Bitcoin Cash Price Forecast: BCH bulls retain control after bearish Thursday – Confluence Detector

- BCH buyers face strong resistance at $282.50 in the path back to $300.

- Bitcoin Cash has a healthy support barrier at $262.50 to cap the downside.

Bitcoin Cash went up from $208 on September 23 to $276 on October 24. Following this move, the bulls and bears have engaged on a tug of war for control over the market, with the price jumping up and down. At the time of writing, the Bitcoin fork is trading for $268. The MACD shows that the market momentum was about flip from bullish to bearish, but BCH/USD has settled down, as bulls still have the edge.

BCH/USD daily chart

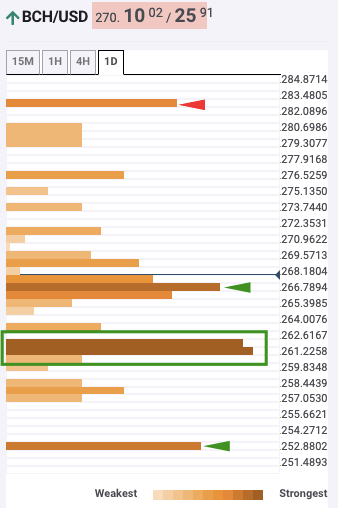

The daily confluence detector helps to visualize strong resistance and support levels. The chart shows how buyers have the freedom to take the price up to the $282.50 resistance barrier. Upon breaking past this level, the price will be able to aim for $300.

BCH daily confluence detector

Can the bears do any damage?

While the overall outlook looks bullish, the bears can still cause severe damage if they can take control. The first support wall that they will face is at $267. Upon taking control of that zone, they will have the freedom to take the price down to $262.50, where they will encounter a strong barrier between $261.50-$262.50. This zone should be strong enough to absorb a large amount of selling pressure. However, a break below here could be fairly alarming since the next viable support is at the 50-day SMA ($257).

Key price levels to watch

Bitcoin Cash has strong resistance at $282.50 before it makes a foray into the $300 zone.

However, if the bears take control and manage to break below the $267 support, they should struggle to go below the $261.50-$262.50 barrier.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

-637396274489065346.png&w=1536&q=95)