Bitcoin breaks past $72,000 for the first time in a month ahead of halving

- Bitcoin climbed to a high of $72,650 for the first time in four weeks.

- BTC price rally liquidated over $55.72 million in the past 24 hours.

- Meme coins rally alongside Bitcoin, with Dogecoin, Shiba Inu, Dogwifhat, PEPE and Flok among the top gainers.

Bitcoin (BTC) hit $72,650 on Monday, the highest level in almost four weeks and liquidating $55.72 million in short positions, according to Coinglass data. The 4% daily increase comes about 10 days away from the Bitcoin halving, an event that historically has led to further price gains.

Alongside Bitcoin’s rise, meme coins prices such as Dogecoin (DOGE), Shiba Inu (SHIB), Dogwifhat (WIF), Pepe (PEPE) and Floki (FLOKI) increased by double digits.

Bitcoin price rally ushers mass liquidation in derivatives market

Bitcoin price ranged below the $73,777 year-to-date peak of March 14. The largest crypto asset by market capitalization started its climb towards the $73,000 level on Monday, hitting a high of $72,760. At the time of writing, Bitcoin price corrected slightly to $71,997.

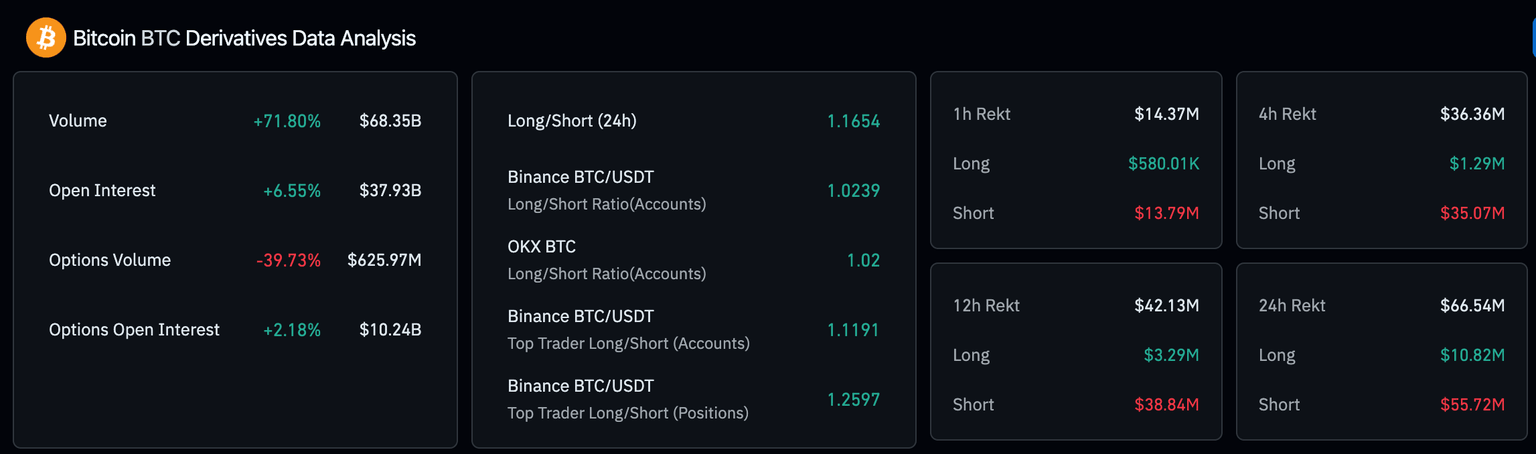

BTC price rally ushered liquidation in short positions in the derivatives market. Traders betting against Bitcoin gains lost nearly $55 million in the past 24 hours. On the contrary, long position holders have gained nearly $11 million, according to Coinglass data.

Bitcoin derivatives data

The Bitcoin halving, scheduled to occur in around ten days, on April 18, is likely the catalyst driving gains in BTC. Typically, Bitcoin price rises in the days leading up to the block reward halving and sees a correction within 90 days after the event. If the pattern of previous halvings repeats itself, the same is expected of BTC in the upcoming halving. Read more about this here.

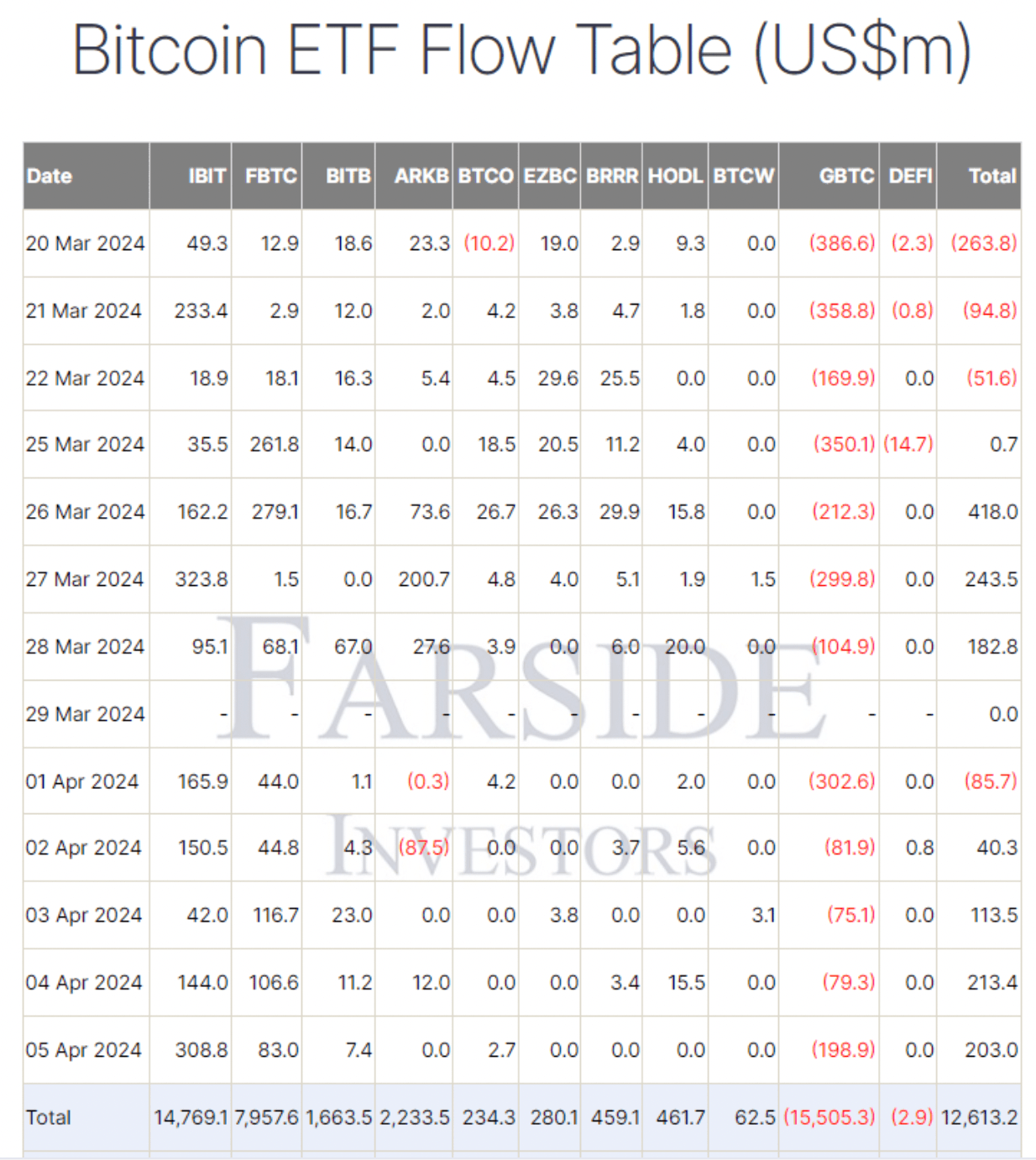

Data from Farside Investors shows that institutional capital inflow to Blackrock’s IBIT ETF closed in on net $15 billion till date, a new milestone for the investment product, alongside Bitcoin’s recent gains.

Bitcoin ETF inflow table

Bitcoin’s gains have catalyzed a meme coin price rally. Largest meme coins by market capitalization DOGE, SHIB, WIF, PEPE and FLOKI have yielded between 4% and 16% gains on the day. In the ongoing cycle, the speculative assets (meme coins) have rallied alongside Bitcoin and suffered a correction each time BTC price declined. Experts consider meme coins a key theme of the Bitcoin bull market in 2024.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.