Bitcoin Cash Price Forecast: BCH’s path to $300 cleared up – Confluence Detector

- BCH bulls face weak resistance in the path back to the $300 zone.

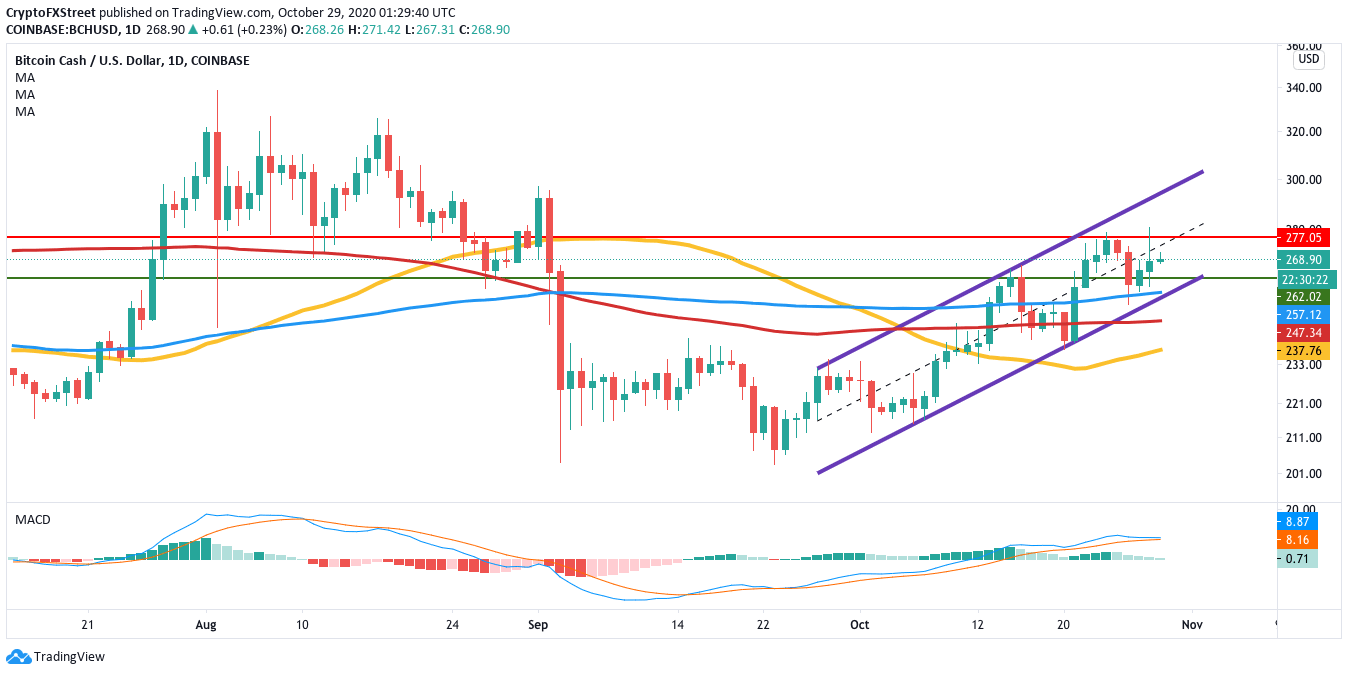

- The daily price chart is currently trending in an ascending channel formation.

After the price found support around $207, Bitcoin Cash has been trending upwards in an ascending channel formation. During this upward trend, the Bitcoin fork managed to cross the 50-day SMA ($238), 200-day SMA ($247.35) and 100-day SMA ($257.15). The MACD shows sustained bullish momentum, which should give the buyers enough firepower to shoot for the $300 zone.

BCH/USD daily chart

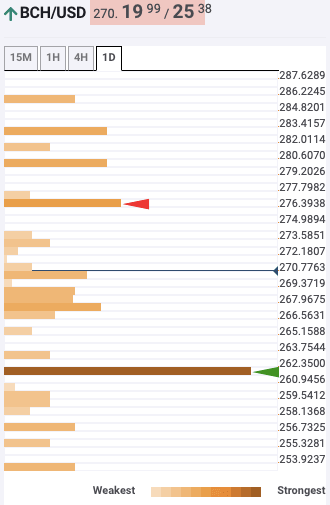

As per the daily confluence detector, BCH faces a moderate resistance barrier at $277, which had managed to previously thwarted the price. Strong support walls well protect the downside at $262 and the three SMAs. The confluence detector shows that this $262 wall is robust enough to absorb a significant amount of selling pressure.

BCH daily confluence detector

The way the whales have been behaving has also been extremely positive. As per Santiment’s holder distribution chart, the number of addresses holding 100-1,000 tokens rose from 12,462 on October 27 to 12,494 on October 29. The number of addresses holding 1,000-10,000 tokens rose from 1,711 on October 27 to 1,724 on October 28, before dipping to 1,723 at the time of writing. Finally, the number of addresses holding 10,000-100,000 tokens rose from 164 on October 25 to 172.

Bitcoin Cash holders distribution

The Flipside: Can the bears take back control

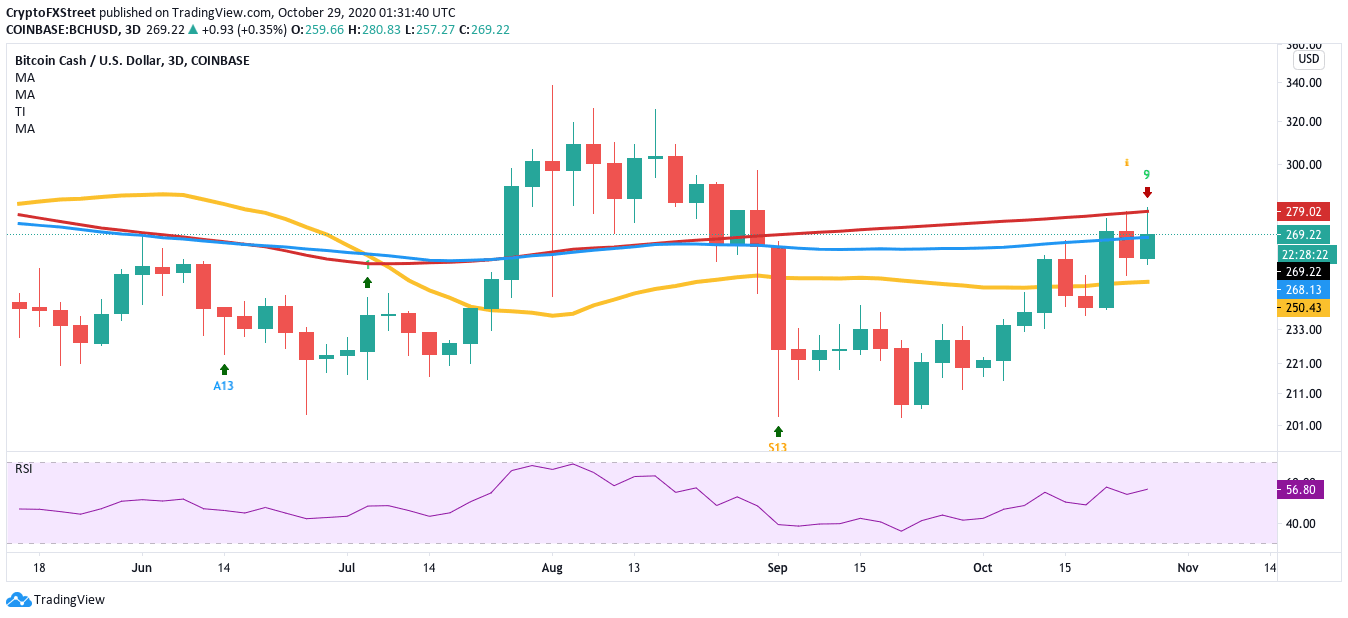

As we have mentioned before, the 3-day chart for BCH has flashed a sell signal with a green-nine candlestick in the TD sequential indicator. The bears now have around 22 hours left to validate the signal. The downside for Bitcoin Cash in the 3-day chart lies at the 100-bar SMA ($268) and 50-bar SMA ($250).

BCH/USD 3-day chart

Key price levels to watch

BCH bulls will need to flip the $277 resistance barrier into support to make their way into the $300 zone.

On the other hand, the bears have to validate the sell signal in the 3-day chart and aim to take the price below the 100-bar SMA ($268) and 50-bar SMA ($250).

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

%20%5B07.00.57%2C%2029%20Oct%2C%202020%5D-637395362996182108.png&w=1536&q=95)