Bitcoin Cash Price Analysis: BCH/USD gains 2%, recovers earlier losses

- Bitcoin Cash reverses earlier losses on Firday.

- The critical resistnace is created by $241.00.

Bitcoin Cash (BCH) is the fifth largest digital asset with the current market value of $4.8 billion. The coin regained ground after the initial sell-off to $228.04 during early Asian hours to trade at $231.23 at the time of writing. BCH experienced a strong growth and gained over 2% in a matter of minutes amid fresh demand registered on approach to the local support area.

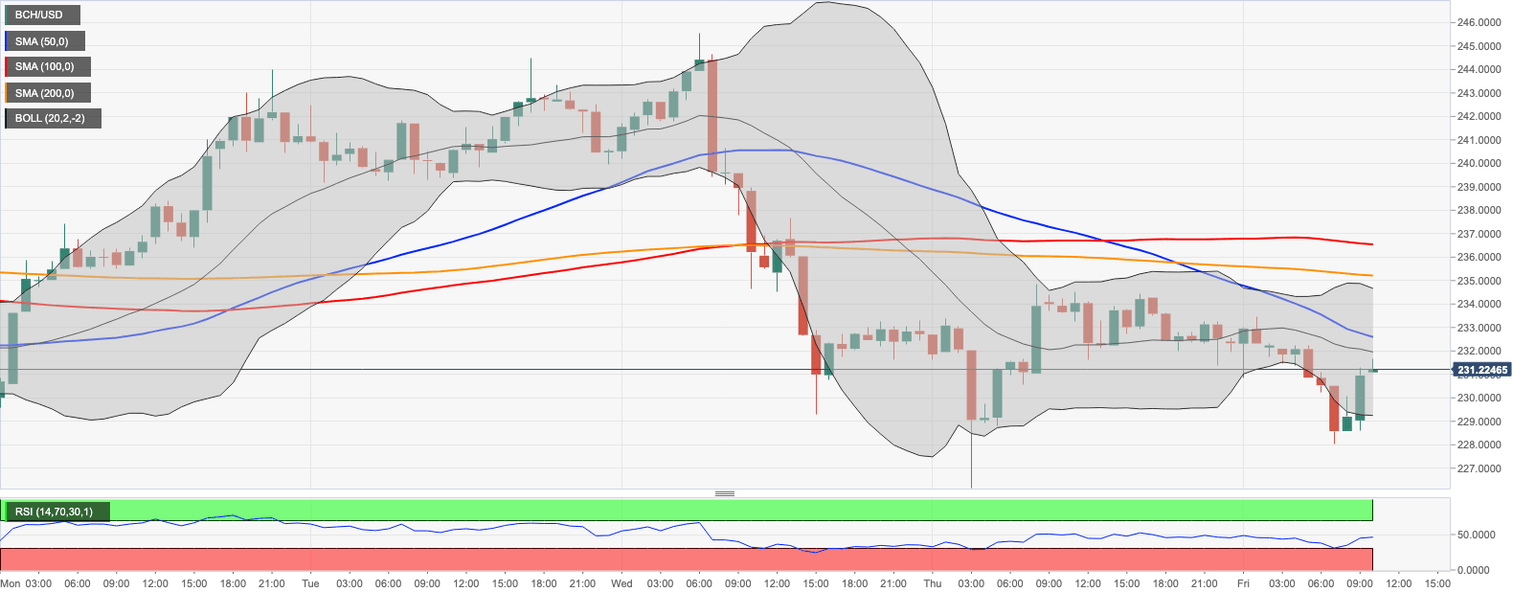

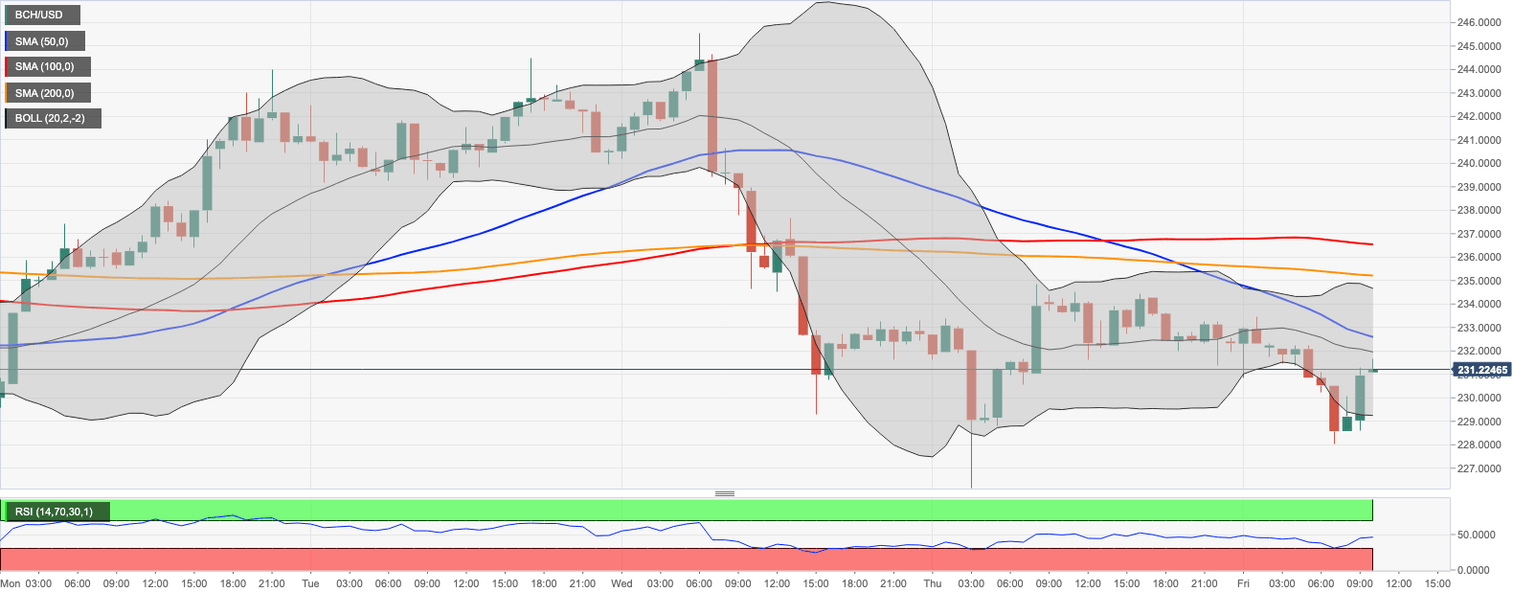

BCH/USD: Technical picture

On the inyraday chart, BCH/USD recovery is capped by the middle line of the Bollinger Band on approach to $232.00. Once it is out of the way, the upside is likely to gain traction with the next focus on 1-hour SMA50 at $232.60 and 1-hour SMA200 on approach to $235.00. This area served as a resistance on Thursday, which means the short-term bulls may have a hard time pushing the price higher. The ultimate technical barrier is created by daily SMA100 at $237/00 and a combination of daily SMA50 and the middle line of the daily Bollinger Band above $241.00.

On the downside, the local support is created by psychological $230.00. Once it is out of the way, the price may retest the intraday low of $228.04. The next barrier comes at $223.22 (the lower line of the daily Bollinger Band).

BCH/USD 1-hour chart

Author

Tanya Abrosimova

Independent Analyst