Binance Coin price ready for 10% breakout on false rumors of Interpol involvement

- Binance Coin price sees bulls triggering breakout trade as bearish element breaks down.

- BNB faces extreme tail risks as Interpol issues arrest warrant for Binance founder Changpeng Zhao.

- Expect to see more whipsaw moves once headlines emerge about further actions from Interpol, SEC or CFTC.

Binance Coin (BNB) price is printing a counterintuitive move this Wednesday after the turmoil from Tuesday. It appeared that Interpol had issued a Red Notice or arrest for Binance CEO Changpeng Zao. The news triggered a 4% implosion quite quickly only to recover later in the trading day and in this ASIA PAC session from Wednesday to break above a key bearish element.

Binance price could advance further as long as traders keep tight management

Binance price is surely having traders puzzled as it pops higher and even overtakes a bearish element. With the turmoil from Tuesday, it is imperative that bulls who venture to trade a long position in this need to do that with a very tight stop. As seen on Tuesday, the risk of any negative headlines coming from Interpol, the Commodity Futures Trading Commission (CFTC) or Securities & Exchange Commission (SEC) could mean mayhem and set BNB up for a bull trap with a return toward $300.

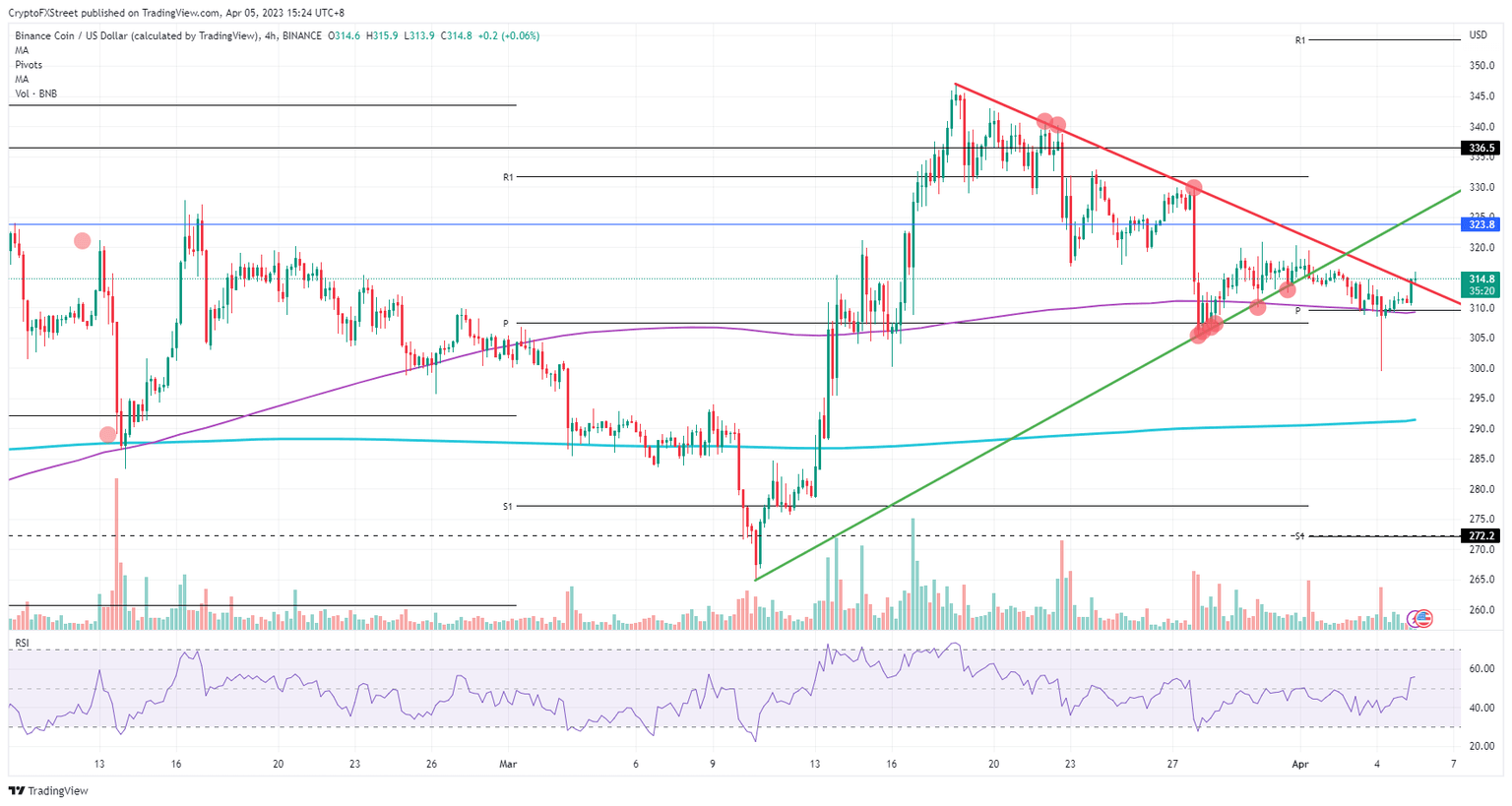

BNB is thus gearing up from a technical point of view for another leg higher. Expect the red descending trend line to act as support now and BNB price swinging up toward $323.80. Once that hurdle is cleared, a double top with the peak of March is up for grabs near $345 for a 10% gain for disciplined traders who work with tight stops and solid trade management.

BNB/USD 4H-chart

As mentioned in the above paragraphs, the number of tail risks is enormous, and any new headline could trigger another fallout. That would mean that the break now turns into a bull trap. Price action could be seen tanking all the way back to the low of Tuesday near $300.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.