Bitcoin halving is less than two weeks away, traders likely to buy the rumor sell the news

- Bitcoin is likely to see a repeat of the 2016 halving, selling pressure could pile up to four months later.

- Three previous Bitcoin halvings were followed by a price rally in the asset, analysts expect the same for the upcoming event.

- BTC price is trading range bound between $73,777 and $60,700 since March 2024.

Bitcoin has been range bound since its year-to-date peak of $73,777 on March 14. The largest asset by market capitalization is less than two weeks away from its block reward halving and analysts at Steno Research say a “buy the rumor, sell the news” scenario is likely.

The previous halvings have revealed that post-halving the immediate impact is not as significant on the asset’s price. Analysts at Steno Research anticipate an uptick in Bitcoin price leading up to the halving event within the next two weeks, and BTC price could dip below its price at the time of the halving within the first 90 days following the halving.

Bitcoin halving 2024 sees echoes of 2016 halving event

Analysts at Steno Research have identified parallels between BTC price trajectory and its performance leading up to the 2016 halving and indicate that similar outcomes can be expected from the upcoming event. The expectation is that the block reward halving could become a “buy the rumor, sell the news,” with the attention and inflows to Bitcoin Spot ETFs and the institutional capital investment, BTC has seen a surge in interest in recent months.

The halving countdown estimates the event could occur on April 20.

BTC price could see an uptick in the weeks leading up to the event and projections by Steno Research suggest that for the majority of the first 90 days following the halving, Bitcoin’s price is likely to see a decline in its price.

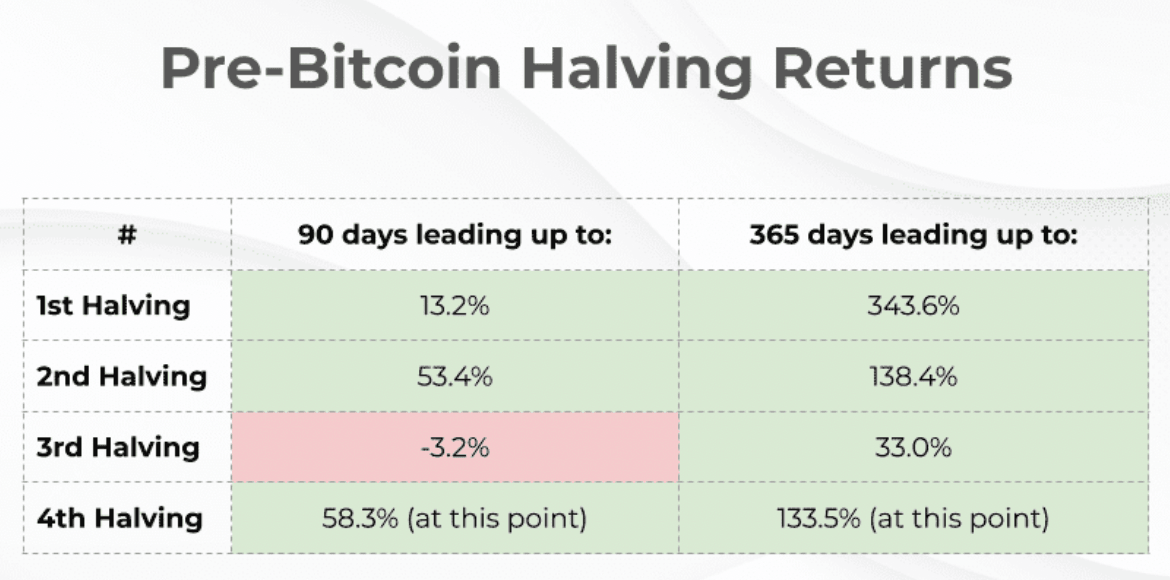

Pre Bitcoin halving returns

The halving is considered a bullish catalyst for Bitcoin price. Typically, immediately after the halving, analysts expect a reduction in selling pressure from miners and this could boost the asset’s price.

Analysts state that once “weak hands” or some ETF investors and traders who bought BTC for quick gains, exit the market, the long-term beneficial effects are likely to kick in, and drive the asset’s price higher.

At the time of writing, Bitcoin price is range bound between $73,777 and $60,700. BTC is exchanging hands at $69,405 on Sunday.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.