Bitcoin Cash Market Update: BCH heading towards third fork in four years

- BCHN (Bitcoin Cash Node) and Bitcoin ABC are the two factions looking to split from each other.

- The controversial Infrastructure Funding Proposal has been in the crosshairs.

Bitcoin (BCH) Cash is on course to a November fork after the Bitcoin ABC team released a new version of its controversial upgrade proposal. Bitcoin ABC happens to be the most popular full node implementation of the BCH protocol.

The proposal

The controversial proposal would siphon away eight percent of the mining rewards, which would fund the Infrastructure Funding Proposal (IFP). Simply put, miners only had access to 92% of the rewards. Roger Ver, one of the most influential figures in the Bitcoin Cash ecosystem, has made his feelings very clear about the proposal:

Diverting part of the #BitcoinCash block reward to pay a single development team is a Soviet style central planner’s dream come true.

— Roger Ver (@rogerkver) August 31, 2020

Please stop. pic.twitter.com/5H6EKDnDjc

What is a fork?

A fork is a term used to describe a split in the underlying blockchain protocol. Basically, it splits the underlying chain into old and new. Now, a fork can be of two kinds – soft and hard. A soft fork allows the old and new chain to freely interact with each other, while the hard fork completely isolates the two chains.

Bitcoin Cash is not a stranger to forks. They were directly involved in two of the most high-profile forks in the last four years:

- Bitcoin - Bitcoin Cash fork: Resulting from the block size/segwit debate, Bitcoin Cash forked away from the original Bitcoin protocol. This new system didn’t use segwit and used an 8 Mb block size instead of 1 Mb.

- Bitcoin Cash - Bitcoin SV: The Bitcoin SV faction led by Craig Wright and Calvin Ayre split from Bitcoin Cash for two reasons – they wanted a 128 Mb block size limit. Plus, they didn’t want smart contract-like functionalities on the protocol since it would deviate from Satoshi Nakamoto’s original vision (SV = Satoshi’s Vision).

The BCHN - Bitcoin ABC fork

It looks like the two factions Bitcoin ABC (led by Amaury Sechet) and the Bitcoin Cash Node or BCHN (led by Roger Ver), are about to split from each other. Sechet is adamant about having the funding proposal go through to make Bitcoin Cash competitive with Bitcoin and Ethereum.

“In comparison, Bitcoin Cash is lacking in funding and the result is a poorly maintained infrastructure, highly dependent on the work of other teams such as Bitcoin Core’s, as well as poor developer tools.”

What are the price implications?

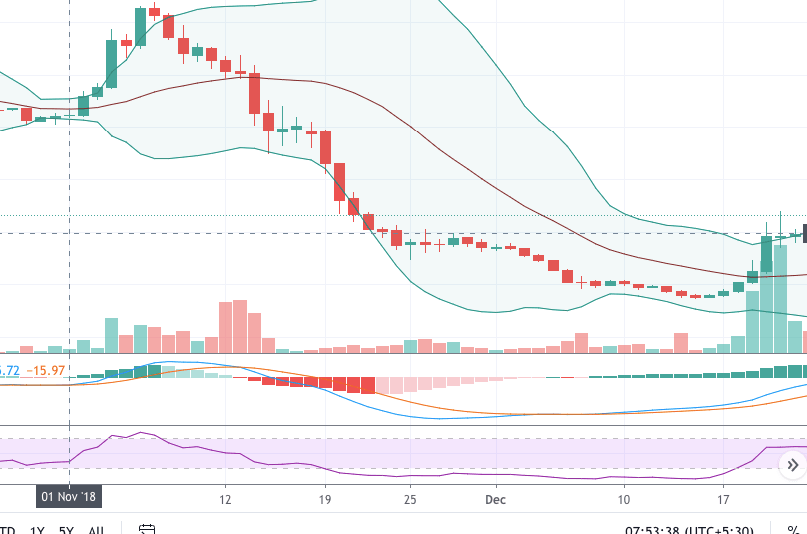

The chart above is a small snapshot of what happened during the Bitcoin Cash-Bitcoin SV fork. The price plummeted from $627 to $74.20 in a little over a month (November 2018 to December 2018). While this sounds very scary (and it should), you must keep in mind this hard fork was incredibly ugly and infantile. The same situation is not expected in this fork. However, we will probably see a period of consolidation before a price dump.

The long-term implications are a little hard to predict since it will depend entirely on which protocol the community and developers support in the future.

BCH/USD daily chart

BCH/USD bulls retained control for the second straight day as the price went up from $230.65 to $230.71. In the process, the price has crept back inside the 20-day Bollinger Band, indicating that it’s no longer overvalued. The relative strength index (RSI) indicator is still hovering next to the oversold zone. This shows that the price still has more potential for growth.

The bulls face strong resistance levels at $243.45, $251.85, $254.82 (SMA 200) and $276.30 (SMA 20 and SMA 50). The SMA 50 has crossed over the SMA 20 to chart a bearish cross pattern.

Key levels

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

-637348719612256077.png&w=1536&q=95)