Binance users hoard BUSD on their exchange accounts: What are they up to?

- The total value of BUSD on Binance wallets nearly doubled in ten days.

- The increased BUSD inflow may be the evidence of the growing DeFi activity on the exchange.

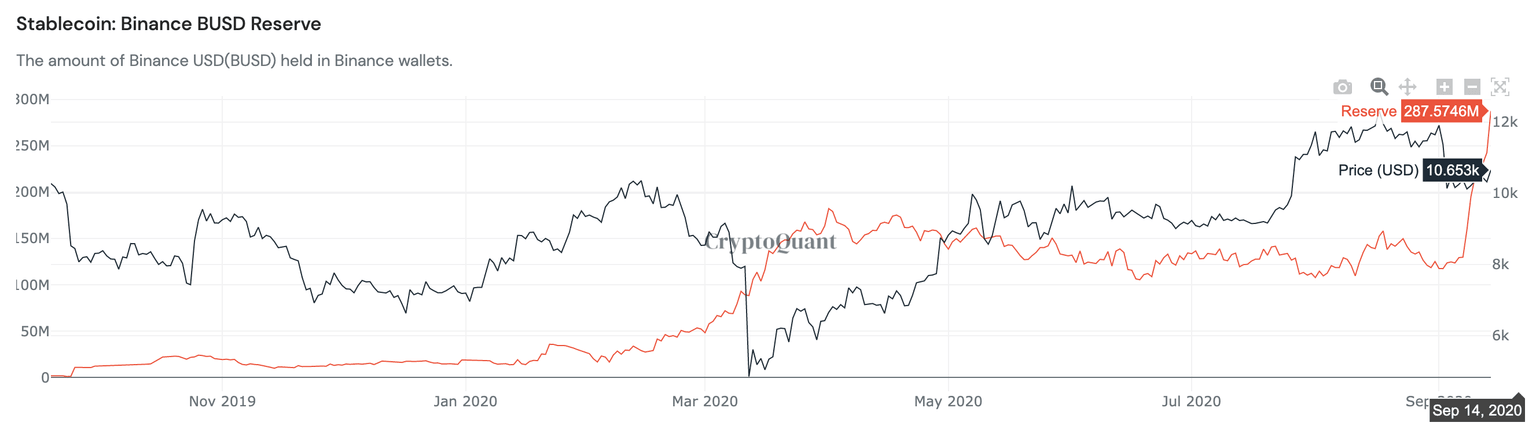

Binance BUSD reserves were parked on the cryptocurrency wallets of the exchange. The coins' total value increased by $113 billion over the past week and nearly doubled in ten days, even though the BTC price remained stagnant. According to the statistical data provided by the on-chain data provider CryptoQuant, now $BUSD has the highest potential buying power over all other stable coins except for $USDT.

The amount of Binance USD(BUSD) held in Binance wallets

Source: CryptoQuant

What is BUSD

Binance USD, or BUSD, is the US Dollar-pegged stablecoin launched by one of the world's largest cryptocurrency exchanges. The project is launched in partnership with Paxos, the platform for building financial companies and moving value between supported financial assets. Binance claims that BUSD is fully backed by USD, while its exchange rate remains stable in USD terms. The New York State Department of the Financial Services approved the coin, offering BUSD-related services to NY citizens.

BUSD total supply is 6,000,000, and it can be purchased on Binance for BTC, BNB, XRP, and other coins. Meanwhile, Paxos is responsible for minting coins and ensuring that it is fully backed by USD.

More DeFi buying ahead?

As we have previously reported, a sharp increase of stablecoins inflow to the exchange accounts might signal that traders and large investors are getting ready to add new coins to their cryptocurrency portfolios. Read more details on how Tether inflows are correlated with BTC price.

However, historically, Binance USD flows are less correlated with BTC price, meaning that some other reasons might have triggered the growth of BUSD purchase power on users' accounts. Namely, Binance has recently engaged in the wild DeFi boom and even launched its yield farming project, Binance Smart Chain. The participants can stake their BNB and BUSD to earn rewards in various DeFi coins, introduced on Binance Launchpool.

The cryptocurrency community criticized the exchange for fuelling DeFi mania and flooding the platform with potentially risky and even fraudulent coins. However, the head of the company, Chanpeng Zhao (CZ), explained that risks and innovations had been going hand in hand. At the same time, users should do their homework themselves before they invest their money.

Since the beginning of September, Binance has added numerous DeFi-tokens to the list of tradable instruments. BEL and WING are among the latest additions to its Launchpad. As CZ explained in the tweet, traders can use BNB and BUSD to qualify for Launchpad and also farm WING by staking them.

In this regard, the increased reserves of BUSD on the Binance cryptocurrency wallet may reflect the growing interest in Binance DeFi initiatives. More yield farmers come to plow Binance fields to get some harvest.

Author

Tanya Abrosimova

Independent Analyst