Bitcoin bulls turn the tide as investors target a 20% recovery

- Bitcoin briefly slipped below $40,000 in Monday's trading.

- BTC price sees a sharp recovery and a break above Monday’s high.

- As a broad recovery looks to be underway, expect bulls to target $50,000 in the first phase.

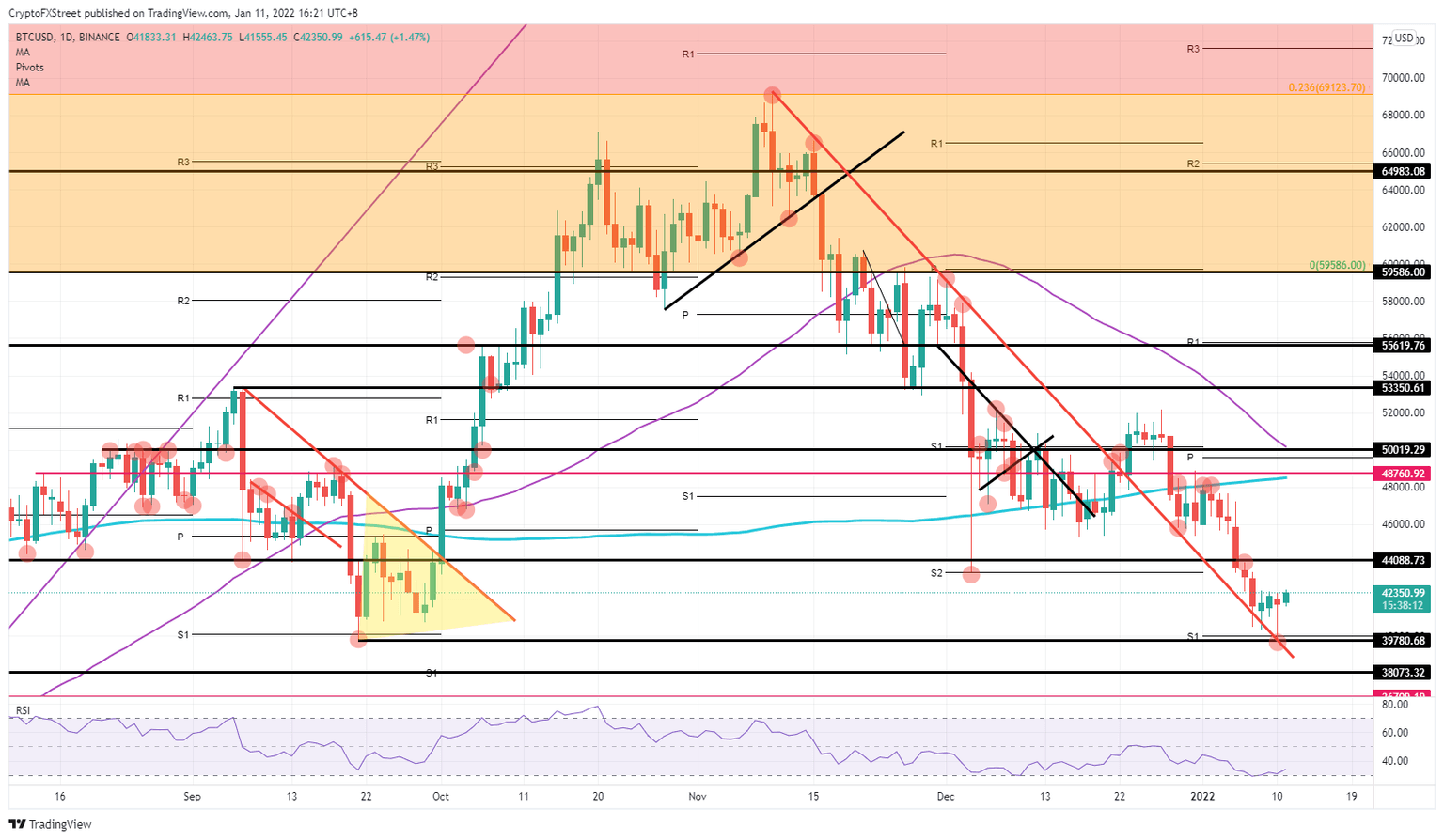

Bitcoin (BTC) saw sellers squeeze out their final drop of gains on Monday after demand briefly dipped below $40,000. This level is in line with the low of the September 21 decline last year and BTC price bounced off the monthly S1 support level and a longer-term red descending trend line. Expect a turnaround from here, with demand switching to the buy-side with risk-on back on the front foot.

BTC price set for a 180-turn back towards $50,000

Bitcoin price has given market participants quite a lot of pain at the start of 2022. Investors that came on strong out of the gate saw their investments devalue by 17%. On the horizon, however, the clouds start to evaporate, and during the European session, a global risk-on tone across assets is set to soothe and possibly erase the negative headwinds that were dictating price action these past ten days of the new year.

Technically, BTC is set for recovery with an entry at around $39,800 and a bounce off the September 21 low, the monthly S1 support level and a rejection by the red descending trend line that formed since November 10. With the turnaround currently in global markets, cryptocurrencies are seeing a tailwind emerge that is set to break the high of Monday and could see it hit $44,088 later today. If markets can hold on to this momentum, expect that by Thursday bulls will attack the 200-day Simple Moving Average (SMA) and the historical $48,760 level, which is then just inches away from $50,000, potentially within sight by the end of the week.

BTC/USD daily chart

With this turnaround, the Relative Strength Index (RSI) will likely see a bounce off the oversold border and start to drift towards the mid-50 area. This could open the door for short sellers to try and enter with sizeable short positions once $44,088 has been hit, and to seek to push BTC price further below $40,000, with $38,073 as the first price target. This will, at the same time, firmly disappoint investors who hoped to reach $50,000. Such a move, however, would most probably go hand in hand with global market sentiment returning to a depressive move.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.