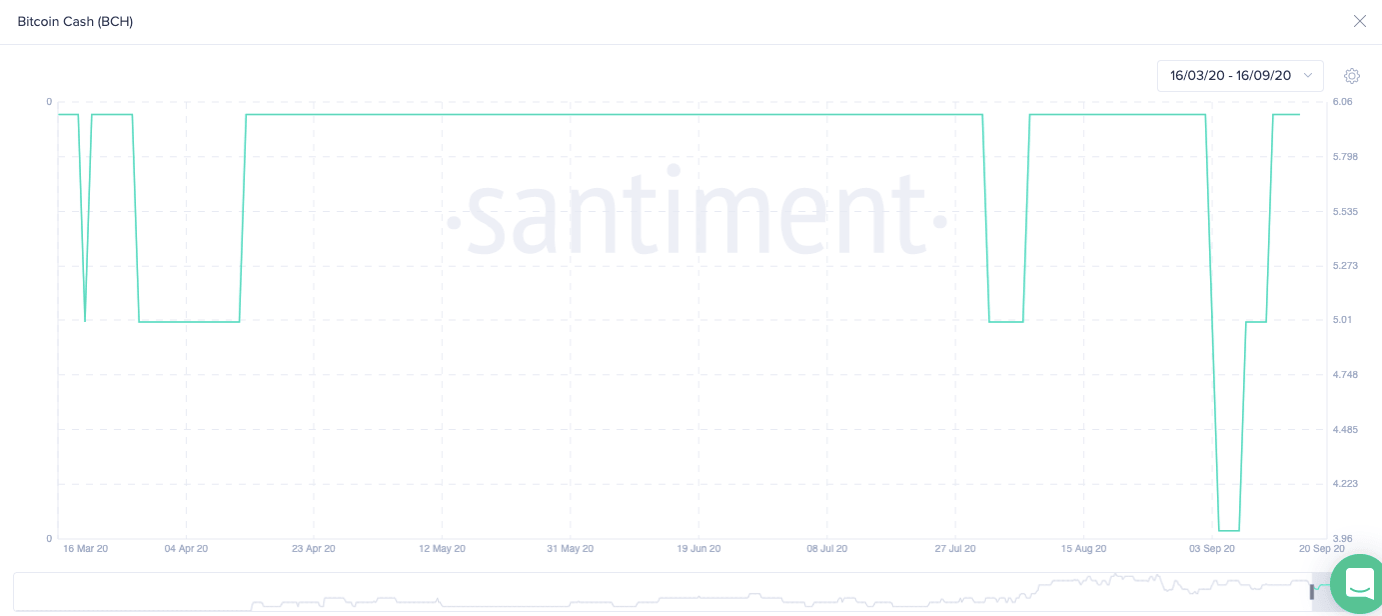

BCH is soon going to go through a consolidation period as the holders prepare themselves for a third fork in four years.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

-637358259911979739.png&w=1536&q=95)